Monolithic Power Systems Inc (MPWR, Financial) has recently shown a daily gain of 3.14% and an impressive 3-month gain of 43.63%. With an Earnings Per Share (EPS) of 9.23, investors are keen to understand if the current stock valuation is justified. Is Monolithic Power Systems fairly valued at its current price? The following analysis aims to shed light on this question, providing a detailed look at the company's intrinsic value and market performance.

Company Introduction

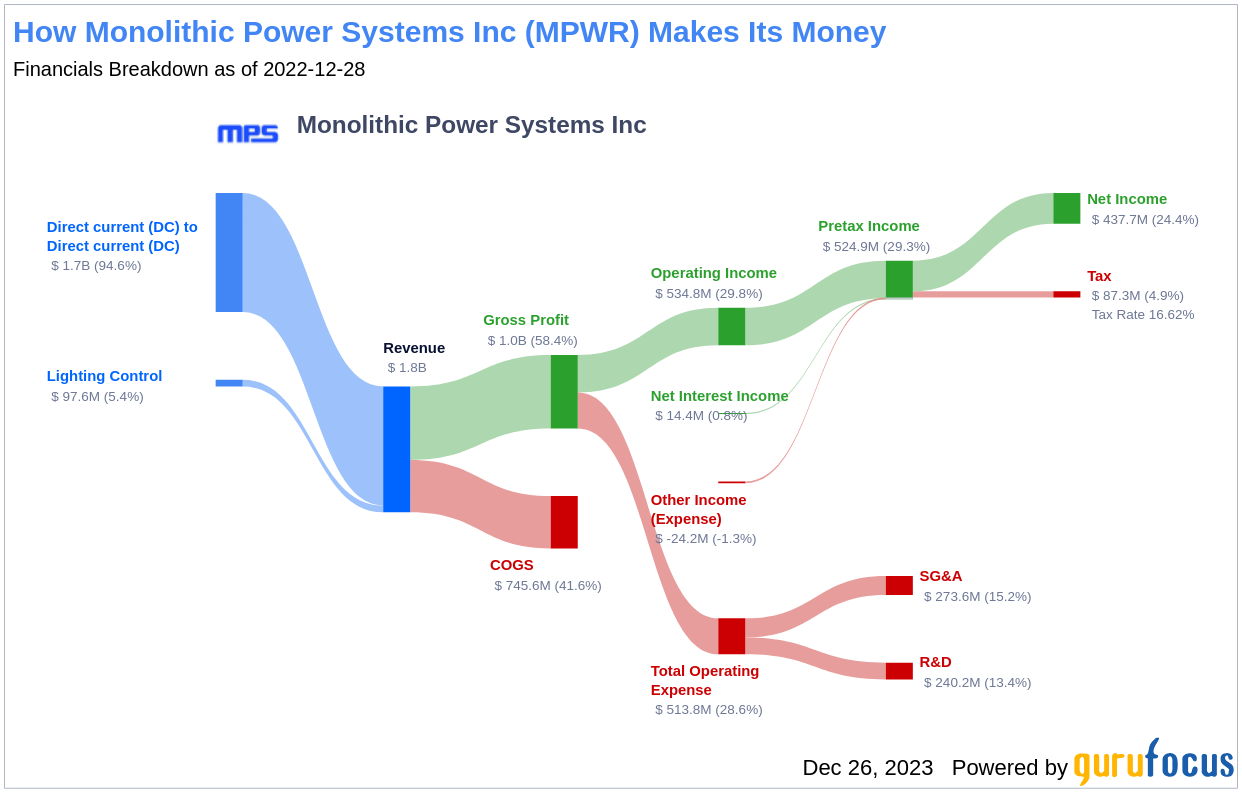

Monolithic Power Systems Inc, a leading analog and mixed-signal chipmaker, specializes in power management solutions aimed at reducing total energy consumption in end systems. The company operates in various markets, including computing, automotive, industrial, communications, and consumer end markets. Utilizing a fabless manufacturing model, Monolithic Power Systems partners with third-party chip foundries, leveraging its proprietary BCD process technology. With a current share price of $637.04 and a GF Value of $610.96, the company's market capitalization stands at $30.50 billion, indicating a close alignment between market price and fair value.

