Old Dominion Freight Line Inc (ODFL, Financial) has recently shown a daily loss of 2.64% and a three-month decline of 15.2%. With an Earnings Per Share (EPS) of 5.68, investors might wonder whether the stock is fairly valued. This analysis aims to explore Old Dominion Freight Line's valuation thoroughly, urging readers to consider the nuanced financial and market data presented.

Company Overview

Old Dominion Freight Line is a prominent player in the U.S. transportation sector, recognized as the second-largest less-than-truckload carrier. The company operates over 250 service centers and maintains a fleet of more than 11,000 tractors. Known for its operational discipline and efficiency, Old Dominion Freight Line stands out for its profitability and superior capital returns compared to its industry peers. Strategic initiatives focus on increasing network density and market share while maintaining top-tier service quality, including minimal cargo claims.

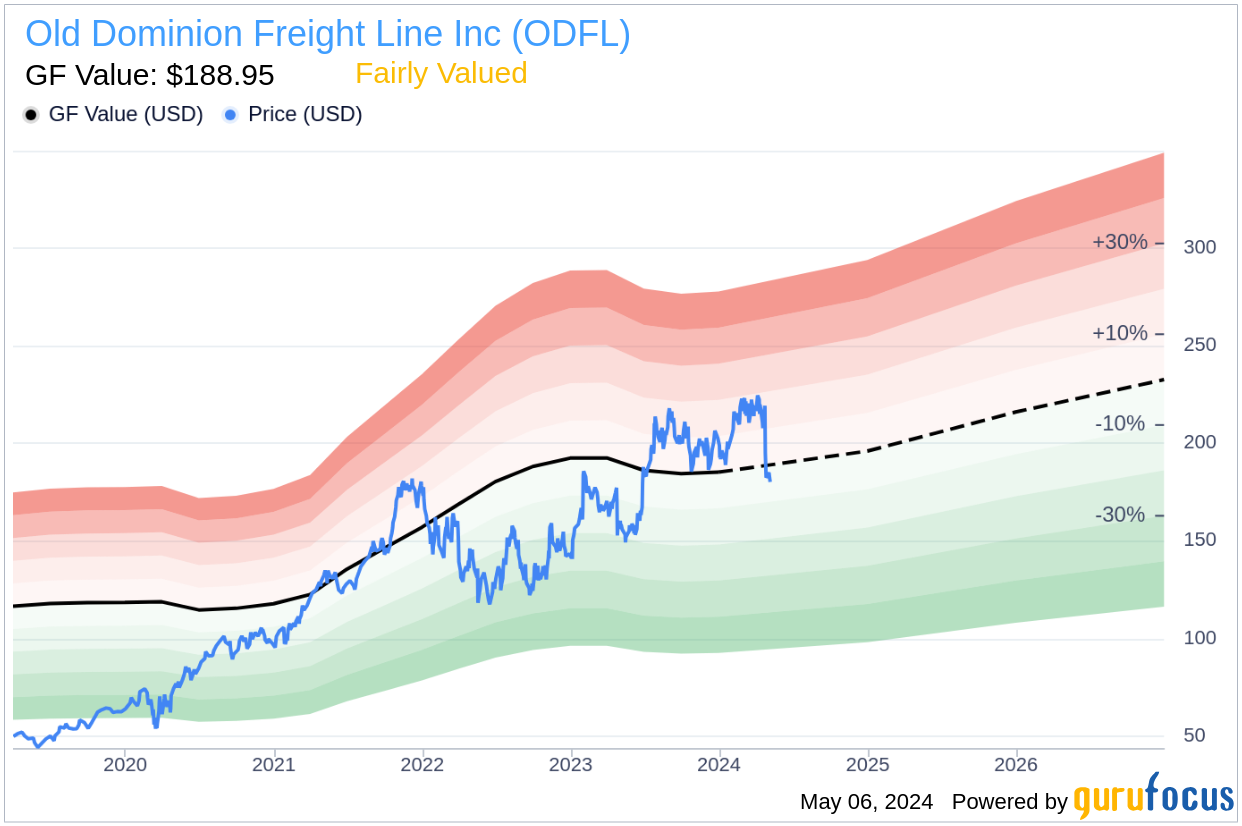

Understanding the GF Value

The GF Value is a proprietary measure used to determine the intrinsic value of a stock, based on historical trading multiples, a GuruFocus adjustment factor from past performance, and projected future business performance. For Old Dominion Freight Line, the GF Value is set at $188.95, suggesting that the stock is fairly valued at its current price of $180.18. This valuation indicates that the stock price aligns closely with the company's actual worth, based on efficient market operations and solid growth prospects.

