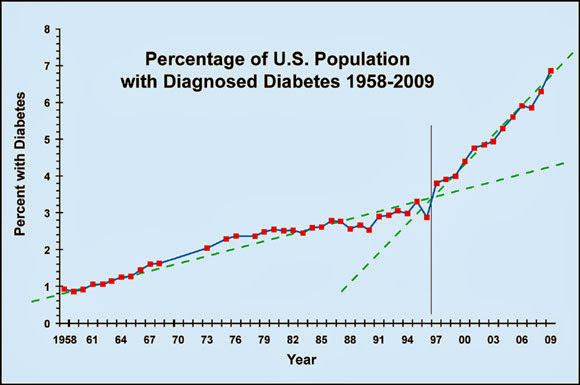

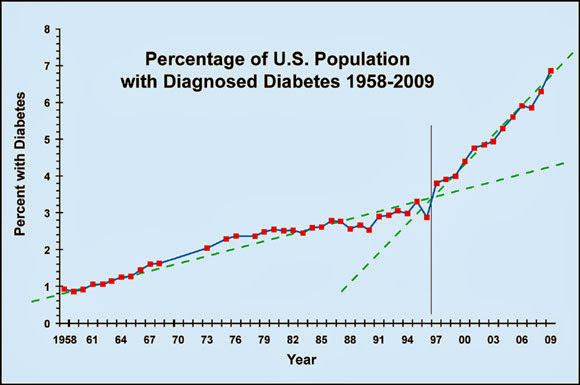

Diabetes is the number one cause of kidney failure in the U.S. That in itself is a pretty strong statement. Here’s another one for you: 8.3% of the entire U.S. population, roughly 25.8 million people, have been diagnosed with diabetes as of 2011. Wow. The number of people with diagnosed diabetes isn’t slowing down anytime soon either. According to the 2011 National Diabetes Fact Sheet, 79 million people in the U.S. are considered to be “prediabetic.” If you have any question as to just how rapidly these numbers are growing, check out the chart below.

If only that were the chart for a recent stock purchase, right? Well, it could be. So how do we make a sad, but prosperous, play on the growing rate of diagnosed diabetes in America? Dialysis. Dialysis is the process of removing waste and excess water from the blood, a job that the kidneys are supposed to do. At the end of 2009, 398,861 patients with End Stage Renal Disease (ESRD) in the U.S. were being treated with some form of dialysis.

So who offers the best way to take advantage of the rapidly growing need for dialysis services while trading at a discount? DaVita does. DaVita HealthCare Partners Inc. (DVA) provides dialysis and administrative services through a network of 1,954 outpatient dialysis centers throughout 44 states and the District of Columbia in the U.S. At the end of 2012, DaVita served a total of approximately 153,000 patients. DaVita also provides acute inpatient dialysis services in approximately 970 hospitals throughout the U.S.

These numbers are an increase from the 2011 figures, which included 1,809 outpatient centers, 142,000 patients, and only 900 hospitals. These are fantastic numbers, speaking as how the company’s U.S. dialysis and related lab services business accounted for approximately 86% of their 2012 net revenues. This percentage might change, however, after the company’s new acquisition.

In the middle of 2012, DaVita purchased doctor group HealthCare Partners LLC (reflected in their new name) for $4.42 billion. If we were to pretend that HCP was acquired at the beginning of 2012, and not the middle of the year, DaVita’s U.S. dialysis and related lab services business would only have accounted for 68% of total net revenue. This is because DaVita and HealthCare Partners LLC are two very different companies. DaVita, as we now know, provides dialysis services to patients with failing kidneys. HealthCare Partners on the other hand is the largest U.S. operator of physician groups and networks, raking in a revenue of about $2.4 billion in revenue for 2011 (DaVita brought in $6.98 billion in the same year). HealthCare Partners focuses on California, Florida, and Nevada, encompassing about 700 doctors in the medical group, and around 8,300 affiliated independent physicians. The company focuses on overseeing nearly all of its patients’ health needs by including primary and specialty care, as well as coordinating other services such as hospital visits.

By making this giant acquisition, DaVita is assuming that American healthcare is shifting directions from a more independent doctor and hospital setting, where providers get fees for each individual service, to a larger integrated pool of providers that coordinate all of a patient’s needs and reap financial benefits depending on the quality and efficiency of care.

