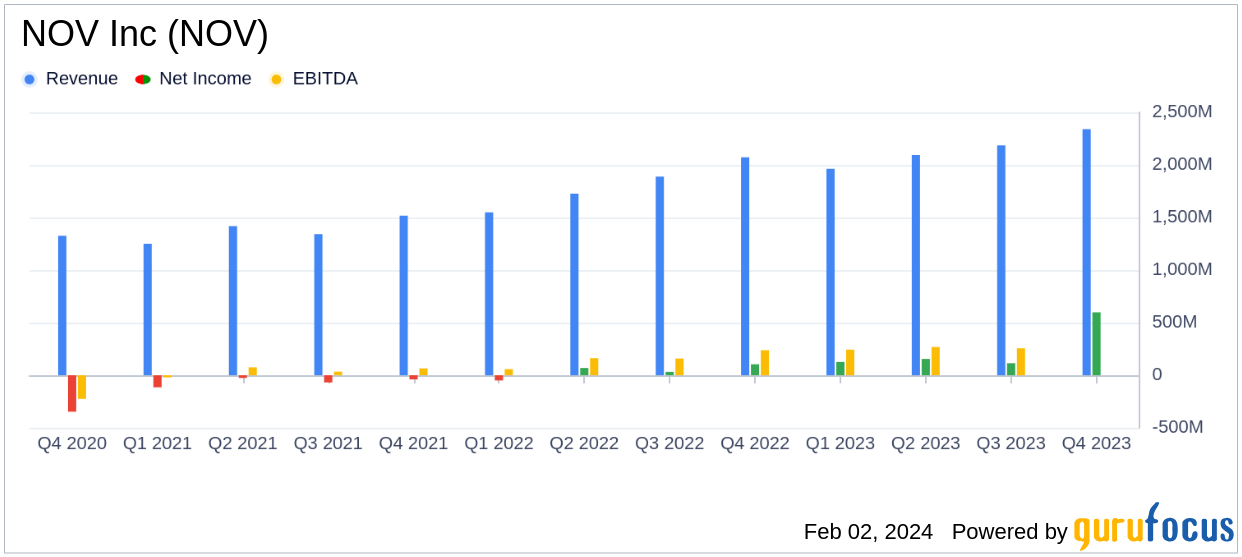

On February 1, 2024, NOV Inc (NOV, Financial), a global leader in supplying equipment and technology to the oil and gas industry, released its 8-K filing, detailing the financial results for the fourth quarter and full year of 2023. The company, which has been a pioneer in the energy sector for over 150 years, reported a 13% increase in year-over-year revenue for Q4, reaching $2.34 billion. This growth reflects NOV's strong market position and its ability to capitalize on rising demand in international and offshore markets.

Despite a sequential decrease in operating profit, which stood at $161 million for Q4, NOV's net income witnessed a remarkable increase to $598 million. This surge was primarily due to the release of valuation allowances on deferred tax assets amounting to $485 million. The company's fully diluted earnings per share (EPS) for the quarter was $1.51, up significantly from both the previous quarter and the same quarter last year.

NOV's financial achievements in Q4 and throughout 2023 are particularly noteworthy given the challenges faced by the oil and gas industry. The company's ability to generate a substantial free cash flow of $301 million in Q4, alongside an adjusted EBITDA of $294 million, underscores its operational efficiency and the successful execution of its strategic initiatives.

Segment Performance and Future Outlook

NOV's three main segments—Wellbore Technologies, Completion & Production Solutions, and Rig Technologies—all reported year-over-year revenue growth. Wellbore Technologies saw an 8% increase, Completion & Production Solutions grew by 9%, and Rig Technologies experienced a notable 24% rise compared to Q4 of the previous year.

Looking ahead, NOV anticipates continued growth in international and offshore markets, which is expected to offset declining demand from North America in 2024. The company's focus on advanced technologies and improving working capital efficiencies is projected to drive robust cash flow in the coming year.

Balance Sheet and Cash Flow Highlights

As of December 31, 2023, NOV had a solid balance sheet with total debt standing at $1.73 billion and a cash and cash equivalents position of $816 million. The company's cash flow from operations was $377 million for Q4, contributing to the strong free cash flow figure.

NOV's strategic achievements, including securing contracts for carbon capture and storage (CCS) projects and the acquisition of Extract, a provider of artificial lift technologies, position the company to capitalize on emerging opportunities in the energy transition landscape.

In conclusion, NOV's Q4 and full-year 2023 financial results demonstrate the company's resilience and strategic positioning in a dynamic market. With a focus on technology-driven solutions and a commitment to sustainable energy production, NOV is well-equipped to navigate the challenges and capitalize on the opportunities that lie ahead in the energy sector.

For a more detailed analysis of NOV Inc's financial performance and future prospects, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from NOV Inc for further details.