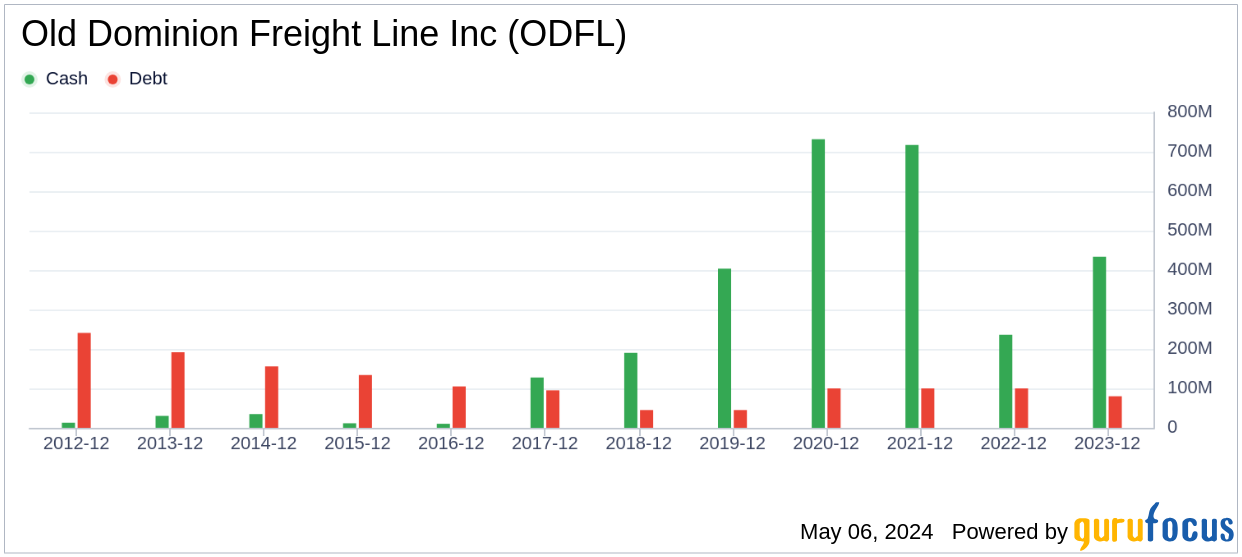

Financial Strength and Stability

Assessing the financial strength of a company is crucial before making investment decisions. Old Dominion Freight Line boasts a strong cash-to-debt ratio of 7.26, outperforming 88.61% of its peers in the transportation industry. This robust financial position is reflected in the company's top financial strength rating of 10 out of 10.

Profitability and Growth Prospects

Old Dominion Freight Line has consistently demonstrated strong profitability, with an impressive operating margin of 27.94%, which is superior to 87.62% of companies in the transportation sector. The company's focus on profitable growth is evident from its revenue figures, which stand at $5.90 billion over the past year. Furthermore, the company's growth metrics are promising, with a 3-year average EBITDA growth rate of 22.1%, ranking better than 65.01% of its industry counterparts.

Comparative Analysis of ROIC and WACC

A key profitability metric is the comparison between the Return on Invested Capital (ROIC) and the Weighted Average Cost of Capital (WACC). Old Dominion Freight Line's ROIC stands at a robust 25.97, significantly higher than its WACC of 12.27, indicating efficient capital utilization and strong potential for investor returns.

Conclusion

Old Dominion Freight Line (ODFL, Financial) is fairly valued at its current market price, reflecting its financial strength, profitability, and growth potential. For a more detailed financial overview, potential investors can view Old Dominion Freight Line's 30-Year Financials here. To discover other high-quality companies that may deliver above-average returns, consider exploring the GuruFocus High Quality Low Capex Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.