Kulicke & Soffa $11.41 - Long term target around $18.20

Incorporated in 1951, Kulicke & Soffa (KLIC, Financial) is a global leader in the design and manufacturing of semiconductor assembly equipment. KLIC specializes in the production of ball, wedge and die bonders for the integrated circuit (IC) and light emitting diode (LED) end-markets. The company’s primary customers are outsourced assembly and test manufacturers (OSAT) and integrated device manufacturers (IDM); largest customers include Advance Semiconductor Engineering, Siliconware Percision Industries, and Haoseng Industrial.

Industry Overview: KLIC operates in two industries, Equipment (wire, ball and die bonders) and Expendable Tools (10% of revenues). Equipment business (90% of revenues) is inherently cyclical as it depends on capital investment cycles of its customers (OSATs). However, the growth trend of the end products created with KLIC equipment, integrated circuits, has been positive because of technological innovations (better performance) and price declines (new applications). The list of end-use products for wire-bonded integrated circuits continues to grow and includes: smartphones, tablets, laptops, memory, computers, cameras, TVs, automotive electronics, others.

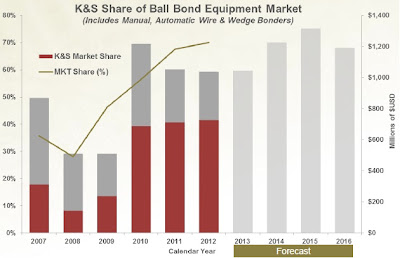

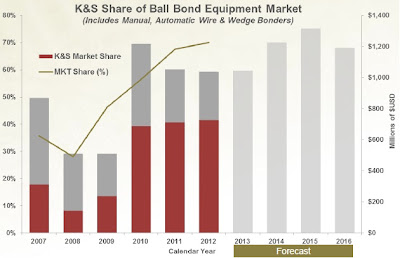

[url=http://3.bp.blogspot.com/-CRQRi-3OR_I/URyFwNYP5zI/AAAAAAAAAI8/IC0ifeUKCFQ/s1600/Copper+Bonder+Market+Share.jpg][/url]

Industry/Company Strategy: KLIC has focused on producing the best bonding equipment (95% of equipment revenue) and continues to spend consistently on R&D ($50 million to $60 million) even during economic and cyclical downturns.

Traditionally, semiconductor bonds were formed using gold; however with gold prices rising approximately 5x over the last decade, alternatives were required. Various materials were considered to replace gold, such as copper and aluminum, each with their own set of pros and cons. KLIC was first to provide a viable alternative in 2010 with their copper bonding specialized equipment, copper bonding requires the use of nitrogen gas in order to prevent copper oxidation in the process. KLIC’s main competitor, ASM Pacific Technologies, has been focusing its R&D on LED bonding (LED is one of the fastest growing markets). With customers shifting to copper enabled bonders and ASM focusing on LED, KLIC emerged as the clear leader in the IC bonding market. This is evident in the company’s No. 1 market share position in all types of IC bonders and in its healthy operational margins and return on invested capital. Overall penetration of copper capable bonders still remains low at under 35%, suggesting there is still room for increasing market share.

Cash Flows: KLIC is not a part of a capital intensive business but rather a R&D led industry; the company’s PPE, cap-ex, and depreciation are extremely low. Cumulatively from 2008-2012 the company has spent just $34m on PPE representing a mere 7% of the $470m in after-tax cash flows generated during the period. For 2013 the company is forecasting $30-31m in capital expenditures due to $15m in facility improvements at their Singapore facility.

Investment Thesis: Being conscious of the fact that the IC capital investment business is cyclical and technology moats vanish over night; I use a 10x free cash flow multiple to the last five-year cycle for a value of $11.62 per share, slightly higher than the current price of $11.45. However, this overlooks the free call option imbedded in KLIC. The company is debt free and has $494 million or $6.52 per share in cash. Not only does the cash provide downside protection, but at its current price you are getting that cash for free. If used for an accretive acquisition or returned to shareholders, this free cash option will end in-the-money. There are not many businesses that trade at under 10x free cash flow and KLIC does have a number attractive qualities like its industry leading technology, broad market shift to copper, high growth end-market, low capital intensity, and industry duopoly. I arrive at my target price using a 10x free cash flow multiple to the previous five-year cycle $11.62 + cash $6.52 =$18.20. This assumes the management can find a 10% FCF yielding investment.

Investment killers checklist (checks out 5/5)

1) Bad management

Management has shown caution or restraint towards acquisitions even with their enormous cash pile. They also issued convertible-bonds at incredibly low interest rates securing extremely cheap financing.

2) Intense competition

Low competition - duopoly industry structure and both companies are growing and profitable, significant R&D, unsexy cyclical industry. However, KLIC does boast high margins during cycle booms .

3) Too high of a price

With a 5.5x trailing P/E, 2.0x ev/ebitda and still a number of underweight recommendations, the stock is definitely not a darling.

4) Debt

No debt

5) Complexity

The business model itself definitely isn't complex but the technology to make copper bonding feasible is.

Disclaimer: I am long KLIC and may exit my position at any point.

Other ideas posted on:

http://the-almost-intelligent-investor.blogspot.ca/2013/02/klic-1141.html

Incorporated in 1951, Kulicke & Soffa (KLIC, Financial) is a global leader in the design and manufacturing of semiconductor assembly equipment. KLIC specializes in the production of ball, wedge and die bonders for the integrated circuit (IC) and light emitting diode (LED) end-markets. The company’s primary customers are outsourced assembly and test manufacturers (OSAT) and integrated device manufacturers (IDM); largest customers include Advance Semiconductor Engineering, Siliconware Percision Industries, and Haoseng Industrial.

