Paul Tudor Jones (Trades, Portfolio), founder and chief investment officer of Boston-based Tudor Investment Group, disclosed in a regulatory filing that his firm’s top buys during the first quarter included new positions in Phillips 66 (PSX, Financial) and Johnson & Johnson (JNJ, Financial). The firm also boosted its holdings of Horizon Therapeutics (HZNP, Financial), Chevron Corp. (CVX, Financial) and Colgate-Palmolive Co. (CL, Financial).

Tudor Investment seeks to generate consistent returns for both client and proprietary capital using key research, trading and investment techniques. The firm believes that innovation is required to compete in rapidly changing markets and thus, it commits significant resources to research and development across a wide range of strategies to increase its edge.

Guru believes the Fed may soon pause interest rate hikes

Jones said in a CNBC interview on Monday that he thinks the Federal Reserve is “done” raising interest rates in the central bank’s fight against inflation now that the consumer price index “declined for 12 straight months,” which has “never happened before in history.”

The consumer price index increased 0.4% in April, in line with Dow Jones estimates. Despite this, inflation increased just 4.9% during the past year, down from the consensus estimate of 5% and the slowest annual pace since April 2021.

Portfolio overview

As of March, Tudor Investment’s $6.46 billion 13F equity portfolio contains 2,336 stocks, with 488 new positions and a quarterly turnover ratio of 47%. The top four sectors in terms of weight are technology, industrials, health care and financial services, which represent 19.57%, 14%, 12.16% and 12.09% of the equity portfolio.

Investors should be aware 13F filings do not give a complete picture of a firm’s holdings as the reports only include its positions in U.S. stocks and American depository receipts, but they can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

Phillips 66

Tudor Investment purchased 341,161 shares of Phillips 66 (PSX, Financial), giving the position 0.54% equity portfolio weight.

Shares of Phillips 66 averaged $101.68 during the first quarter; the stock is modestly undervalued based on its price-to-GF Value ratio of 0.78 as of Tuesday.

The Houston-based crude oil refining company has a GF Score of 82 out of 100 based on a momentum rank of 8 out of 10, a growth rank of 5 out of 10 and a rank of 7 out of 10 for GF Value, profitability and financial strength.

Phillips 66’s gross margin has declined by approximately 13% per year on average over the past five years and underperforms approximately 74% of global competitors. Despite this, the company’s return on assets of 17.49% outperforms approximately 85% of global energy companies.

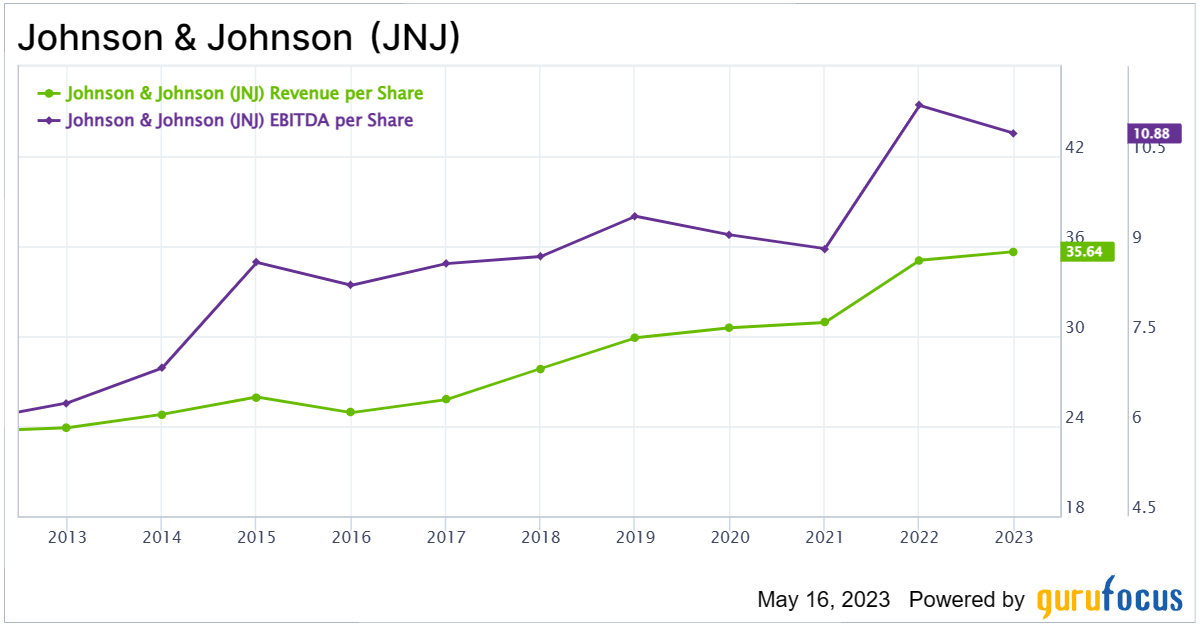

Johnson & Johnson

The firm invested in 216,183 shares of Johnson & Johnson (JNJ, Financial), giving the position 0.52% equity portfolio weight.

