Despite a daily loss of 28.39% and a 3-month loss of 42.62%, Aramark (ARMK, Financial) showcases an Earnings Per Share (EPS) of 2.07. These figures pose a critical question: Is the stock significantly undervalued? This article aims to answer this question by providing a comprehensive valuation analysis of Aramark (ARMK). We invite readers to delve into the following analysis for a better understanding of the company's intrinsic value.

Company Introduction

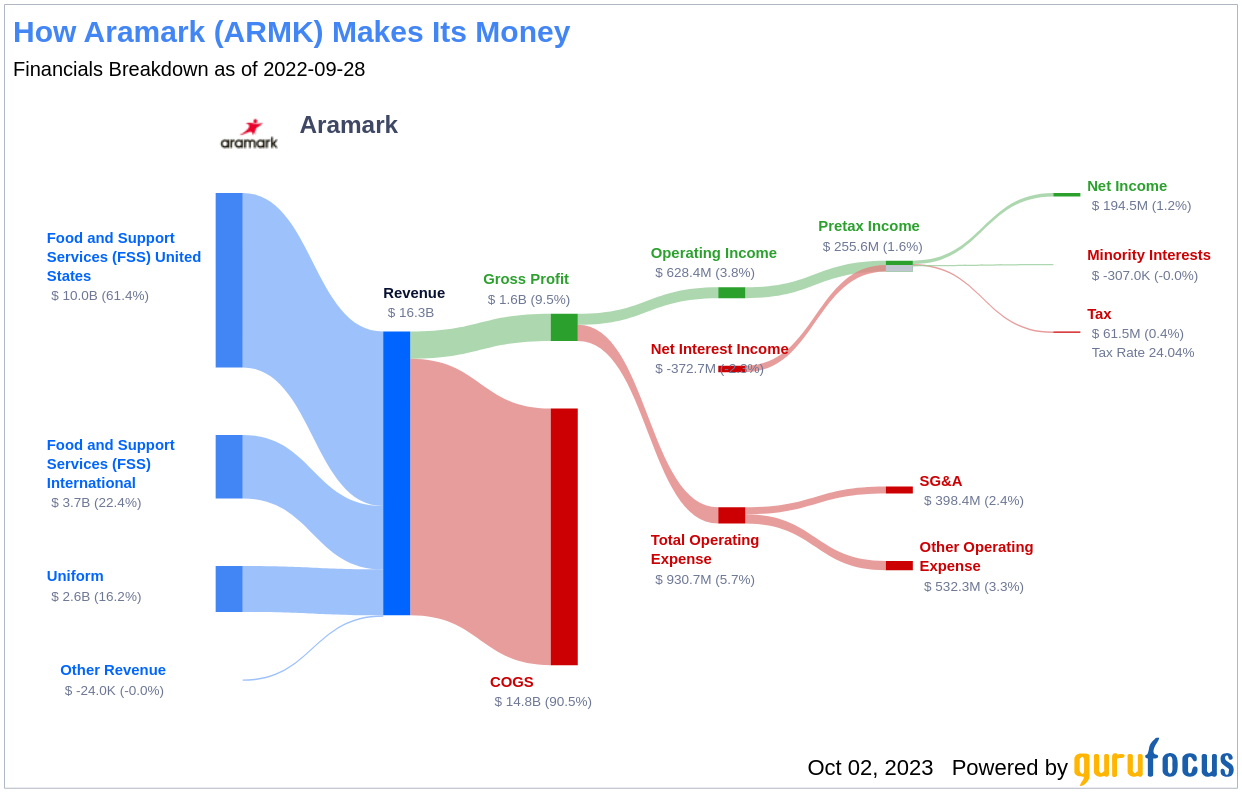

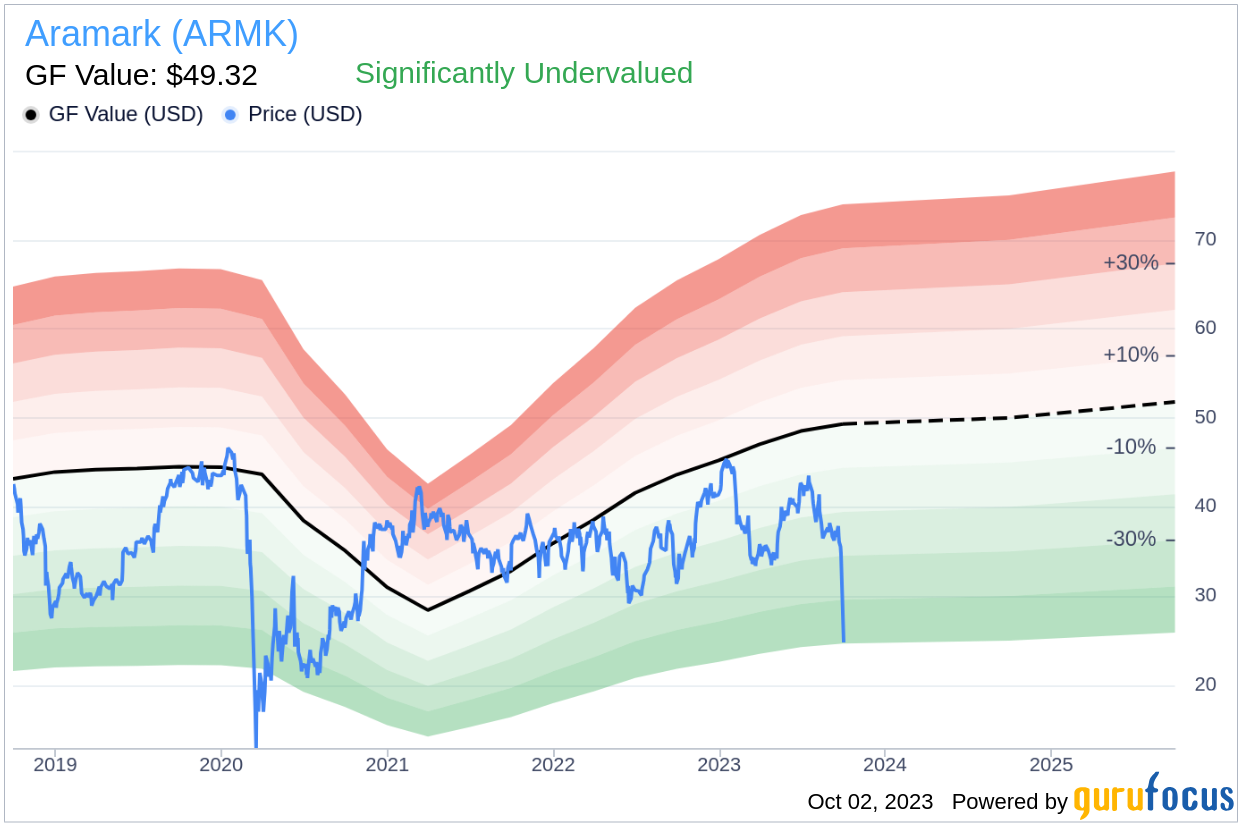

Aramark, a provider of food, facilities, and uniform services, serves a variety of clients and institutions. The majority of its revenue comes from its North American food and support services segment. The company also has substantial segments in food and support services international and uniform and career apparel. With hundreds of service locations and distribution centers across the U.S. and Canada, Aramark has a significant presence in the market. However, with a current stock price of $24.85 and a fair value (GF Value) of $49.32, the stock appears to be significantly undervalued.

Understanding GF Value

The GF Value is a proprietary measure of a stock's intrinsic value, calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line denotes the stock's ideal fair trading value. If the stock price is significantly above the GF Value Line, it is overvalued, and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

Based on these calculations, Aramark (ARMK, Financial) is believed to be significantly undervalued. With a current price of $24.85 per share and a market cap of $6.50 billion, the stock's long-term return is likely to be much higher than its business growth.

