Preferred stocks have long been a staple of any income investors' portfolio as both a stable source of dividends as well as an excellent capital appreciation opportunity. Preferred shares are often described as a type of hybrid investment: part equity and part debt security.

The benefit of owning a preferred stock is that the equity component stations you higher in the capital structure of the company while the income component typically pays a higher yield than bonds. The price of preferred stocks on the secondary market typically fluctuate with interest rates, similar to bond prices, but they can also be subject to equity-like price characteristics as well.

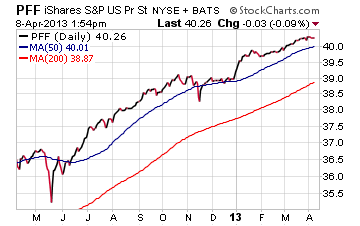

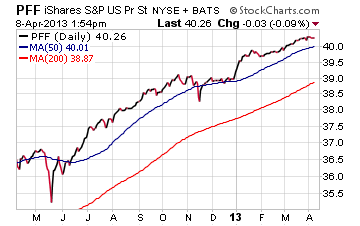

One of the most widely held preferred stock funds is the iShares S&P U.S. Preferred Stock ETF (PFF, Financial) with over $11 billion in total assets. This fund holds over 300 securities that are centered primarily in the financial, real estate, insurance and utility sectors. The current 30-day SEC yield on PFF is 5.62% and looking at the chart below, you can see that it's hovering very near its 52-week highs.

The relatively steady price appreciation of PFF and its dependable monthly income stream make it a very attractive holding for a diversified income portfolio. I don't directly own this ETF at this time because I think that we are going to get an opportunity to purchase it at lower prices. Although, I do have indirect exposure to PFF through the iShares Multi-Asset Income Fundn (IYLD, Financial).

Given the lofty levels in both the stock and bond market I would not be surprised to see anywhere from a 3% to 5% pullback in this security which would setup a nice long-term buying opportunity. I would look to be a buyer in and around the $38 level on PFF, similar to where it dipped in November 2012. I would also set a trailing stop loss on the position as a risk management tool to guard against any sustained volatility.

Three other preferred stocks that are worth noting:

PowerShares Preferred Portfolio (PGX, Financial): This offering from PowerShares has a similar makeup to PFF with a yield of 6.35%.

iShares International Preferred Stock ETF (IPFF, Financial): This international preferred stock fund is made up primarily of Canadian and UK-based companies in the financial and energy sectors. IPFF has a current yield of 2.82%.

Market Vectors Preferred Securities ex Financials ETF (PXFX, Financial): This new and unique offering from Van Eck Global seeks to differentiate itself by getting away from the traditional financial sector dominance of other preferred ETFs. Its primary sector exposure includes REITs, utilities, automotive and telecommunication companies. The current yield of PFXF is 5.96%.

No matter what preferred stock ETF you ultimately choose, you should base your decision on the underlying holdings, track record, expense ratio and most importantly your risk tolerance and investment objectives.

The benefit of owning a preferred stock is that the equity component stations you higher in the capital structure of the company while the income component typically pays a higher yield than bonds. The price of preferred stocks on the secondary market typically fluctuate with interest rates, similar to bond prices, but they can also be subject to equity-like price characteristics as well.

One of the most widely held preferred stock funds is the iShares S&P U.S. Preferred Stock ETF (PFF, Financial) with over $11 billion in total assets. This fund holds over 300 securities that are centered primarily in the financial, real estate, insurance and utility sectors. The current 30-day SEC yield on PFF is 5.62% and looking at the chart below, you can see that it's hovering very near its 52-week highs.

The relatively steady price appreciation of PFF and its dependable monthly income stream make it a very attractive holding for a diversified income portfolio. I don't directly own this ETF at this time because I think that we are going to get an opportunity to purchase it at lower prices. Although, I do have indirect exposure to PFF through the iShares Multi-Asset Income Fundn (IYLD, Financial).

Given the lofty levels in both the stock and bond market I would not be surprised to see anywhere from a 3% to 5% pullback in this security which would setup a nice long-term buying opportunity. I would look to be a buyer in and around the $38 level on PFF, similar to where it dipped in November 2012. I would also set a trailing stop loss on the position as a risk management tool to guard against any sustained volatility.

Three other preferred stocks that are worth noting:

PowerShares Preferred Portfolio (PGX, Financial): This offering from PowerShares has a similar makeup to PFF with a yield of 6.35%.

iShares International Preferred Stock ETF (IPFF, Financial): This international preferred stock fund is made up primarily of Canadian and UK-based companies in the financial and energy sectors. IPFF has a current yield of 2.82%.

Market Vectors Preferred Securities ex Financials ETF (PXFX, Financial): This new and unique offering from Van Eck Global seeks to differentiate itself by getting away from the traditional financial sector dominance of other preferred ETFs. Its primary sector exposure includes REITs, utilities, automotive and telecommunication companies. The current yield of PFXF is 5.96%.

No matter what preferred stock ETF you ultimately choose, you should base your decision on the underlying holdings, track record, expense ratio and most importantly your risk tolerance and investment objectives.