Investors who focus on value are constantly scouring the market for stocks that appear undervalued compared to their intrinsic worth. One such company that has caught the eye of the market is Cogent Communications Holdings Inc (CCOI, Financial). With a current stock price of $65.18 and a recent daily loss of 4.48%, the stock has shown a slight increase of 0.18% over the past three months. However, the stock's GF Value is estimated at a higher $93.68, suggesting potential undervaluation.

The GF Value is a unique measure that reflects the intrinsic value of a stock, incorporating historical trading multiples such as PE, PS, PB ratios, and Price-to-Free-Cash-Flow, an adjustment factor based on the company's past performance, and projections of future business outcomes. Ideally, a stock's price would hover around its GF Value, with significant deviations indicating overvaluation or undervaluation.

Despite the attractive numbers, a deeper dive into the financials of Cogent Communications Holdings is crucial before making any investment decisions. Concerning signs such as a low Beneish M-Score of 5.05, which exceeds the -1.6 threshold indicating possible earnings manipulation, suggest that Cogent Communications Holdings may be a potential value trap. These metrics highlight the necessity for comprehensive due diligence when considering investment choices.

Understanding the Beneish M-Score

The Beneish M-Score is an analytical tool developed by Professor Messod Beneish, which utilizes eight financial metrics to evaluate a company's financial stability and the likelihood of earnings manipulation. Indicators such as Days Sales Outstanding (DSO), Gross Margin (GM), and changes in various financial ratios provide a multifaceted view of a company's financial health.

Company Profile: Cogent Communications Holdings

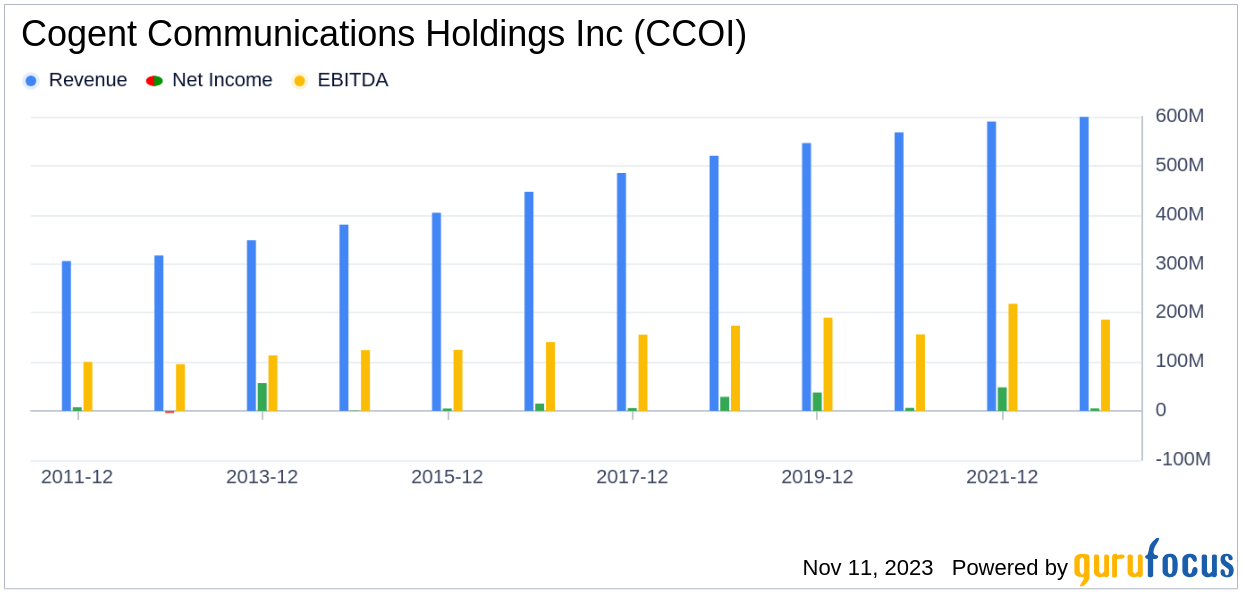

Carrying over one-fifth of the world's internet traffic, Cogent Communications Holdings serves as a vital broadband provider for businesses. With corporate customers mainly in North America, Cogent Communications Holdings offers dedicated internet access and virtual private networking. The company's netcentric customers, including ISPs and content providers, rely on Cogent Communications Holdings to deliver internet transit, with roughly half of this revenue originating from outside the U.S.

When evaluating Cogent Communications Holdings's financials, the Gross Margin trend is concerning, with a decline from 61.68 in 2021 to 48.01 in 2023. This significant contraction could signal potential issues in profitability and operational cost management.

An increase in the asset quality ratio from 0.01 in 2021 to 0.14 in 2023 also raises questions about the company's financial stability. This shift could indicate inflated assets and obscured operational costs, casting doubt on the company's true financial position and potential risk for investors.

The change in Selling, General, and Administrative (SG&A) expenses is another critical factor to consider. Cogent Communications Holdings's SG&A expenses have fluctuated, with a notable increase to 237.94 in 2023. While this could reflect changes in operational efficiency, it may also suggest cost-cutting measures that could harm long-term growth and sustainability.

Is Cogent Communications Holdings a Value Trap?

Considering the combination of an attractive GF Value and concerning financial indicators, Cogent Communications Holdings presents a complex investment profile. The potential for earnings manipulation, as indicated by the Beneish M-Score, alongside declining gross margins and questionable asset quality, suggest that the stock may indeed be a value trap. This underscores the importance of thorough research and a cautious approach when considering an investment in Cogent Communications Holdings.

To discover high-quality companies that may deliver above-average returns, please check out the GuruFocus High Quality Low Capex Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.