On September 13, 2023, Peter Gray, the Senior Executive Vice President and Chief Operating Officer of ESSA Bancorp Inc (ESSA, Financial), purchased 1,000 shares of the company. This move is significant as it indicates the insider's confidence in the company's future performance.

Peter Gray has been with ESSA Bancorp Inc for several years, serving in various executive roles. His extensive experience and deep understanding of the company's operations make his stock purchases particularly noteworthy for investors.

ESSA Bancorp Inc is a community-oriented savings bank that provides financial services to individuals, families, and businesses. The company offers a range of retail and commercial banking, financial management, insurance, and investment services. It operates through a network of offices in northeastern Pennsylvania.

Over the past year, Peter Gray has purchased a total of 4,000 shares and has not sold any shares. This trend suggests a strong belief in the company's potential for growth and profitability.

The insider transaction history for ESSA Bancorp Inc shows a total of 8 insider buys over the past year, with no insider sells during the same period. This trend indicates a positive sentiment among the company's insiders.

On the day of the insider's recent buy, shares of ESSA Bancorp Inc were trading at $14.85 each, giving the company a market cap of $155.498 million. The price-earnings ratio stands at 7.36, which is lower than both the industry median of 8.29 and the company’s historical median price-earnings ratio. This suggests that the stock may be undervalued.

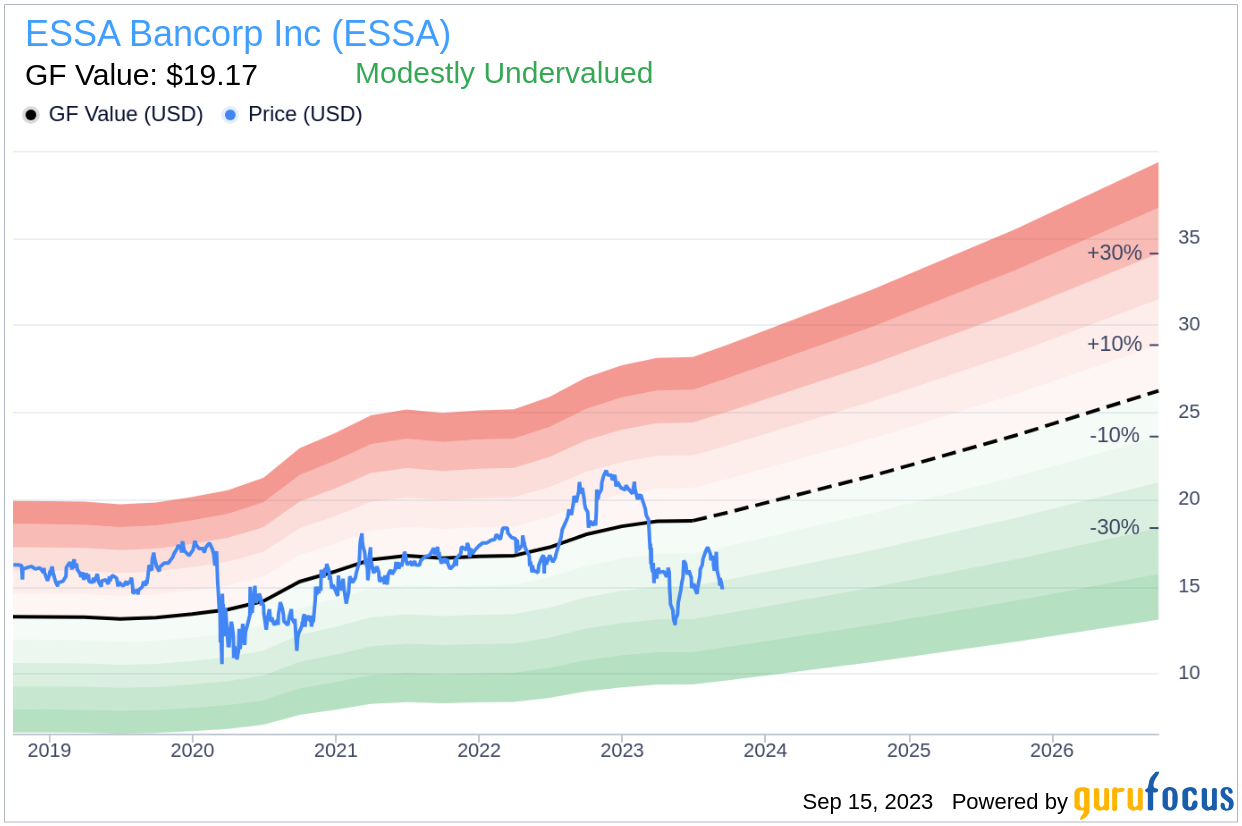

The GuruFocus Value for ESSA Bancorp Inc is $19.17, resulting in a price-to-GF-Value ratio of 0.77. This indicates that the stock is modestly undervalued.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples (price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow) that the stock has traded at, a GuruFocus adjustment factor based on the company’s past returns and growth, and future estimates of business performance from Morningstar analysts.

In conclusion, the recent insider buying activity at ESSA Bancorp Inc, coupled with the stock's modest undervaluation, suggests a positive outlook for the company. Investors may want to keep a close eye on this stock.