The Simply Good Foods Co (SMPL, Financial) experienced a daily loss of 7.79%, and over the past three months, the stock has seen a 7% decline. Despite these losses, the company reported an Earnings Per Share (EPS) (EPS) of 1.26. This raises the question: is the stock modestly undervalued? In this analysis, we will delve into the company's financials and valuation to answer this question. Keep reading for a comprehensive review of The Simply Good Foods Co's (SMPL) stock value.

Introduction to The Simply Good Foods Co

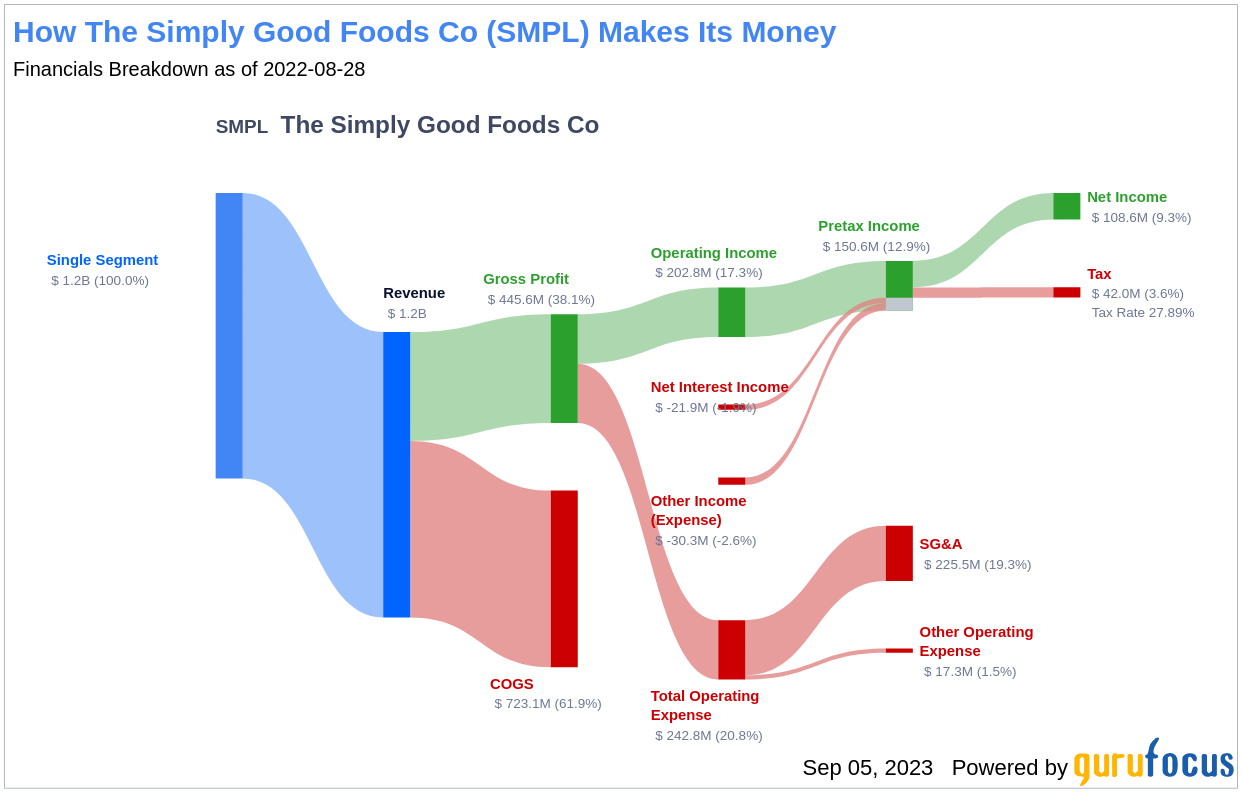

The Simply Good Foods Co specializes in low-carbohydrate, high protein products under the Atkins and Quest brands, including bars, shakes, confections, chips, and cookies. The company's philosophy aligns with Dr. Robert Atkins' high protein/low carbohydrate diet trend, attracting consumers with active lifestyles. In fiscal 2022, 97% of the firm's sales occurred within North America.

Comparing the stock price of $33.36 to the GF Value of $40.34, it appears that The Simply Good Foods Co may be modestly undervalued. This discrepancy between the market price and the estimated fair value warrants a deeper investigation into the company's value.

Understanding the GF Value

The GF Value is a unique measure of a stock's intrinsic value, calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line provides an overview of the fair value that the stock should trade at. If the stock price significantly deviates from the GF Value Line, it can indicate if the stock is overvalued or undervalued.

The Simply Good Foods Co (SMPL, Financial) appears to be modestly undervalued according to the GF Value estimation. This suggests that the long-term return of its stock is likely to be higher than its business growth.

Link: These companies may deliever higher future returns at reduced risk.

