CoSine Communications Inc (COSN, Financial) has released its 10Q for the quarter ended September 30, 2009.

We’ve been following COSN (see Greenbackd’s COSN post archive) because it is a cash box controlled by activist investor Steel Partners. Steel Partners own 47.5% of the stock and sits on the board. The stock is up 11.4% since our initial post to close Friday at $1.95. I initially estimated the net cash value to be around $22.2M or $2.20 per share. After reviewing the 10Q I’ve slightly reduced it in line with the ~$0.3M cash burn for the last two quarters to $21.9M or $2.17 per share. The net cash value has remained relatively stable through 2006, 2007, 2008 and 2009. COSN presents an opportunity to invest alongside Steel Partners at a discount to net cash in a company with substantial NOLs.

The value proposition updated

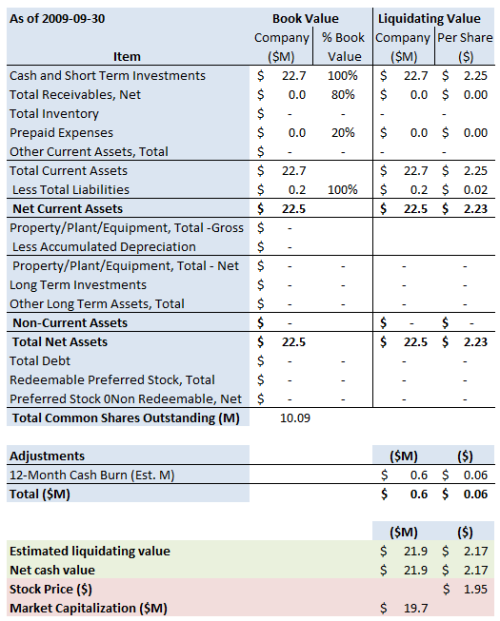

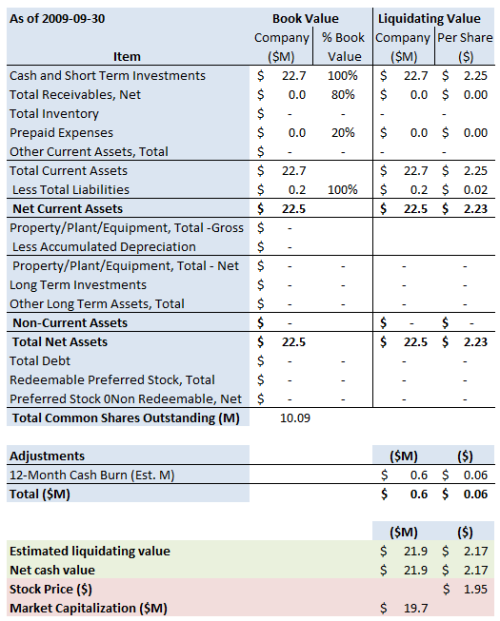

Little has changed over the last two quarters. The valuation on COSN remains straight-forward: It has around $22.7m in cash and short-term investments, $0.2M in liabilities and 10.1M shares outstanding. I’ve set out the valuation below in the usual manner (the “Book Value” column shows the assets as they are carried in the financial statements, and the “Liquidating Value” column shows our estimate of the value of the assets in a liquidation):

Balance sheet adjustments

I’ve made the following adjustments to the balance sheet estimates above:

A quick primer on net operating loss carry-forwards (“NOLs”) from the most 2009 10K:

NOLs may be carried forward to offset federal and state taxable income in future years and eliminate income taxes otherwise payable on such taxable income, subject to certain adjustments. Based on current federal corporate income tax rates, our NOLs and other carry-forwards could provide a benefit to us, if fully utilized, of significant future tax savings. However, our ability to use these tax benefits in future years will depend upon the amount of our otherwise taxable income. If we do not have sufficient taxable income in future years to use the tax benefits before they expire, we will lose the benefit of these NOLs permanently. Consequently, our ability to use the tax benefits associated with our substantial NOLs will depend significantly on our success in identifying suitable acquisition candidates, and once identified, successfully consummating an acquisition of these candidates.

