Professor Damodaran shares his updated thoughts and valuation of Apple:

As has been the case for much of the last two years, the Apple earnings report on April 24, 2013 was a media event, previewed endlessly on investment sites, covered heavily by the media and tweeted about by both Apple fans and foes. While I try to stay away from the hype around earnings reports, this is a good occasion to revisit my earlier posts on Apple, and especially the one I made at the start of this year on its valuation.The Signal amidst the Noise

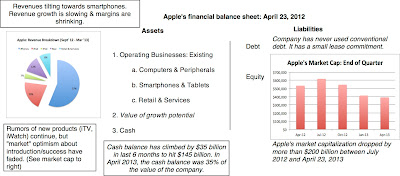

One of the most difficult parts of being an investor in Apple has become dealing with the cacophony of rumors, stories and news releases that seem to permeate the day-to-day coverage of the stock. Not only do we, as investors, have to determine whether there is truth to a story but we also have to evaluate its impact on value (and indirectly on whether to continue holding the stock). To keep my perspective, as I read these stories, I go back to basics and draw on my “financial balance sheet” view of a company. While it resembles an accounting balance sheet in broad terms, it is different on two dimensions. First, it is a forward looking and value based assessment of a company, rather than being backward looking and historical cost based. Second, it is flexible enough to allow me to record the potential for future growth as an asset, thus giving businesses credit for value that they may create in the future from growth. In very broad terms, here is what Apple’s financial balance sheet looked like just before the most recent earnings report:

There is nothing surprising about this balance sheet but it brings together much of what has happened to the company between April 2012 and April 2013. During the year, the company has become increasingly dependent upon its smartphone business, accounting for 60% of revenues and even more of operating income, generating immense amounts of cash for the company (with the cash balance climbing $50 billion over the course of the year to hit $145 billion). During the course of the year, we have seen a slowing of revenue growth and pressure on margins, both of which have contributed to declining stock prices. The other big change over the course of the year is that the value of growth potential (from unspecified future products) has faded, at least in the market’s eyes, and this is reflected in the decline of $200 billion in market value over the last nine months.

The Last Earnings Report (April 23, 2013)

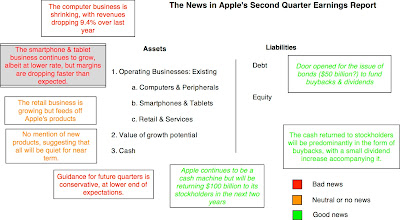

The most recent earnings report contained a mix of good news on the financial front (cash and financing mix) and bad or neutral news on the operating asset front. Using the same framework that I used in the last section, here is how I parsed the news in the report:

First, in the no news category, revenue growth is no longer in the double digits and smartphones continue to increase their share of overall revenues & operating income. Well, we knew that already and the revenue growth was well within the expected bounds. Second, the bad news is that margins are shrinking faster than we expected them to, though I get the sense that Apple is understating its margins (by moving some expenses forward) and its guidance for the future with the intent of getting ahead of the expectations game. Third, in near term bad news, the fact there is no mention of any new products or breakthroughs suggests that there will be no revolutionary product announcement (iWatch, iTV, iWhatever) in the next quarter. However, if you are a long term investor, it is mildly disappointing that it looks like that there will be no blockbuster announcements in the next three months but it is clearly not the end of the world.

On the financial side, there was substantial news, much of which I think is positive.

- Cash return to stockholders: The decision to decision to return about $100 billion more in cash to stockholders in buybacks and dividends by 2015 has to be viewed as vindication for those (like David Einhorn) who have arguing that Apple should be explicit about its future plans for cash and that it should distribute a large chunk cash with stockholders.

- Buybacks versus Dividends: In a bit of a surprise, the cash return will be more in the form of buybacks than dividends. I, for one, am on board with that decision because hiking the dividends further will essentially make this stock a "dividend" play, with an investor base that will put dividend growth in the future ahead of all other considerations. If Apple wants to retain the option of entering a new and perhaps more capital intensive business in the future, it is better positioned as a consequence of this decision.

- Debt coming? In an even bigger surprise, Apple has opened the door to taking on conventional debt. While the details are still fuzzy and the initial bond issue may be for only about $10 billion, it seems likely that the debt issued will grow beyond that amount. To those who would take issue with this decision, arguing that Apple does not need to borrow with all of its cash reserves, you may be missing the reason why this debt will add to value. If the trade off on debt is that you weigh the tax benefits of debt against the bankruptcy cost, there can be no arguing against the fact that borrowing money will add value for stockholders. To those who feel that it is in some way immoral or unethical, based upon the argument that Apple is sheltering its foreign income from additional US taxes while claiming a tax deduction for interest expenses, I would be more inclined to listen to you if you showed me convincing proof that you make mortgage interest payments every year but did not claim the mortgage tax deduction in your tax returns, because you think that it deprives the treasury of much needed revenue. The US tax code is an abomination, with its treatment of foreign income as exhibit 1, but to ask Apple (and its stockholders) to pay the price for the tax code's failures makes little sense to me.

In summary, the net effect of the earnings report is negative on operating cash flows (with the declining margins) but positive on the financial side (with any discount on cash dissipating, as a result of the cash return announcement, and the tax benefits from debt augmenting value).

Continue Reading: _http://aswathdamodaran.blogspot.ca/2013/04/apple-calm-after-storm.html