Link: These companies may deliver higher future returns at reduced risk.

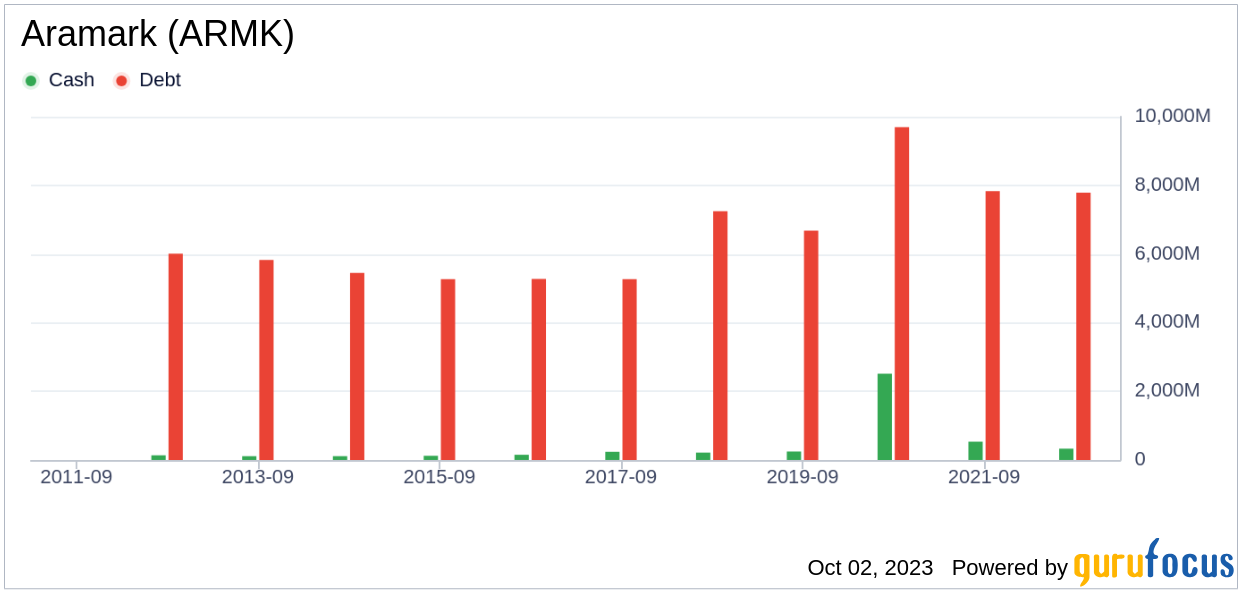

Financial Strength

Companies with poor financial strength offer investors a high risk of permanent capital loss. To avoid this, it's crucial to review a company's financial strength before deciding to purchase shares. Aramark's cash-to-debt ratio of 0.05 ranks worse than 90.76% of 1039 companies in the Business Services industry, indicating poor financial strength.

Profitability and Growth

Companies with consistent profitability over the long term offer less risk for investors. Aramark has been profitable 8 out of the past 10 years. However, its operating margin of 4.27% ranks worse than 58.84% of 1052 companies in the Business Services industry, indicating fair profitability.

Growth is a crucial factor in a company's valuation. The 3-year average annual revenue growth rate of Aramark is -0.7%, which ranks worse than 64.99% of 974 companies in the Business Services industry. The 3-year average EBITDA growth rate is -8.8%, which ranks worse than 82.49% of 845 companies in the Business Services industry.

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to the weighted average cost of capital (WACC) can determine its profitability. When the ROIC is higher than the WACC, the company is creating value for shareholders. For Aramark, the ROIC is 4.72, and the WACC is 8.1, indicating a need for improvement.

Conclusion

Overall, Aramark (ARMK, Financial) stock is believed to be significantly undervalued. Despite its poor financial condition and fair profitability, its growth ranks worse than 82.49% of 845 companies in the Business Services industry. For more details about Aramark stock, check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.