Charlie Munger once provided 3 simple tips on becoming a successful investor:

1) Follow the great investors.

2) Look at the cannibals (companies aggressively buying back shares).

3) Carefully study spinoffs.

So, here is an analysis of a recent spinoff by Dean Foods in which David Tepper of Appaloosa Management had been an active shareholder. At the start of 2011, Appaloosa held close to 7% of the total shares outstanding, however has since reduced its position to about 1%, taking profits on the way. The analysis below is for the Fresh Dairy business of DF and involves shorting the illiquid IPO of WWAV, which is a trade someone of Appaloosa's size cannot execute.

Summary

Dean Foods (NYSE: DF) recently spun-off its high growth business, "WhiteWave" (NYSE: WWAV) through an IPO. This presents an interesting opportunity to buy the remaining Fresh Dairy Direct (FDD, Financial) business on its own through a long-short trade. Dean Foods currently retains 86.7% ownership of WWAV, however it will distribute the majority of its stake on April 23, 2013, retaining 19.9% , after the IPO lock-up period expires. DF plans to distribute or sell the remaining stake at a later date as suitable per tax issues.

Dean Foods stand-alone (DF Stub) is currently trading at a Fwd P/E of 7.6x, P/FCF of 5.2x, and an EV/EBITDA multiple of 5.2x. The DF Stub currently has a price of $3.80/sh ($710m market cap, calculation below); however, I believe it's fair value is closer to $6.23/sh (67.3% upside) even based on the company's relatively weak 2013 guidance (will discuss later); and an upside value of about $9.95 in a normalized margin scenario combined with further capital structure savings.

DF Stub Capital Structure

*the stand alone debt includes debt reductions from the Morningstar sale completed on Jan 3, 2013

The Business

Dean Foods is a leading food and beverage company and the largest processor and distributor of milk and other fluid dairy products in the United States. The company has two business segments: Fresh Dairy Direct and The WhiteWave Foods Company ("WhiteWave"), which it spun out through an IPO. After the spin-off and distribution, DF holders will be left with just FDD.

Fresh Dairy Direct is the largest processor and distributor of fluid milk in the United States, and Fresh Dairy Direct also processes and distributes ice cream, cultured dairy products, creamers, ice cream mix and other dairy products. Dean Foods sold its longer shelf-life business, Morningstar, to Saputo in December 2012, leaving milk as 75% of the remaining FDD business. DF is the largest and only national player in the fragmented industry and maintains a 40% market share.

Dean Food's size doesn't provide it the supply-side economies of scale you would expect from a dominant industry player. DF sources milk from fragmented local farmers; however, milk prices are set by the US Government on a monthly basis to provide farmers the ability to earn reasonable profits and pass-through inflation of their inputs costs (corn).

Dean Foods also doesn't have any demand-side economies of scale. Its customers are retailers, and like other middle of the supply chain businesses, Dean Foods competes largely on price. With low switching costs, no product differentiation, and numerous local providers of milk; Dean Foods also has little power over its customers as well.

Where Dean Foods does have an advantage is in its distribution network and economic scale. The company continues to look for cost efficiencies in it's distribution network, capital structure, and overhead costs. Over the last 2 years, Dean Foods has reduced its operating leverage through de-leveraging its capital structure (reduced debt burden from $3.4b to $1.4b) and seeking efficiencies in its distributions network and overhead expenses ($300m or about 3% cost reduction). Management expects to achieve another $100m to $150m per year over the next two years through debt refinancing and further distribution savings). Dean Foods' transformation over the last two years has unlocked significant value for its share holders, the market value of the company has responded increasing from 2b at the start of 2012 to 3.5b currently (DF + WWAV, excluding DF ownership of WWAV). However, this is a thesis on DF FDD Stub, which remains undervalued.