Financial Strength of The Simply Good Foods Co

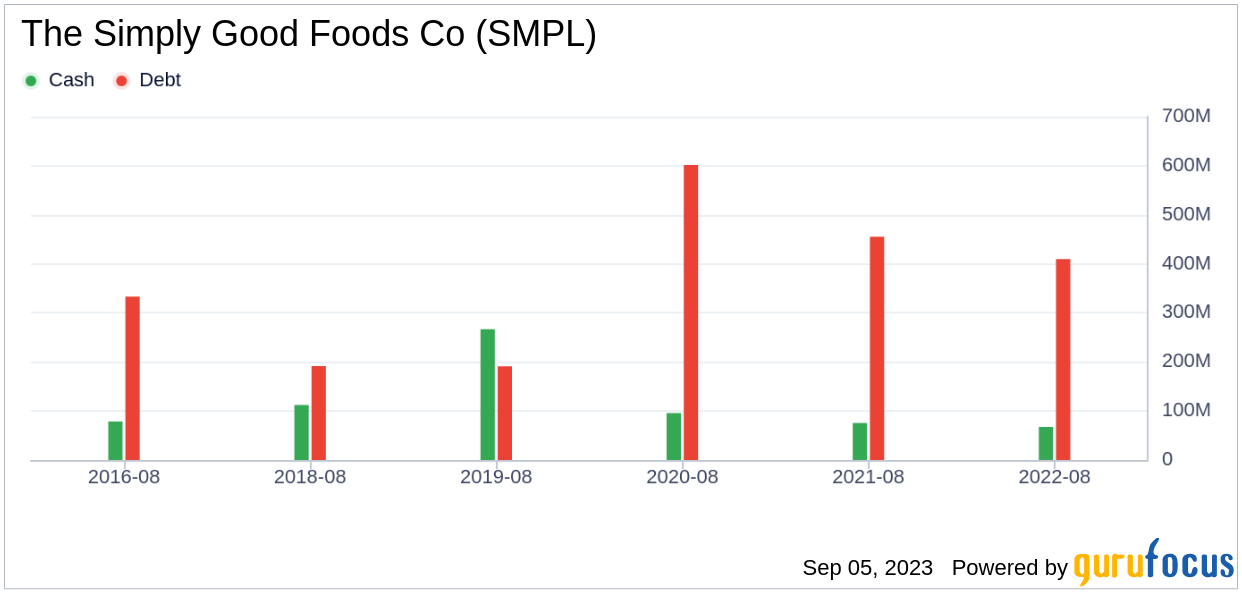

Investing in companies with poor financial strength carries a higher risk of permanent capital loss. Therefore, it's crucial to assess a company's financial strength before buying its stock. The Simply Good Foods Co has a cash-to-debt ratio of 0.19, ranking worse than 67.52% of companies in the Consumer Packaged Goods industry. However, GuruFocus ranks the overall financial strength of The Simply Good Foods Co at 7 out of 10, indicating fair financial strength.

Profitability and Growth of The Simply Good Foods Co

Investing in profitable companies typically carries less risk, especially if the company has demonstrated consistent profitability over the long term. The Simply Good Foods Co has been profitable for 5 years over the past 10 years. With an operating margin of 16.11%, the company performs better than 87.18% of companies in the Consumer Packaged Goods industry. GuruFocus ranks The Simply Good Foods Co's profitability as fair.

Growth is a crucial factor in a company's valuation. The Simply Good Foods Co's 3-year average annual revenue growth is 21.4%, ranking better than 83.92% of companies in the Consumer Packaged Goods industry. The 3-year average EBITDA growth rate is 132%, ranking better than 97.95% of companies in the industry. This suggests that The Simply Good Foods Co has a strong growth potential.

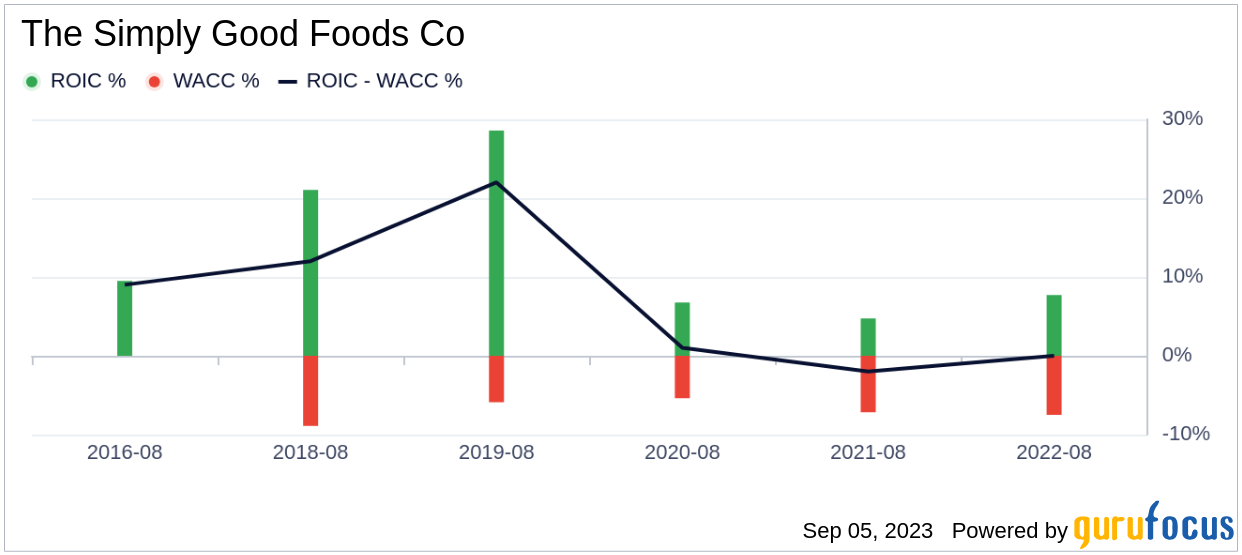

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted cost of capital (WACC) can provide insight into its profitability. A higher ROIC than WACC indicates that the company is creating value for shareholders. Over the past 12 months, The Simply Good Foods Co's ROIC was 7.67, while its WACC came in at 8.22.

Conclusion

In conclusion, The Simply Good Foods Co (SMPL, Financial) appears to be modestly undervalued. The company's financial condition and profitability are fair, and its growth potential is strong. For more details about The Simply Good Foods Co stock, you can check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, check out the GuruFocus High Quality Low Capex Screener.