With the stock market hitting new all-time highs last week, many investors are starting to wonder if this most recent rally is going to last for much longer. With every passing day we are getting closer to the "sell in May and go away" time frame that has historically been a good time to ratchet down the stock risk in your portfolio.

While I am not one to blindly follow a trading strategy that focuses solely on timing the calendar, I am starting to become more cautious about the prospects for further upward momentum. The odds are starting to favor at least a modest pull back which could setup an excellent buying opportunity for money that has been left on the sidelines.

So how do you adjust your asset allocation to lower the risk in your portfolio while still keeping a modest level of correlation to stocks in case the rally continues?

The answer is simple: You select a fund with a multi-asset approach that has an overweight allocation to core fixed income.

There are two funds on my radar from iShares that accomplish this objective and are perfect for conservative investors that can't handle the volatility and psychology of a steep correction in the market. In addition, they may be excellent placeholders for short-term traders that want to lower their exposure to stocks in order to assess additional opportunities in the marketplace.

The iShares S&P Conservative Allocation Fund (AOK, Financial) is a fund of funds that holds nine other iShares ETFs with a 71% weighting to domestic bonds, 17% weighting to domestic equities and 13% weighting to international equities. The expense ratio of the fund is only 0.30% and it currently has a 30-day SEC yield of 2.30% that is distributed monthly. The combination of overweight bonds and underweight equities gives the fund a beta of only 0.25 vs. the S&P 500 Index.

The iShares S&P Moderate Allocation Fund (AOM, Financial) is a similar multi-asset strategy with a more balanced 57% weighting to domestic bonds, 28% weighting to domestic equities, and 15% allocation to international equities. The beta of AOM is 0.41 vs. the S&P 500 Index. Because of its higher allocation to stocks this fund is going to have more upside potential than AOK.

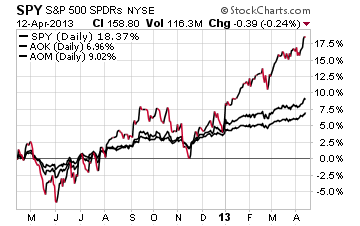

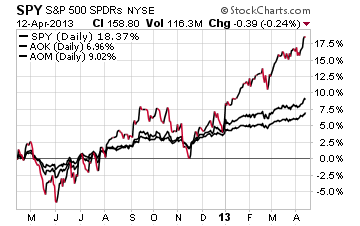

A one year comparison of AOK and AOM to the SPDR S&P 500 [color=#0000ff"> shows that while neither of them has come close to matching the price appreciation of SPY, they didn't see the same volatility in the October-November 2012 time frame either. What you see on the chart is a very smooth and steady price trend because the high quality bonds in the portfolio offset the more volatile stocks.

While these funds are not for everyone, they do have attractive qualities for conservative to moderate risk takers that want diversified exposure to both stocks and bonds. In addition, they may be good starter positions for investors that have missed the rally and want to begin purchasing an ETF that they can average into over time.

While I am not one to blindly follow a trading strategy that focuses solely on timing the calendar, I am starting to become more cautious about the prospects for further upward momentum. The odds are starting to favor at least a modest pull back which could setup an excellent buying opportunity for money that has been left on the sidelines.

So how do you adjust your asset allocation to lower the risk in your portfolio while still keeping a modest level of correlation to stocks in case the rally continues?

The answer is simple: You select a fund with a multi-asset approach that has an overweight allocation to core fixed income.

There are two funds on my radar from iShares that accomplish this objective and are perfect for conservative investors that can't handle the volatility and psychology of a steep correction in the market. In addition, they may be excellent placeholders for short-term traders that want to lower their exposure to stocks in order to assess additional opportunities in the marketplace.

The iShares S&P Conservative Allocation Fund (AOK, Financial) is a fund of funds that holds nine other iShares ETFs with a 71% weighting to domestic bonds, 17% weighting to domestic equities and 13% weighting to international equities. The expense ratio of the fund is only 0.30% and it currently has a 30-day SEC yield of 2.30% that is distributed monthly. The combination of overweight bonds and underweight equities gives the fund a beta of only 0.25 vs. the S&P 500 Index.

The iShares S&P Moderate Allocation Fund (AOM, Financial) is a similar multi-asset strategy with a more balanced 57% weighting to domestic bonds, 28% weighting to domestic equities, and 15% allocation to international equities. The beta of AOM is 0.41 vs. the S&P 500 Index. Because of its higher allocation to stocks this fund is going to have more upside potential than AOK.

A one year comparison of AOK and AOM to the SPDR S&P 500 [color=#0000ff"> shows that while neither of them has come close to matching the price appreciation of SPY, they didn't see the same volatility in the October-November 2012 time frame either. What you see on the chart is a very smooth and steady price trend because the high quality bonds in the portfolio offset the more volatile stocks.

While these funds are not for everyone, they do have attractive qualities for conservative to moderate risk takers that want diversified exposure to both stocks and bonds. In addition, they may be good starter positions for investors that have missed the rally and want to begin purchasing an ETF that they can average into over time.