Profitability

FDD has a gross profit margin of 20-25% and operating margin of about 2.5%; management is expecting 2013 to be another tough year because of high projected milk prices. However, even with the lower gross margins, Dean Foods will be able to achieve higher profitability through improved SG&A margins and a substantially lower interest expense. Management also sees debt refinancing as an avenue for further cost savings into 2014 as Dean Foods has substantially improved its leverage and credit position and will be able to secure financing at much lower interest rates (most recent senior notes were issued at 9.75%).

The upside scenario represents a normal gross margin year, combined with further interest expense savings. The downside scenario simulates an ever tougher margin environment than 2011, when Dean Foods experienced what management calls "irrational competition."

Valuation

Below are valuations based on the above profitability scenarios. I believe the base case represents a fairly conservative scenario of compressed gross margins and leaving the low-hanging fruit of reducing financing expenses on the table. As mentioned earlier, the base scenario represents a 67% upside with fairly conservative profitability and multiples scenario.

The upside scenario is definitely not out of reach. Management has shown great diligence over the last two years in reducing costs. If milk margins normalize and management continues to find ways to improve margins, the upside scenario is a definite possibility.

More impressive than the cost reductions has been the managements efforts to unlock shareholder value through de-leveraging and separating the parts of Dean Foods. Post WWAV distribution, Dean Foods stand alone will be a cash-cow (pun intended) with strong profitability and low capital intensity for an industrial business. Management plans to continue shareholder friendly capital allocation practices in the future through dividends or share-repurchases, which could help target multiples as well.

Risks/Downside Scenario: like any other industrial business, Dean Foods doesn't have control over its input costs and has little power over its customers as well. Periods of intense competition from smaller, local competitors, could lead to decreased profitability. However the de-leveraged capital structure and improved SG&A margins should allow Dean Foods to use its scale to out-compete in the long run.

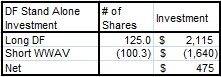

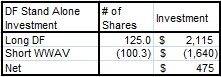

Executing FDD Stub

This is an analysis of the FDD business alone; therefore, execution must be done such that you are purchasing FDD only and hedging out the embedded WWAV ownership. To execute FDD Stub you should use a long DF 125 shares to short WWAV 100 shares ratio.

Disclaimer: I do not have a position in DF or WWAV, however may initiate a position within 72 hours.

1) Follow the great investors.

2) Look at the cannibals (companies aggressively buying back shares).

3) Carefully study spinoffs.

So, here is an analysis of a recent spinoff by Dean Foods in which David Tepper of Appaloosa Management had been an active shareholder. At the start of 2011, Appaloosa held close to 7% of the total shares outstanding, however has since reduced its position to about 1%, taking profits on the way. The analysis below is for the Fresh Dairy business of DF and involves shorting the illiquid IPO of WWAV, which is a trade someone of Appaloosa's size cannot execute.

Summary

Dean Foods (NYSE: DF) recently spun-off its high growth business, "WhiteWave" (NYSE: WWAV) through an IPO. This presents an interesting opportunity to buy the remaining Fresh Dairy Direct (FDD, Financial) business on its own through a long-short trade. Dean Foods currently retains 86.7% ownership of WWAV, however it will distribute the majority of its stake on April 23, 2013, retaining 19.9% , after the IPO lock-up period expires. DF plans to distribute or sell the remaining stake at a later date as suitable per tax issues.

Dean Foods stand-alone (DF Stub) is currently trading at a Fwd P/E of 7.6x, P/FCF of 5.2x, and an EV/EBITDA multiple of 5.2x. The DF Stub currently has a price of $3.80/sh ($710m market cap, calculation below); however, I believe it's fair value is closer to $6.23/sh (67.3% upside) even based on the company's relatively weak 2013 guidance (will discuss later); and an upside value of about $9.95 in a normalized margin scenario combined with further capital structure savings.

DF Stub Capital Structure

*the stand alone debt includes debt reductions from the Morningstar sale completed on Jan 3, 2013

The Business

Dean Foods is a leading food and beverage company and the largest processor and distributor of milk and other fluid dairy products in the United States. The company has two business segments: Fresh Dairy Direct and The WhiteWave Foods Company ("WhiteWave"), which it spun out through an IPO. After the spin-off and distribution, DF holders will be left with just FDD.