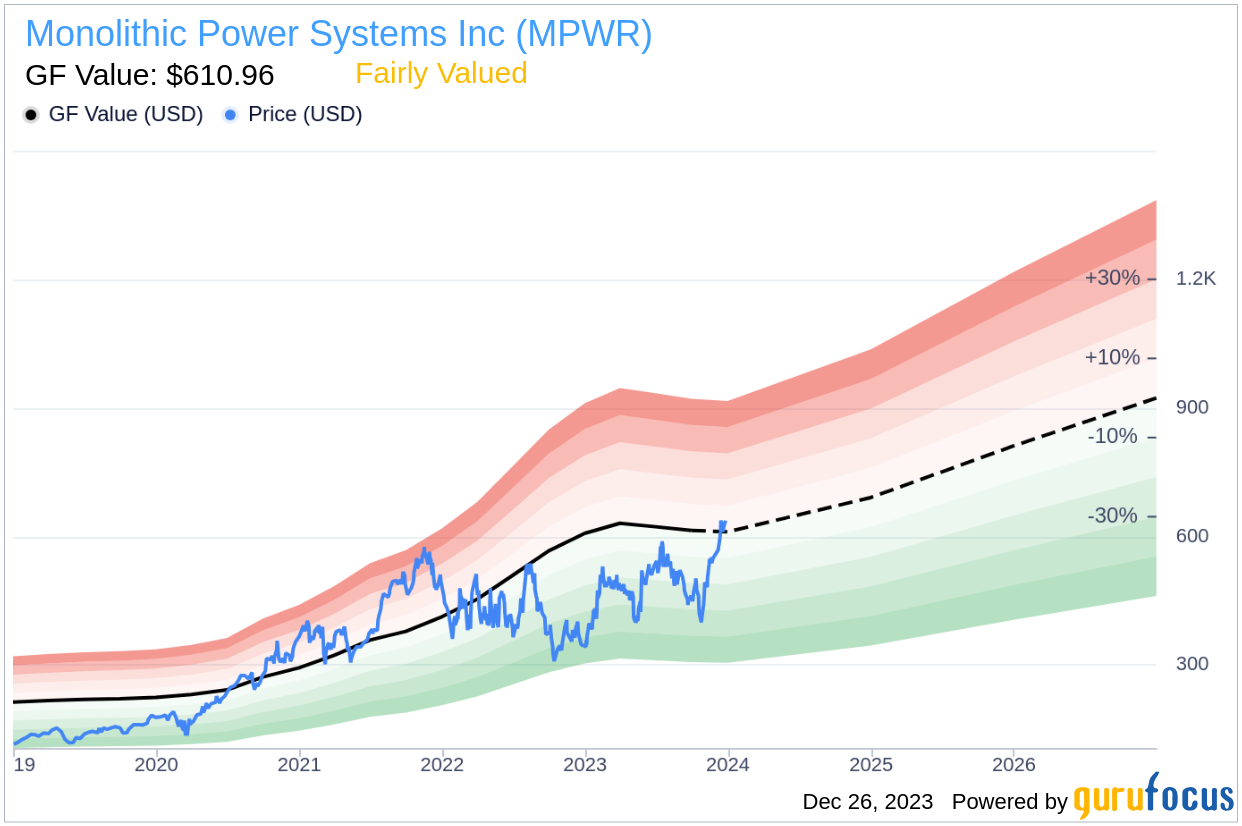

Summarize GF Value

The GF Value is a unique measure that captures the intrinsic value of a stock by considering historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. Monolithic Power Systems (MPWR, Financial) appears to be fairly valued according to this method. The stock price is currently hovering around the GF Value Line, suggesting that the stock is neither significantly overvalued nor undervalued. This equilibrium implies that the long-term return of Monolithic Power Systems' stock is likely to mirror the company's business growth rate.

