Steven Cohen (Trades, Portfolio)’s Point72 Asset Management recently disclosed its 13F portfolio updates for the third quarter of 2022, which ended on Sept. 30.

Point72 is a hedge fund that was formed in 2014 when SAC Capital Advisors converted its investment operations into a family office. In 2018, the firm reopened to external investors. Point72 invests via a wide range of asset classes and strategies worldwide. Its core investing strategy is based on bottom-up research with a focus on fundamentals and macroeconomic conditions. Cohen serves as the president, CEO and chairman of the firm.

According to its latest 13F report, the firm had an incredibly high turnover rate of 43% for the third quarter. However, this is not much higher than normal for Point72, which is known for trading in and out of positions and typically has a turnover rate above 30%. Its most notable trades for the third quarter included an addition to Biogen Inc. (BIIB, Financial), a new buy for Workday Inc. (WDAY, Financial), a near-elimination of its Uber Technologies Inc. (UBER, Financial) holding and the sale of its entire stake in Coca-Cola Co. (KO, Financial).

Biogen

The firm added 1,222,182 shares to its Biogen (BIIB, Financial) investment for a total holding of 1,677,982 shares, adding 1.33% to the position’s equity portfolio weight and making it the top holding. During the quarter, shares traded for an average price of $212.38.

Biogen is a biotech company based in Cambridge, Massachusetts that primarily researches and develops therapies for neurological and neurodegenerative diseases, including multiple sclerosis, leukemia and Alzheimer’s.

The stock has truly been on a roller-coaster ride since 2014, marked by dramatic ups and downs on various good and bad news breaks. The company has not brought a new blockbuster to the table for years, which really began to weigh on its results around mid-2020.

After the Aduhelm disaster, though, it is beginning to look like Biogen is gearing up for its big Alzheimer’s treatment break in the form of lecanemab, an experimental treatment developed together with Eisai Co. (ESALY), which recently turned out surprisingly positive results in a phase 3 clinical trial. According to the results of the trial, which included 1,795 patients, early-stage Alzheimer's disease patients given lecanemab “showed 27% less decline on the ‘Clinical Dementia Rating -- Sum of Boxes’ (CDR-SB) test after 18 months of treatment.” Statistically, the results of the trial count as nearly irrefutable evidence that the treatment is effective, which should make the approval process much easier.

Workday

Point72 initiated a new stake of 1,061,911 shares in Workday Inc. (WDAY, Financial) after selling out of its previous investment in the stock in the second quarter of 2022. At the quarter’s average share price, this gives the stock a weight of 0.66% in the equity portfolio.

Headquartered in Pleasanton, California, Workday is an enterprise cloud solutions company that provides software for the management of financial assets as well as human capital. Its multidimensional financial and operational reporting and analytics are designed for large companies.

Workday falls into the tech growth stock category. Despite decent revenue growth, its bottom line is still negative, so in the current risk-off environment, its stock price has tanked. Estimates from Morningstar (MORN, Financial) analysts call for earnings per share to turn positive again for the fiscal year ending in January 2024, though GuruFocus issues a warning sign for assets growing faster than revenue, meaning the company might be becoming less profitable.

However, the bottom-line decline should not be of too much concern to long-term investors as the company is focusing on expansion rather than profitability at the moment. The company’s three-year free cash flow growth rate is an incredible 44% (the company became free cash flow positive in 2017), and it continues to gain market share, with co-CEO Chano Fernandez highlighting its connected partner ecosystem and low or no-code applications as key customer draws.

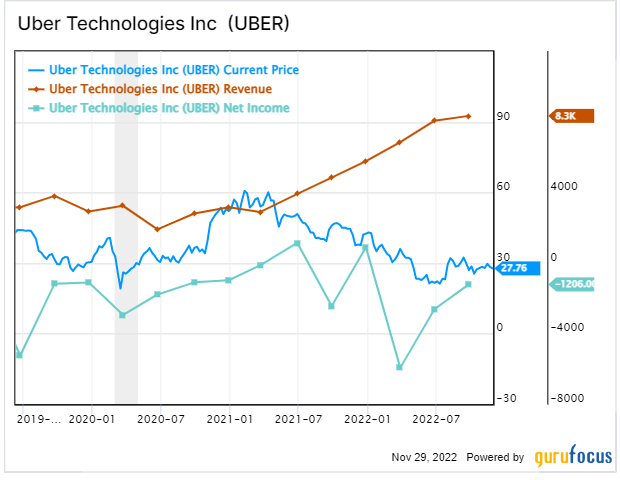

Uber Technologies

The firm slashed its Uber Technologies (UBER, Financial) holding by 7,231,188 shares, shaving off 0.64% of the position’s equity portfolio weight and leaving a holding of just 52,600 shares. The stock was trading around an average price of $27.63 during the quarter.

Most famous for being the world’s largest ridesharing company, Uber also offers food delivery, electric bikes and scooters and has various technology projects. The company is based in San Francisco and operates in 63 countries worldwide.

Uber is the poster child for companies that look like they should be incredibly profitable but end up burning cash. It has to balance paying drivers enough that they will consider the job attractive while simultaneously remaining cheaper for the customer than traditional taxi services. It has to scale up both its ride-sharing and food delivery businesses in order to achieve profitability, but scaling up these services means it has to be feasible for customers who are not the wealthiest in the world to afford them, again putting a ceiling on the fees the company can charge.

On the positive side, Uber’s adjusted Ebitda has soared in recent years once you take out its messy equity investments and stock-based compensation for executives, though what matters for investors is GAAP Ebitda, which is still negative and continues to decline. Uber Freight has good potential, but so far truckers do not seem impressed with it, and it has a long way to go before being able to disrupt the trucking management software industry.

Coca-Cola

Point72 dumped all 2,278,860 of its Coca-Cola (KO, Financial) shares, which previously took up 0.61% of the equity portfolio. During the quarter, shares averaged $62.15 apiece.

This iconic multinational beverage company is based in Atlanta and is home to brands such as Coca-Cola, Dasani, Fanta, Minute Maid and Powerade. In recent years, the company has been implementing a strategy where it drops lower-margin brands and focuses on promoting higher-margin ones.

The strength of Coca-Cola’s brands is undeniable, and people around the world will likely be drinking the company’s beverages for many years to come. However, even as the stock price has continued rising over the years, the company’s revenue has declined and its net income has stagnated. Growth looks better on a per-share basis, but that is partially due to a huge earnings per share decline in 2017.

Coca-Cola now trades with a price-earnings ratio of 27.28, which is just above its median historical valuation. It offers a decent dividend yield of 2.79%. With a main focus on ditching low-margin brands to spend more on advertising high-margin brands, the company seems to be a decent stalwart but is unlikely to post stellar growth numbers, especially when we consider the company’s size and market saturation in many regions.

See also

As of the quarter’s end, the firm held common stock shares in 1,329 companies valued at a total of $24.64 billion.

The top holding was Biogen with 1.82% of the equity portfolio, followed by T-Mobile US Inc. (TMUS, Financial) with 1.24% and Alibaba Group Holding Ltd. (BABA, Financial) with 1.15%.

Other significant trades for the quarter included additions to Alibaba and AstraZeneca PLC (AZN, Financial) and reductions to Humana Inc. (HUM, Financial) and Seagen Inc. (SGEN, Financial).

In terms of sector weighting, the firm was most invested in health care, technology and consumer cyclical stocks.