Additionally, if we underwent an ownership change, the NOLs would be subject to an annual limit on the amount of the taxable income that may be offset by our NOLs generated prior to the ownership change. If an ownership change were to occur, we may be unable to use a significant portion of our NOLs to offset taxable income. In general, an ownership change occurs when, as of any testing date, the aggregate of the increase in percentage points is more than 50 percentage points of the total amount of a corporation’s stock owned by “5-percent stockholders,” within the meaning of the NOLs limitations, whose percentage ownership of the stock has increased as of such date over the lowest percentage of the stock owned by each such “5-percent stockholder” at any time during the three-year period preceding such date. In general, persons who own 5% or more of a corporation’s stock are “5-percent stockholders,” and all other persons who own less than 5% of a corporation’s stock are treated, together, as a single, public group “5-percent stockholder,” regardless of whether they own an aggregate of 5% of a corporation’s stock.

The amount of NOLs that we have claimed has not been audited or otherwise validated by the U.S. Internal Revenue Service (“IRS”). The IRS could challenge our calculation of the amount of our NOLs or our determinations as to when a prior change in ownership occurred and other provisions of the Internal Revenue Code may limit our ability to carry forward our NOLs to offset taxable income in future years. If the IRS was successful with respect to any such challenge, the potential tax benefit of the NOLs to us could be substantially reduced.[/quote]According to the 10K, as of December 31, 2008, COSN had federal NOLs of approximately $353M, which begin to expire in 2018 if not utilized and state NOLs of approximately $213M, which will begin to expire in 2009 if not utilized. The NOLs have a substantial value as a tax shield should COSN acquire a business with taxable earnings, but assessing that value is beyond us.

Catalyst

Steel Partners’ most recent 13D filing sets out its 47.5% holding. Steel Partners’ strategy is to use COSN’s cash to acquire a business with taxable earnings that can be offset by the NOLs. From the 10Q:

Redeployment Strategy and Liquidity

In July 2005, after a comprehensive review of strategic alternatives, our board of directors approved a strategy to redeploy our existing resources to identify and acquire one or more new business operations with existing or prospective taxable earnings that can be offset by use of our NOLs.

Ordinarly, I would prefer a return of cash to the acquisition of a business. This situation is different from the usual case because Steel Partners’ business is investment, and so I think the risk that they might make a bad investment is low. That said, there’s no assurance that they will find a suitable candidate, or if they do, that COSN will be able to use the NOLs.

Conclusion

COSN initially presented an opportunity to invest alongside Steel Partners at a 26% discount to net cash in a company with substantial NOLs. With the increase in the stock price the discount to its net cash position has narrowed to around 11%. I’m maintaining the position in the Greenbackd Portfolio.

[Full Disclosure: We do not have a holding in COSN. This is neither a recommendation to buy or sell any securities. All information provided believed to be reliable and presented for information purposes only. Do your own research before investing in any security.

Greenbackd

http://greenbackd.com/

We’ve been following COSN (see Greenbackd’s COSN post archive) because it is a cash box controlled by activist investor Steel Partners. Steel Partners own 47.5% of the stock and sits on the board. The stock is up 11.4% since our initial post to close Friday at $1.95. I initially estimated the net cash value to be around $22.2M or $2.20 per share. After reviewing the 10Q I’ve slightly reduced it in line with the ~$0.3M cash burn for the last two quarters to $21.9M or $2.17 per share. The net cash value has remained relatively stable through 2006, 2007, 2008 and 2009. COSN presents an opportunity to invest alongside Steel Partners at a discount to net cash in a company with substantial NOLs.

The value proposition updated

Little has changed over the last two quarters. The valuation on COSN remains straight-forward: It has around $22.7m in cash and short-term investments, $0.2M in liabilities and 10.1M shares outstanding. I’ve set out the valuation below in the usual manner (the “Book Value” column shows the assets as they are carried in the financial statements, and the “Liquidating Value” column shows our estimate of the value of the assets in a liquidation):

Balance sheet adjustments

I’ve made the following adjustments to the balance sheet estimates above:

- Cash burn: The company used $0.58M in cash in the last three quarters, which we’ve annualized to $0.6M.

