Brookfield Properties Corporation (BPO, Financial) is a North American commercial real estate company. The Company operates in two principal business segments: the ownership, development and management of commercial office properties in select cities in North America, and the development of residential land. As of December 31, 2008, the Company’s commercial property portfolio consisted of investment in 108 office comprising 74 million square feet in 12 United States and Canadian markets. The Company’s primary markets are the financial, energy and government center cities of New York, Boston, Washington, D.C., Houston, Los Angeles, Toronto, Calgary and Ottawa. Brookfield Properties is 50.2% owned by Brookfield Asset Management (BAM, Financial)Â

Q1 Results:

Q2 Results:

Here is what makes Brookfield so interesting to me at this time..

From the BPOÂ Press Release:

Brookfield Properties and Brookfield Asset Management will each own 25% of the fund.

So we know based on results these guys know how to buy property that will hold up during the worst of times. So, when we are in the worst of times, doesn't it make sense to go with the guys that have near $5B to pick up the pieces?

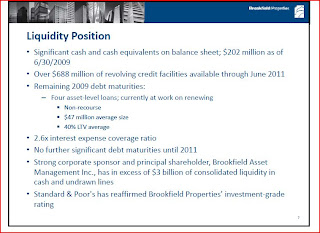

BUT, the big fear on any real estate company is their debt. Can they roll it/pay it or will it undo them? Here is Brookfield immediate picture:

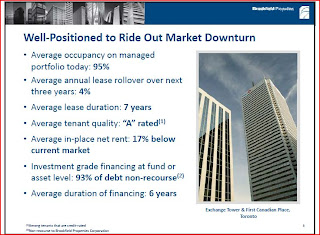

Leases you say?

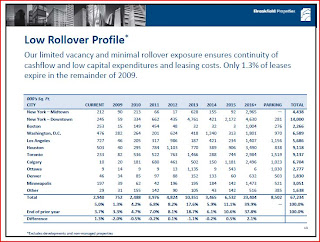

Lease expiration schedule:

The beauty of investing in real estate this way is that you get the benefit of these folks expertise which, based on results, is tops in the industry. You also get a global opportunity and the patience they have to execute the right deals at the right time.Â

So, armed with $4.9B to invest (which is, by the way, more than the current market cap of the company) I think folks looking into real estate would have a hard time going wrong here...Â

Full Report:

bpo

Here is their current portfolio Q2, 2009 (XLS)

Link to SEDAR documents (Canadian version of SEC)

Todd Sullivan

http://valueplays.blogspot.com

Q1 Results:

Brookfield Properties Corporation (BPO: NYSE, TSX) today announced that net income for the three months ended March 31, 2009 was $38 million or $0.10 per diluted share, compared to $23 million or $0.06 per diluted share during the same period in 2008.

Funds from operations ("FFO") was $127 million or $0.32 per diluted share for the three months ended March 31, 2009, compared with $126 million or $0.32 per diluted share during the same period in 2008.

Commercial property net operating income for the first quarter of 2009 was $327 million, compared to $340 million during the first quarter of 2008.

During the first quarter, Brookfield Properties leased 1.8 million square feet of space in its managed portfolio, improving the company's five-year lease expiry profile by 160 basis points. The company's managed-portfolio occupancy rate finished the quarter at 95.6%.

Q2 Results:

--Jul. 29, 2009-- Brookfield Properties Corporation (BPO: NYSE, TSX) today announced that net income for the three months ended June 30, 2009 was $60 million or $0.15 per diluted share, compared with $45 million or $0.11 per diluted share during the same period in 2008.

Funds from operations (“FFO”) was $148 million or $0.38 per diluted share for the three months ended June 30, 2009 compared with $157 million or $0.40 per diluted share during the same period in 2008.

Commercial property net operating income for the second quarter of 2009 was $338 million, compared with $341 million during the second quarter of 2008 as a result of the impact of a weaker Canadian dollar and a lower contribution from non-managed properties. Absent these items, commercial property net operating income increased 3% over the same period in the prior year.

During the second quarter, Brookfield Properties leased 725,000 square feet of space in its managed portfolio at an average net rent of $25 per square foot, which represents a 32% improvement versus the average expiring net rent of $19 on this space in the quarter.Â

Additionally, the company has improved its five-year lease rollover exposure by 240 basis points since the start of the year. Year-to-date leasing totals 2.5 million square feet. Brookfield’s managed portfolio occupancy rate finished the quarter at 95%

Here is what makes Brookfield so interesting to me at this time..

From the BPOÂ Press Release:

Brookfield Asset Management Inc. (NYSE/TSX/Euronext: BAM) and Brookfield Properties Corporation (NYSE/TSX: BPO) (collectively, “Brookfield”) today announced the formation of a US$4 billion Investor Consortium dedicated to investing in under-performing realestate. The Consortium will invest in equity and debt in under-valued real estate companies or real estate portfolios where value can be created for stakeholders in a variety of ways, including financial and operational restructuring, strategic direction or sponsorship, portfolio repositioning, redevelopment or other active asset management. Investments will be targeted at corporate property restructurings with a minimum US$500 million equity commitment, and pursued on a global basis, but with a focus on North America, Europe and Australasia.

In addition to Brookfield, the participants in the Consortium consist of a number of institutional real estate investors who have each allocated between US$300 million and US$1 billion to the Consortium. Brookfield has allocated US$1 billion to the Consortium with opportunities in the office sector being funded by Brookfield Properties, at its option, and opportunities in other sectors being funded by Brookfield Asset Management. The Consortium participants have expertise in investing across different geographies and property types and this expertise will be pooled together to maximum advantage in individual investment opportunities.

“This is the next step in our global property growth plan, as it combines our strength as one of the world’s leading real estate operating companies with our extensive expertise in corporate restructurings and strategic acquisitions,” said Ric Clark, CEO of Brookfield Properties.

Brookfield Properties and Brookfield Asset Management will each own 25% of the fund.

So we know based on results these guys know how to buy property that will hold up during the worst of times. So, when we are in the worst of times, doesn't it make sense to go with the guys that have near $5B to pick up the pieces?

BUT, the big fear on any real estate company is their debt. Can they roll it/pay it or will it undo them? Here is Brookfield immediate picture:

Leases you say?

Lease expiration schedule:

The beauty of investing in real estate this way is that you get the benefit of these folks expertise which, based on results, is tops in the industry. You also get a global opportunity and the patience they have to execute the right deals at the right time.Â

So, armed with $4.9B to invest (which is, by the way, more than the current market cap of the company) I think folks looking into real estate would have a hard time going wrong here...Â

Full Report:

Here is their current portfolio Q2, 2009 (XLS)

Link to SEDAR documents (Canadian version of SEC)

Todd Sullivan

http://valueplays.blogspot.com