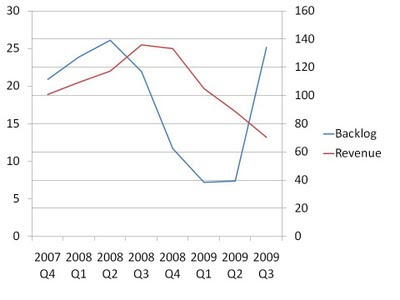

Wall Street is entirely too focused on current earnings, as noted by Ben Graham. So when a company shows declining earnings on declining revenues, the stock price will take a hit, even if the declines are purely cyclical. For example, consider the quarter-by-quarter revenue chart for KSW Inc. (KSW, Financial) below:

As a result of this decline, Mr. Market's valuation of this company offers great opportunities for value investors. The company trades for just $20 million despite having a net cash position (cash minus debt) of over $14 million. Before the credit crisis caused the cancellation of many of the company's jobs, the company was earning profits of around $4 million per year!

Because the company's cost structure is flexible (as discussed here), the company has also avoided losses during this recession despite the harsh drop in revenue.

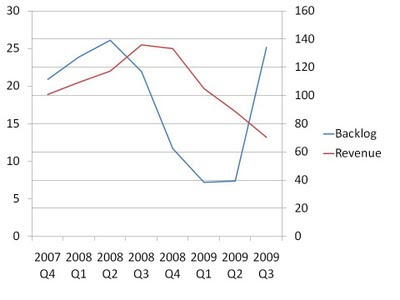

But how can one be sure that the company is only undergoing a cyclical decline, and is not instead getting battered by stronger competition? A leap of faith is not required. Consider the company's backlog below:

Some of the company's cancelled projects have been brought back online, and the company has expanded its reach. As a result, the company's backlog has not been this high since the early part of 2008! Investors don't have to wait long, as it appears the company will soon be returning to business as usual. Considering the company's cash balance, however, investors are only paying for a couple of years worth of earnings.

Disclosure: Author has a long position in shares of KSW

Saj Karsan

http://www.barelkarsan.com

As a result of this decline, Mr. Market's valuation of this company offers great opportunities for value investors. The company trades for just $20 million despite having a net cash position (cash minus debt) of over $14 million. Before the credit crisis caused the cancellation of many of the company's jobs, the company was earning profits of around $4 million per year!

Because the company's cost structure is flexible (as discussed here), the company has also avoided losses during this recession despite the harsh drop in revenue.

But how can one be sure that the company is only undergoing a cyclical decline, and is not instead getting battered by stronger competition? A leap of faith is not required. Consider the company's backlog below:

Some of the company's cancelled projects have been brought back online, and the company has expanded its reach. As a result, the company's backlog has not been this high since the early part of 2008! Investors don't have to wait long, as it appears the company will soon be returning to business as usual. Considering the company's cash balance, however, investors are only paying for a couple of years worth of earnings.

Disclosure: Author has a long position in shares of KSW

Saj Karsan

http://www.barelkarsan.com