- Off-balance sheet arrangements and contractual obligations: According to COSN’s 10Q, it has no off-balance sheet arrangements.

A quick primer on net operating loss carry-forwards (“NOLs”) from the most 2009 10K:

NOLs may be carried forward to offset federal and state taxable income in future years and eliminate income taxes otherwise payable on such taxable income, subject to certain adjustments. Based on current federal corporate income tax rates, our NOLs and other carry-forwards could provide a benefit to us, if fully utilized, of significant future tax savings. However, our ability to use these tax benefits in future years will depend upon the amount of our otherwise taxable income. If we do not have sufficient taxable income in future years to use the tax benefits before they expire, we will lose the benefit of these NOLs permanently. Consequently, our ability to use the tax benefits associated with our substantial NOLs will depend significantly on our success in identifying suitable acquisition candidates, and once identified, successfully consummating an acquisition of these candidates.

Additionally, if we underwent an ownership change, the NOLs would be subject to an annual limit on the amount of the taxable income that may be offset by our NOLs generated prior to the ownership change. If an ownership change were to occur, we may be unable to use a significant portion of our NOLs to offset taxable income. In general, an ownership change occurs when, as of any testing date, the aggregate of the increase in percentage points is more than 50 percentage points of the total amount of a corporation’s stock owned by “5-percent stockholders,” within the meaning of the NOLs limitations, whose percentage ownership of the stock has increased as of such date over the lowest percentage of the stock owned by each such “5-percent stockholder” at any time during the three-year period preceding such date. In general, persons who own 5% or more of a corporation’s stock are “5-percent stockholders,” and all other persons who own less than 5% of a corporation’s stock are treated, together, as a single, public group “5-percent stockholder,” regardless of whether they own an aggregate of 5% of a corporation’s stock.

The amount of NOLs that we have claimed has not been audited or otherwise validated by the U.S. Internal Revenue Service (“IRS”). The IRS could challenge our calculation of the amount of our NOLs or our determinations as to when a prior change in ownership occurred and other provisions of the Internal Revenue Code may limit our ability to carry forward our NOLs to offset taxable income in future years. If the IRS was successful with respect to any such challenge, the potential tax benefit of the NOLs to us could be substantially reduced.[/quote]According to the 10K, as of December 31, 2008, COSN had federal NOLs of approximately $353M, which begin to expire in 2018 if not utilized and state NOLs of approximately $213M, which will begin to expire in 2009 if not utilized. The NOLs have a substantial value as a tax shield should COSN acquire a business with taxable earnings, but assessing that value is beyond us.

Catalyst

Steel Partners’ most recent 13D filing sets out its 47.5% holding. Steel Partners’ strategy is to use COSN’s cash to acquire a business with taxable earnings that can be offset by the NOLs. From the 10Q:

Redeployment Strategy and Liquidity

In July 2005, after a comprehensive review of strategic alternatives, our board of directors approved a strategy to redeploy our existing resources to identify and acquire one or more new business operations with existing or prospective taxable earnings that can be offset by use of our NOLs.

Ordinarly, I would prefer a return of cash to the acquisition of a business. This situation is different from the usual case because Steel Partners’ business is investment, and so I think the risk that they might make a bad investment is low. That said, there’s no assurance that they will find a suitable candidate, or if they do, that COSN will be able to use the NOLs.

Conclusion

COSN initially presented an opportunity to invest alongside Steel Partners at a 26% discount to net cash in a company with substantial NOLs. With the increase in the stock price the discount to its net cash position has narrowed to around 11%. I’m maintaining the position in the Greenbackd Portfolio.

[Full Disclosure: We do not have a holding in COSN. This is neither a recommendation to buy or sell any securities. All information provided believed to be reliable and presented for information purposes only. Do your own research before investing in any security.

Greenbackd

http://greenbackd.com/