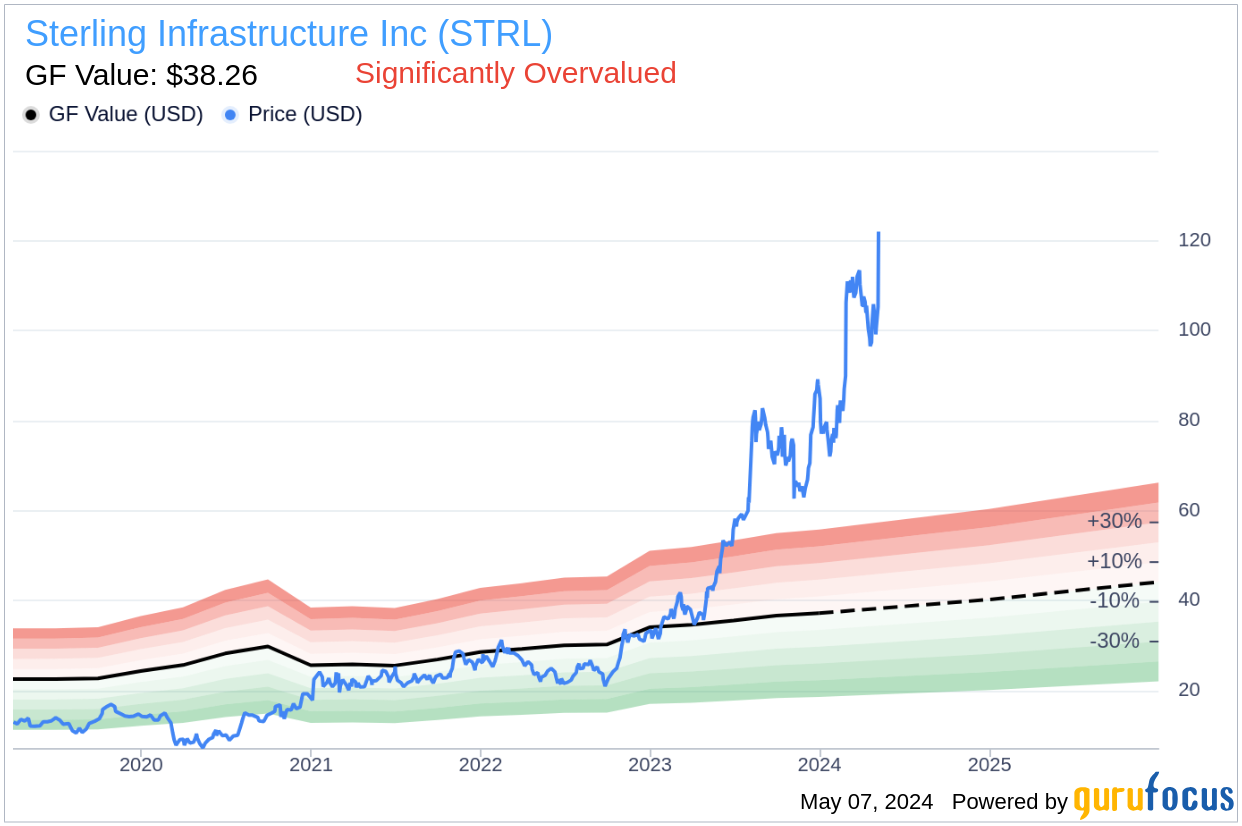

Sterling Infrastructure Inc (STRL, Financial) has recently seen a notable increase in its stock price, with a significant daily gain of 15.78% and an impressive three-month gain of 53.2%. With an Earnings Per Share (EPS) of 4.81, investors are prompted to question whether the stock is significantly overvalued. This article aims to explore this valuation in depth, encouraging readers to examine the comprehensive analysis that follows.