Fresh Dairy Direct is the largest processor and distributor of fluid milk in the United States, and Fresh Dairy Direct also processes and distributes ice cream, cultured dairy products, creamers, ice cream mix and other dairy products. Dean Foods sold its longer shelf-life business, Morningstar, to Saputo in December 2012, leaving milk as 75% of the remaining FDD business. DF is the largest and only national player in the fragmented industry and maintains a 40% market share.

Dean Food's size doesn't provide it the supply-side economies of scale you would expect from a dominant industry player. DF sources milk from fragmented local farmers; however, milk prices are set by the US Government on a monthly basis to provide farmers the ability to earn reasonable profits and pass-through inflation of their inputs costs (corn).

Dean Foods also doesn't have any demand-side economies of scale. Its customers are retailers, and like other middle of the supply chain businesses, Dean Foods competes largely on price. With low switching costs, no product differentiation, and numerous local providers of milk; Dean Foods also has little power over its customers as well.

Where Dean Foods does have an advantage is in its distribution network and economic scale. The company continues to look for cost efficiencies in it's distribution network, capital structure, and overhead costs. Over the last 2 years, Dean Foods has reduced its operating leverage through de-leveraging its capital structure (reduced debt burden from $3.4b to $1.4b) and seeking efficiencies in its distributions network and overhead expenses ($300m or about 3% cost reduction). Management expects to achieve another $100m to $150m per year over the next two years through debt refinancing and further distribution savings). Dean Foods' transformation over the last two years has unlocked significant value for its share holders, the market value of the company has responded increasing from 2b at the start of 2012 to 3.5b currently (DF + WWAV, excluding DF ownership of WWAV). However, this is a thesis on DF FDD Stub, which remains undervalued.

Profitability

FDD has a gross profit margin of 20-25% and operating margin of about 2.5%; management is expecting 2013 to be another tough year because of high projected milk prices. However, even with the lower gross margins, Dean Foods will be able to achieve higher profitability through improved SG&A margins and a substantially lower interest expense. Management also sees debt refinancing as an avenue for further cost savings into 2014 as Dean Foods has substantially improved its leverage and credit position and will be able to secure financing at much lower interest rates (most recent senior notes were issued at 9.75%).

The upside scenario represents a normal gross margin year, combined with further interest expense savings. The downside scenario simulates an ever tougher margin environment than 2011, when Dean Foods experienced what management calls "irrational competition."

Valuation

Below are valuations based on the above profitability scenarios. I believe the base case represents a fairly conservative scenario of compressed gross margins and leaving the low-hanging fruit of reducing financing expenses on the table. As mentioned earlier, the base scenario represents a 67% upside with fairly conservative profitability and multiples scenario.

The upside scenario is definitely not out of reach. Management has shown great diligence over the last two years in reducing costs. If milk margins normalize and management continues to find ways to improve margins, the upside scenario is a definite possibility.

More impressive than the cost reductions has been the managements efforts to unlock shareholder value through de-leveraging and separating the parts of Dean Foods. Post WWAV distribution, Dean Foods stand alone will be a cash-cow (pun intended) with strong profitability and low capital intensity for an industrial business. Management plans to continue shareholder friendly capital allocation practices in the future through dividends or share-repurchases, which could help target multiples as well.

Risks/Downside Scenario: like any other industrial business, Dean Foods doesn't have control over its input costs and has little power over its customers as well. Periods of intense competition from smaller, local competitors, could lead to decreased profitability. However the de-leveraged capital structure and improved SG&A margins should allow Dean Foods to use its scale to out-compete in the long run.

Executing FDD Stub

This is an analysis of the FDD business alone; therefore, execution must be done such that you are purchasing FDD only and hedging out the embedded WWAV ownership. To execute FDD Stub you should use a long DF 125 shares to short WWAV 100 shares ratio.

Disclaimer: I do not have a position in DF or WWAV, however may initiate a position within 72 hours.