Financial Strength

DaVita has put up an awesome record of consistent earnings growth that has held steady through the tough financial times of 2001 and 2008 as if they never happened. Over the last 10 years, DaVita has experienced an increase in revenue per share and EBITDA per share without missing a beat. Book value per share and earning per share have seen solid increases over the last 10 years as well, with the exception of a couple years.

DaVita’s free cash flow also has a pretty impressive trendline, dropping in 2012 due to acquisitions.

The company has more Total Assets than Total Liabilities, and more current assets than current liabilities. DaVita also has an impressive operating margin and net profit margin of 14.05% and 6.8% respectively. DaVita’s operating margin is higher than 86% of its peers. Management must be doing their job, because the company also rakes in a return on equity of 17.59%.

At first glance, one might become slightly concerned with the company’s price to book ratio of 2.89x, but DaVita’s three-year low is only 2.73x.

Here's a peek into the company's latest impressive financials:

Risks

DaVita’s shares have recently taken a dip. This is because on July 1, the Centers for Medicare and Medicaid Services issued a proposed rule that would cut spending to large dialysis organizations in calendar year 2014. This rule changes overall Medicare payments for end-stage renal disease patients to be lower by 9.4%. This will lower payments for large dialysis organizations in 2014 by 12%. This may hinder DaVita’s U.S.-based business growth, forcing the company to devise certain cost-cutting measures. On the bright side, it has been assumed that the cuts may be scaled in over multiple years. This would help soften the hit that the company would take to revenue growth. Maybe the recent sell-off was a simple overreaction?

Catalysts

The long-term outlook for dialysis is still very prevalent. The recent short-term drop in share price may be an indicator of an ideal long-term entry point. Also, right after the dip, guess who added to his current position of DVA? Yours truly, Warren Buffett and his multinational conglomerate holding company Berkshire Hathaway (BRK.A, Financial)(BRK.B, Financial). Need we say more? Buffett now owns a total of 15,723,415 share of the company, with his most recent average purchase price of $57.28 per share. Buffett first purchased shares of DVA in the end of 2011 for an average purchase price of $35.53. The fact that he is still adding to his position after his initial purchase has already gained 58% should say something in itself.

According to the Kidney End-of-Life Coalition, 45% of the patients receiving dialysis treatments in the United States are over the age of 60. Let me show you this chart from DaVita’s most recent 10-K:

The large majority of DaVita’s customer-base are people on Medicare (65+). It would be helpful to know what percentage of their patients are age 60 to 65 as well. Why does this matter? Well, the largest group of Baby Boomers are still in their 50s, with the first of the baby boomers in their late 60s. Every year that passes, more and more of the large chunk of baby boomers are susceptible to chronic kidney disease, needing dialysis. That being said, it appears that DaVita has a pretty decent pipeline of customers.

End Notes

What are your thoughts? Is DVA trading at a discount? What does Berkshire like about it so much? Comment and let us know your opinion!

Disclosure: No current position held at the time of writing.

Disclaimer: The opinions and ideas in this article are for informational and educational purposes only. They are not a recommendation to buy or sell any stock at any given time. As always, it is imperative for each individual investor to do their own due diligence and perform their own research on any and all stocks before making an investment decision.

If only that were the chart for a recent stock purchase, right? Well, it could be. So how do we make a sad, but prosperous, play on the growing rate of diagnosed diabetes in America? Dialysis. Dialysis is the process of removing waste and excess water from the blood, a job that the kidneys are supposed to do. At the end of 2009, 398,861 patients with End Stage Renal Disease (ESRD) in the U.S. were being treated with some form of dialysis.

So who offers the best way to take advantage of the rapidly growing need for dialysis services while trading at a discount? DaVita does. DaVita HealthCare Partners Inc. (DVA) provides dialysis and administrative services through a network of 1,954 outpatient dialysis centers throughout 44 states and the District of Columbia in the U.S. At the end of 2012, DaVita served a total of approximately 153,000 patients. DaVita also provides acute inpatient dialysis services in approximately 970 hospitals throughout the U.S.

These numbers are an increase from the 2011 figures, which included 1,809 outpatient centers, 142,000 patients, and only 900 hospitals. These are fantastic numbers, speaking as how the company’s U.S. dialysis and related lab services business accounted for approximately 86% of their 2012 net revenues. This percentage might change, however, after the company’s new acquisition.