Industry Overview: KLIC operates in two industries, Equipment (wire, ball and die bonders) and Expendable Tools (10% of revenues). Equipment business (90% of revenues) is inherently cyclical as it depends on capital investment cycles of its customers (OSATs). However, the growth trend of the end products created with KLIC equipment, integrated circuits, has been positive because of technological innovations (better performance) and price declines (new applications). The list of end-use products for wire-bonded integrated circuits continues to grow and includes: smartphones, tablets, laptops, memory, computers, cameras, TVs, automotive electronics, others.

[url=http://3.bp.blogspot.com/-CRQRi-3OR_I/URyFwNYP5zI/AAAAAAAAAI8/IC0ifeUKCFQ/s1600/Copper+Bonder+Market+Share.jpg][/url]

Industry/Company Strategy: KLIC has focused on producing the best bonding equipment (95% of equipment revenue) and continues to spend consistently on R&D ($50 million to $60 million) even during economic and cyclical downturns.

All figures in $US 000s | 2008 | 2009 | 2010 | 2011 | 2012 |

Net Revenues | 328,050 | 225,240 | 762,784 | 830,401 | 791,023 |

Gross Margin | 40.8% | 39.4% | 44.0% | 46.7% | 46.4% |

SG&A Margin | 27.2% | 47.1% | 17.2% | 18.4% | 15.8% |

R&D Margin | 18.3% | 23.7% | 7.4% | 7.8% | 8.0% |

Operating Margin | -4.7% | -31.4% | 19.4% | 20.5% | 22.7% |

Operating Income | (15,480) | (70,815) | 148,035 | 170,060 | 179,226 |

Interest Expense | (8,601) | (8,188) | (8,333) | (8,280) | (5,808) |

Earnings before Taxes | (28,501) | (76,641) | 140,105 | 162,428 | 174,251 |

Adjusted Earnings | (15,739) | (64,868) | 142,142 | 127,610 | 160,580 |

EBITDA | (3,185) | (48,484) | 165,969 | 188,469 | 197,324 |

Depreciation | 7,563 | 21,225 | 17,531 | 17,761 | 17,265 |

Cashflow to D+E | 425 | (35,455) | 168,006 | 153,651 | 183,653 |

PPE | (7,851) | (5,263) | (6,271) | (7,688) | (6,902) |

FCF to D+E | (7,426) | (40,718) | 161,735 | 145,963 | 176,751 |

Traditionally, semiconductor bonds were formed using gold; however with gold prices rising approximately 5x over the last decade, alternatives were required. Various materials were considered to replace gold, such as copper and aluminum, each with their own set of pros and cons. KLIC was first to provide a viable alternative in 2010 with their copper bonding specialized equipment, copper bonding requires the use of nitrogen gas in order to prevent copper oxidation in the process. KLIC’s main competitor, ASM Pacific Technologies, has been focusing its R&D on LED bonding (LED is one of the fastest growing markets). With customers shifting to copper enabled bonders and ASM focusing on LED, KLIC emerged as the clear leader in the IC bonding market. This is evident in the company’s No. 1 market share position in all types of IC bonders and in its healthy operational margins and return on invested capital. Overall penetration of copper capable bonders still remains low at under 35%, suggesting there is still room for increasing market share.

Cash Flows: KLIC is not a part of a capital intensive business but rather a R&D led industry; the company’s PPE, cap-ex, and depreciation are extremely low. Cumulatively from 2008-2012 the company has spent just $34m on PPE representing a mere 7% of the $470m in after-tax cash flows generated during the period. For 2013 the company is forecasting $30-31m in capital expenditures due to $15m in facility improvements at their Singapore facility.

Investment Thesis: Being conscious of the fact that the IC capital investment business is cyclical and technology moats vanish over night; I use a 10x free cash flow multiple to the last five-year cycle for a value of $11.62 per share, slightly higher than the current price of $11.45. However, this overlooks the free call option imbedded in KLIC. The company is debt free and has $494 million or $6.52 per share in cash. Not only does the cash provide downside protection, but at its current price you are getting that cash for free. If used for an accretive acquisition or returned to shareholders, this free cash option will end in-the-money. There are not many businesses that trade at under 10x free cash flow and KLIC does have a number attractive qualities like its industry leading technology, broad market shift to copper, high growth end-market, low capital intensity, and industry duopoly. I arrive at my target price using a 10x free cash flow multiple to the previous five-year cycle $11.62 + cash $6.52 =$18.20. This assumes the management can find a 10% FCF yielding investment.

Investment killers checklist (checks out 5/5)

1) Bad management

Management has shown caution or restraint towards acquisitions even with their enormous cash pile. They also issued convertible-bonds at incredibly low interest rates securing extremely cheap financing.

2) Intense competition

Low competition - duopoly industry structure and both companies are growing and profitable, significant R&D, unsexy cyclical industry. However, KLIC does boast high margins during cycle booms .

3) Too high of a price

With a 5.5x trailing P/E, 2.0x ev/ebitda and still a number of underweight recommendations, the stock is definitely not a darling.

4) Debt

No debt

5) Complexity

The business model itself definitely isn't complex but the technology to make copper bonding feasible is.

Disclaimer: I am long KLIC and may exit my position at any point.

Other ideas posted on:

http://the-almost-intelligent-investor.blogspot.ca/2013/02/klic-1141.html