Vodafone Group PLC (VOD, Financial) shares are down 26% year to date and 63% over the past five years. After this huge decline, the GF Value chart rates the stock as modestly undervalued. Could this stock now be a contrarian value opportunity?

Yet, in last week’s half-year report, the company warned that it is losing customers in one of its most profitable and important markets, Germany, and had to reduce guidance for its earnings and free cash flow for the full fiscal year. This didn’t help the stock, and the continued business decline begs the question: could this actually be a value trap instead?

About the company

Vodafone is the largest pan-European and African technology communications company, operating mobile and fixed networks in 21 countries and partnering with mobile networks in 47 more countries.

As of Sept. 30, the group had over 300 million mobile customers, more than 28 million fixed broadband customers and 22 million TV customers. Vodafone is a world leader in the Internet of Things as well, connecting more than 150 million devices and platforms.

It has revolutionised fintech in Africa through M-Pesa, which celebrates its 15th anniversary in 2022. M-Pesa is the region’s largest fintech platform, providing access to financial services for more than 50 million people in a secure, affordable and convenient way. The group states that its purpose is “to connect for a better future by using technology to improve lives, digitalise critical sectors and enable inclusive and sustainable digital societies.”

A lot of potential

Vodafone seems to have so much potential. It has important positions in European spectrum, it has a good position in the fast-growing markets in Africa and it is exposed to the megatrend of the Internet of Things. Yet its stock keeps going down. The market is getting tired of sector underperformance, questionable growth strategies and quite frankly management's repeated excuses for failure to improve the group’s margins. While telecommunications is a defensive sector, some of the products and services Vodafone sell are still exposed to disposable income and the business sector’s information technology spend, so this has not helped recent performance.

With this backdrop, Vodafone described its trading performance for the fiscal half-year to end of September as “resilient” with revenue growth of 2%, but adjusted earnings were down 2.6%. Obviously, this is a difficult economic environment right now, so this performance isn’t too bad. One thing to remember is that that the telecom industry is very capital intensive, with big numbers spent on capex and opex every year to keep infrastructure and constantly evolving technology competitive.

For the first half of the year, Vodafone’s capital spending came to 3.5 billion Euros ($3.5 billion). A concern for investors is that these investments don’t produce big returns. A return on capital employed of about 5% doesn’t inspire too much excitement. Because of the intense competition in telecom, and now with inflation reducing many people’s disposable income in real terms, telecom companies like Vodafone are finding it hard to raise prices right now. Meanwhile, inflation is increasing the company's own costs, so margins are suffering.

Lackluster execution

Investors in Vodafone often own it for the relatively high dividend, with the dividend yield currently at an attractive 8.5%, which is at the high end relative to the industry. The problem is, a high dividend yield can mean one of two things, either a cheap stock or an unstainable dividend which is going to be cut. Indeed, Vodafone has already cut its dividend and its three-year dividend growth rate is -16.70%.

In its most recent financial report, Vodafone reported that free cash flow was -€3.2 billion and that €1.3 billion had been spent on dividends. Essentially, this means this stock is using more cash than it is earning. The dividend is not covered by earnings, either. I would prefer to see a company earning twice as much as it is paying out, but Vodafone’s earnings per share over its dividends per share give a poor coverage ratio of 0.78.

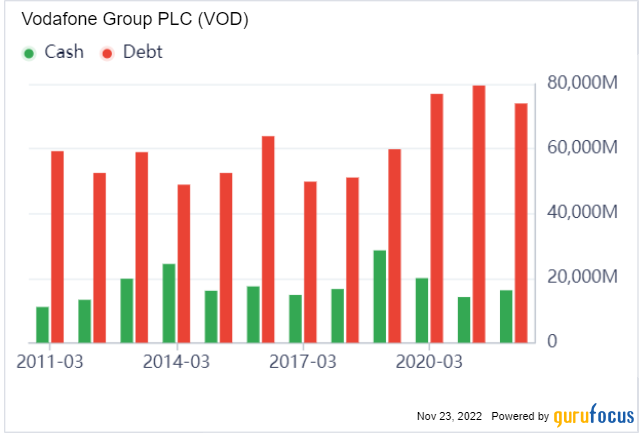

As a consequence of taking on debt for the dividend and capex, net debt has shot up to €45.5 billion, which is almost double 2012 levels and much higher than Vodafone’s €27 billion market value. Most worryingly Vodafone’s Altman Z-Score is a stressed -0.5, signalling financial distress and the possibility of bankruptcy.

On the positive side of things, Vodafone has managed to lock in its debt financing for several years at about 2.5% and it has recently raised some cash from selling a stake in Vantage Towers (XTER:VTWR, Financial). The problem is that a strategy of selling assets to raise cash isn’t sustainable.

Conclusion

There's no doubt Vodafone looks cheap. In the longer term, the Internet of Things and growth in the Africa region should boost Vodafone. There's also the potential merger with Three UK; if the companies managed to successfully merge, they could generate better economies of scale by becoming Britain’s biggest mobile operator. However, judging by Vodafone stock’s price action, investors are not enthusiastic about the negotiations for the deal. It's too early to say if this will become a catalyst.

Vodafone is an interesting investment prospect, but the turnaround job management is facing is a big one. I’ll be watching, but I won’t consider buying until the financials are stronger, and I will want to see its GF Score climb into the 80s first compared to the current GF Score of 74.