Company Overview

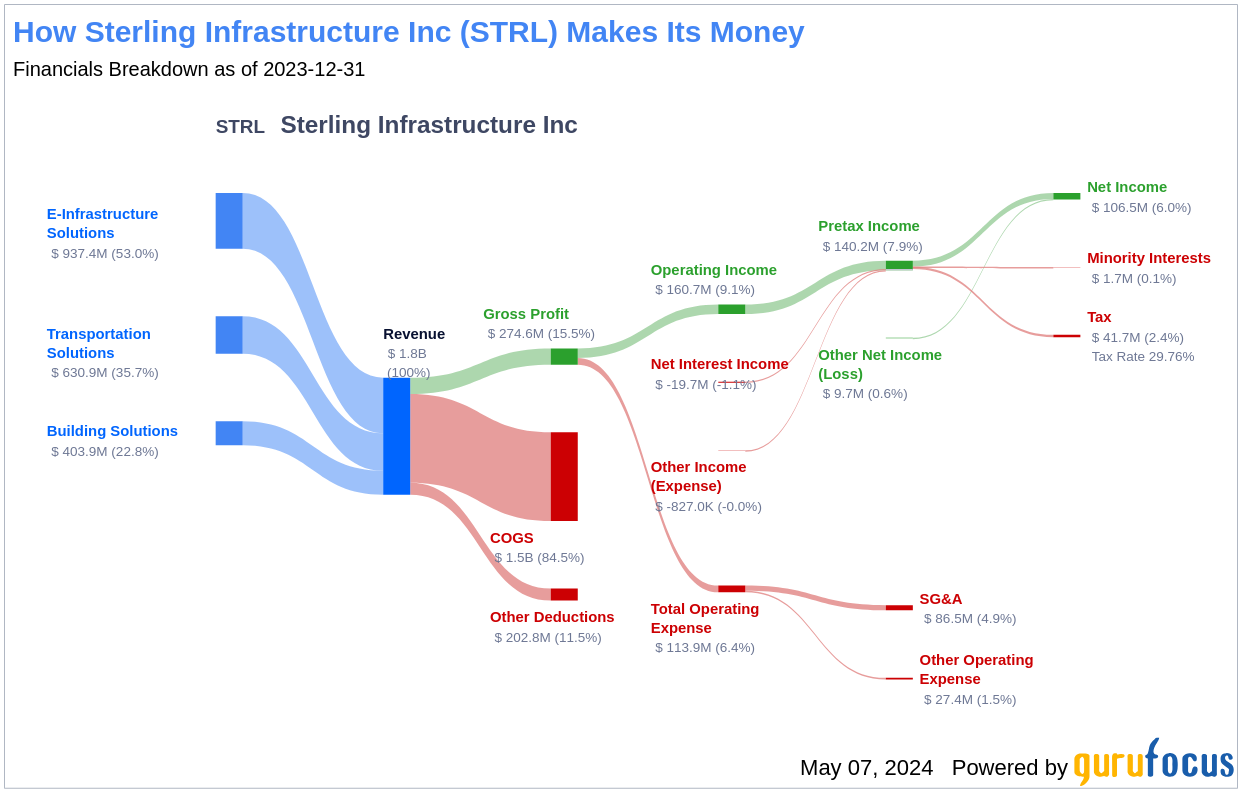

Sterling Infrastructure Inc operates in the construction sector, focusing on heavy civil infrastructure construction and rehabilitation, along with residential construction projects. It has three main business segments: Transportation Solutions, E-Infrastructure Solutions, and Building Solution. The company's substantial revenue primarily stems from its E-Infrastructure Solutions, catering to high-profile sectors like e-commerce and data centers. Despite its current price of $122 per share and a market cap of $3.80 billion, a stark contrast is observed when compared to the GF Value of $38.26, suggesting a potential overvaluation.

Understanding GF Value

The GF Value is a proprietary measure calculated to represent the intrinsic value of a stock. This valuation considers historical trading multiples, an adjustment factor from past performance and growth, and future business performance estimates. According to this metric, Sterling Infrastructure appears significantly overvalued, suggesting that the stock's future returns might be lower than its business growth potential.

Financial Strength and Stability

Investing in companies with robust financial health reduces the risk of permanent capital loss. Sterling Infrastructure's cash-to-debt ratio stands at 1.18, positioning it better than 62.36% of its industry peers. This favorable ratio, coupled with a GuruFocus financial strength rating of 7 out of 10, underscores its fair financial condition.

Profitability and Growth Analysis

Sterling Infrastructure has maintained profitability over 7 of the past 10 years, with a revenue of $2 billion in the last 12 months and an operating margin that outperforms 75.45% of its competitors. Its consistent profitability and a growth rate in revenue of 13.2% over three years, which ranks above 72.75% of the companies in the Construction industry, highlight its robust market position and business model.

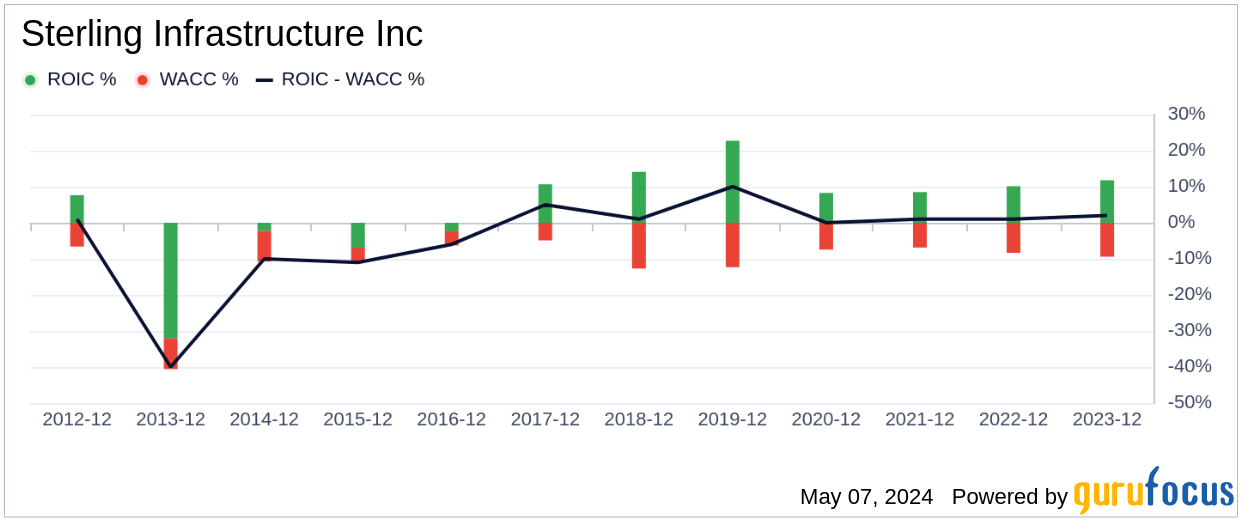

ROIC vs. WACC: Creating Shareholder Value

An effective way to gauge profitability is comparing the Return on Invested Capital (ROIC) against the Weighted Average Cost of Capital (WACC). Sterling Infrastructure's ROIC of 11.99 slightly surpasses its WACC of 11.58, indicating efficient value creation for shareholders.

Conclusion

Although Sterling Infrastructure (STRL, Financial) shows solid financial and profitability metrics, its current market price significantly exceeds the GF Value estimate, suggesting it is overvalued. Prospective investors should consider this analysis to make informed decisions.

To explore more about Sterling Infrastructure and other high-quality investment opportunities, visit GuruFocus High Quality Low Capex Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.