Link: These companies may deliver higher future returns at reduced risk.

Financial Strength

Investing in companies with robust financial strength is crucial to avoid permanent capital loss. Monolithic Power Systems' cash-to-debt ratio of 10000 places it ahead of 99.79% of its peers in the Semiconductors industry, reflecting a strong balance sheet. This financial resilience is underscored by a financial strength rating of 10 out of 10 from GuruFocus.

Profitability and Growth

Consistent profitability is a hallmark of a less risky investment. Monolithic Power Systems has maintained profitability for the last decade, boasting a revenue of $1.80 billion and an Earnings Per Share (EPS) of $9.23. With an operating margin of 28.3%, the company stands well above most of its industry counterparts. Additionally, Monolithic Power Systems' growth rates in revenue and EBITDA are commendable, indicating a robust trajectory for future value creation.

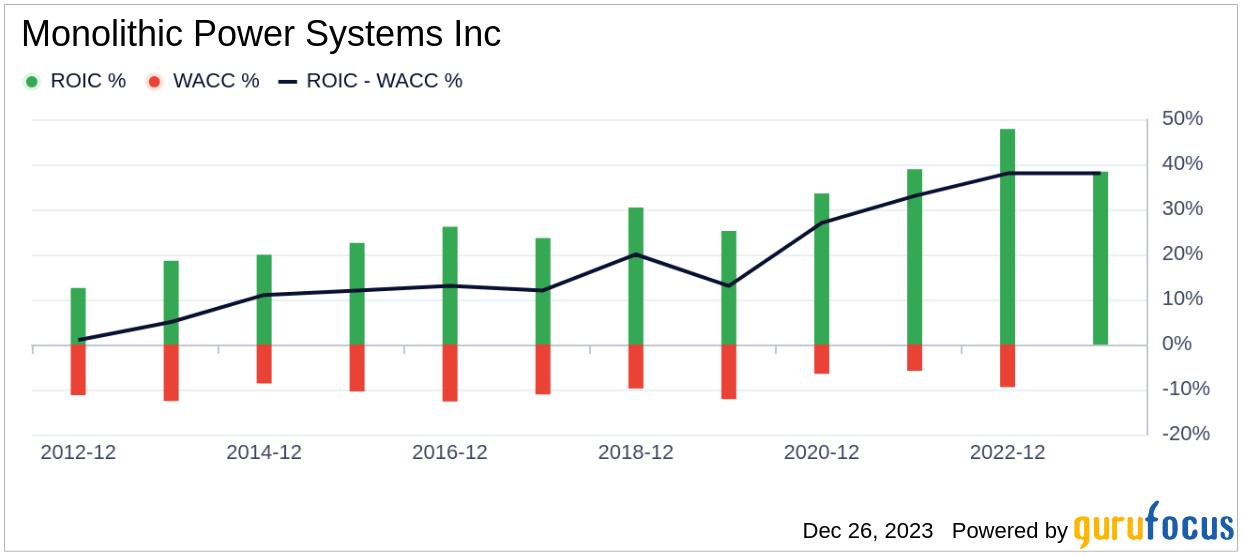

ROIC vs WACC

Comparing a company's Return on Invested Capital (ROIC) with its Weighted Average Cost of Capital (WACC) provides insight into its value creation efficiency. Monolithic Power Systems' ROIC of 39.63 significantly surpasses its WACC of 13.18, indicating that the company is generating substantial value for its shareholders.

Conclusion

In summation, Monolithic Power Systems (MPWR, Financial) presents as fairly valued in the current market. The company's financials are robust, profitability is strong, and its growth rates are commendable, outperforming a significant portion of the semiconductor industry. For a deeper dive into Monolithic Power Systems' financials, one can explore their 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, consider the GuruFocus High Quality Low Capex Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.