In the middle of 2012, DaVita purchased doctor group HealthCare Partners LLC (reflected in their new name) for $4.42 billion. If we were to pretend that HCP was acquired at the beginning of 2012, and not the middle of the year, DaVita’s U.S. dialysis and related lab services business would only have accounted for 68% of total net revenue. This is because DaVita and HealthCare Partners LLC are two very different companies. DaVita, as we now know, provides dialysis services to patients with failing kidneys. HealthCare Partners on the other hand is the largest U.S. operator of physician groups and networks, raking in a revenue of about $2.4 billion in revenue for 2011 (DaVita brought in $6.98 billion in the same year). HealthCare Partners focuses on California, Florida, and Nevada, encompassing about 700 doctors in the medical group, and around 8,300 affiliated independent physicians. The company focuses on overseeing nearly all of its patients’ health needs by including primary and specialty care, as well as coordinating other services such as hospital visits.

By making this giant acquisition, DaVita is assuming that American healthcare is shifting directions from a more independent doctor and hospital setting, where providers get fees for each individual service, to a larger integrated pool of providers that coordinate all of a patient’s needs and reap financial benefits depending on the quality and efficiency of care.

Financial Strength

DaVita has put up an awesome record of consistent earnings growth that has held steady through the tough financial times of 2001 and 2008 as if they never happened. Over the last 10 years, DaVita has experienced an increase in revenue per share and EBITDA per share without missing a beat. Book value per share and earning per share have seen solid increases over the last 10 years as well, with the exception of a couple years.

DaVita’s free cash flow also has a pretty impressive trendline, dropping in 2012 due to acquisitions.

The company has more Total Assets than Total Liabilities, and more current assets than current liabilities. DaVita also has an impressive operating margin and net profit margin of 14.05% and 6.8% respectively. DaVita’s operating margin is higher than 86% of its peers. Management must be doing their job, because the company also rakes in a return on equity of 17.59%.

At first glance, one might become slightly concerned with the company’s price to book ratio of 2.89x, but DaVita’s three-year low is only 2.73x.

Here's a peek into the company's latest impressive financials:

Risks

DaVita’s shares have recently taken a dip. This is because on July 1, the Centers for Medicare and Medicaid Services issued a proposed rule that would cut spending to large dialysis organizations in calendar year 2014. This rule changes overall Medicare payments for end-stage renal disease patients to be lower by 9.4%. This will lower payments for large dialysis organizations in 2014 by 12%. This may hinder DaVita’s U.S.-based business growth, forcing the company to devise certain cost-cutting measures. On the bright side, it has been assumed that the cuts may be scaled in over multiple years. This would help soften the hit that the company would take to revenue growth. Maybe the recent sell-off was a simple overreaction?

Catalysts

The long-term outlook for dialysis is still very prevalent. The recent short-term drop in share price may be an indicator of an ideal long-term entry point. Also, right after the dip, guess who added to his current position of DVA? Yours truly, Warren Buffett and his multinational conglomerate holding company Berkshire Hathaway (BRK.A, Financial)(BRK.B, Financial). Need we say more? Buffett now owns a total of 15,723,415 share of the company, with his most recent average purchase price of $57.28 per share. Buffett first purchased shares of DVA in the end of 2011 for an average purchase price of $35.53. The fact that he is still adding to his position after his initial purchase has already gained 58% should say something in itself.

According to the Kidney End-of-Life Coalition, 45% of the patients receiving dialysis treatments in the United States are over the age of 60. Let me show you this chart from DaVita’s most recent 10-K:

The large majority of DaVita’s customer-base are people on Medicare (65+). It would be helpful to know what percentage of their patients are age 60 to 65 as well. Why does this matter? Well, the largest group of Baby Boomers are still in their 50s, with the first of the baby boomers in their late 60s. Every year that passes, more and more of the large chunk of baby boomers are susceptible to chronic kidney disease, needing dialysis. That being said, it appears that DaVita has a pretty decent pipeline of customers.

End Notes

What are your thoughts? Is DVA trading at a discount? What does Berkshire like about it so much? Comment and let us know your opinion!

Disclosure: No current position held at the time of writing.

Disclaimer: The opinions and ideas in this article are for informational and educational purposes only. They are not a recommendation to buy or sell any stock at any given time. As always, it is imperative for each individual investor to do their own due diligence and perform their own research on any and all stocks before making an investment decision.