Shares of Johnson & Johnson averaged $161.47 during the first quarter; the stock is modestly undervalued based on its price-to-GF Value ratio of 0.89 as of Tuesday.

The New Brunswick, New Jersey-based pharmaceutical company has a GF Score of 89 out of 100 based on a rank of 9 out of 10 for profitability and growth, a momentum rank of 4 out of 10 and a rank of 6 out of 10 for financial strength and GF Value.

Johnson & Johnson’s high profitability rank is driven by several positive investing signs, which include a four-star business predictability rank and a gross profit margin that outperforms approximately 81% of global competitors.

Horizon Therapeutics

Tudor Investment purchased 429,473 shares of Horizon Therapeutics (HZNP, Financial), expanding the position by 66.21% and its equity portfolio by 0.72%.

Shares of Horizon Therapeutics averaged $110.54 during the first quarter; the stock is modestly undervalued based on its price-to-GF Value ratio of 0.76 as of Tuesday.

The Irish biotech company’s GF Score of 82 out of 100 is driven by a rank of 7 out of 10 for financial strength and growth. Despite this, the company’s GF Value, momentum and profitability rank just 6 out of 10.

Horizon Therapeutics’ financial strength ranks 7 out of 10 on the back of a strong Altman Z-score of 4.98 despite cash-to-debt and interest coverage ratios underperforming more than 55% of global competitors.

Chevron

The firm added 190,255 shares of Chevron (CVX, Financial), expanding the position by 1,252.09% and its equity portfolio by 0.48%.

Shares of Chevron averaged $167.65 during the first quarter; the stock is modestly undervalued based on its price-to-GF Value ratio of 0.80 as of Tuesday.

The San Ramon, California-based integrated energy company has a GF Score of 86 out of 100 based on a financial strength rank of 8 out of 10 and a rank of 7 out of 10 for momentum, profitability, growth and GF Value.

Chevron’s high financial strength is driven by several positive investing signs, including a high Piotroski F-score of 9 out of 9, a strong Altman Z-score of 4.56 and an interest coverage ratio that outperforms approximately 80% of global competitors.

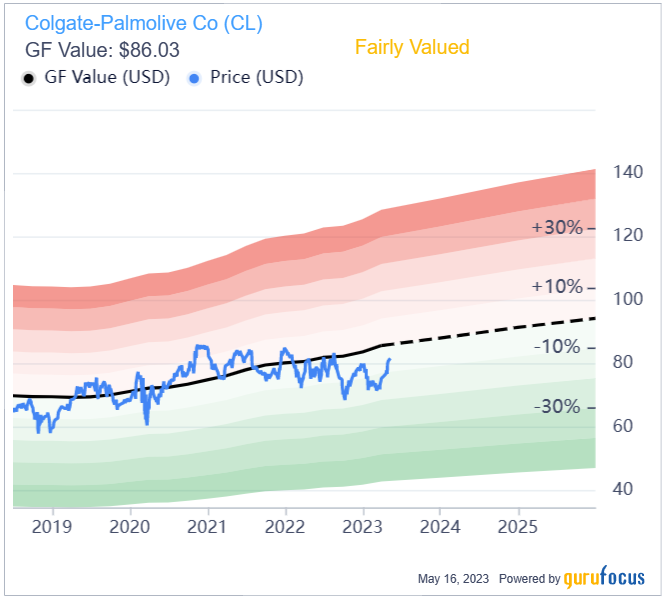

Colgate-Palmolive

The firm purchased 409,919 shares of Colgate-Palmolive (CL, Financial), expanding the position by 802.65% and its equity portfolio by 0.48%.

Shares of Colgate-Palmolive averaged $74.36 during the first quarter; the stock is fairly valued based on its price-to-GF Value ratio of 0.94 as of Tuesday.

The New York-based consumer products company has a GF Score of 78 out of 100 based on a profitability rank of 8 out of 10 and a rank of 5 out of 10 for momentum, growth, GF Value and financial strength.

The company’s high profitability rank is driven by profit margins and returns that are outperforming more than 85% of global competitors.