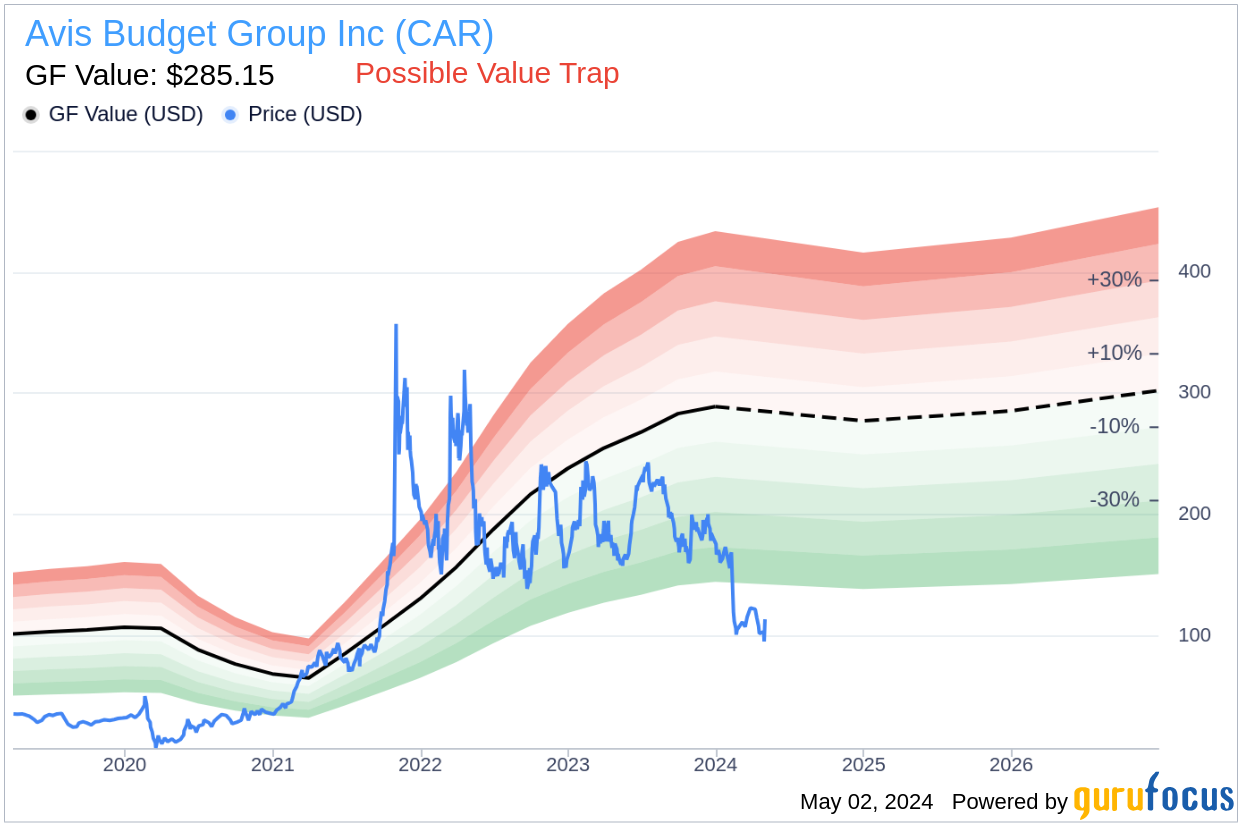

Value-focused investors are constantly on the lookout for undervalued stocks that promise significant returns. Avis Budget Group Inc (CAR, Financial) emerges as a prime candidate in this quest, with its current stock price at $113.79, which recently surged by 20.09% in a single day. Despite this impressive gain, the stock has experienced a 3-month decline of 29.54%. According to the GF Value, the fair valuation of Avis Budget Group stands at $285.15, suggesting a potential undervaluation.

The GF Value is a proprietary measure reflecting the intrinsic value of a stock, calculated through historical trading multiples, an adjustment factor based on past performance, and future business projections. This metric suggests that Avis Budget Group's stock might be trading below its fair value, indicating an attractive investment opportunity. However, the potential risks associated with the investment cannot be overlooked.

Understanding the Financial Stability of Avis Budget Group

Before making any investment decision, it's crucial to assess the financial health of the company. A pivotal tool in this assessment is the Altman Z-score, a predictor of the likelihood of business failure within two years. Avis Budget Group's Altman Z-score currently stands at 0.82, which is significantly below the safety threshold of 1.8. This low score indicates a high risk of financial distress, which could potentially lead to bankruptcy, rendering the stock a risky bet.

The implications of a low Altman Z-score are severe, as it integrates multiple financial ratios to gauge the overall corporate health. Factors such as working capital, asset performance, and earnings stability are considered, all of which seem to be underperforming in Avis Budget Group's case. This financial instability is a red flag for investors, suggesting that the stock could indeed be a value trap.

Company Overview and Financial Performance

Avis Budget Group Inc provides automotive vehicle rental and car-sharing services, with brands like Avis, Budget, and Zipcar under its umbrella. The company's largest revenue-generating region is the Americas. Despite a promising business model, the company's financial metrics raise concerns. For instance, while the company boasts a market cap of $4.10 billion and sales of $12.40 billion, its return on invested capital (ROIC) is relatively low at 6.52%, compared to a weighted average cost of capital (WACC) of 2.94%.

The financial discrepancies highlighted by the Altman Z-score are supported by additional financial data. These include operational challenges and an Earnings Per Share (EPS) figure of $31.68, which might not accurately reflect the underlying risks.

Conclusion: Navigating the Investment Dilemma

In conclusion, while Avis Budget Group (CAR, Financial) presents a seemingly lucrative investment opportunity based on its GF Value, the underlying financial health indicators tell a different story. The low Altman Z-score, coupled with operational inefficiencies, suggests that the stock might be a value trap. Investors are advised to proceed with caution and consider these risks extensively.

For those looking to avoid such pitfalls, GuruFocus Premium members can explore stocks with high financial stability using our exclusive Walter Schloss Screen. This tool helps in identifying safer investment opportunities, potentially leading to better investment outcomes.

Is investing in Avis Budget Group a calculated risk worth taking, or is it a financial misstep waiting to happen? This is the critical question investors must ponder.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.