On Friday, WSJ reported that one in four borrowers is underwater:

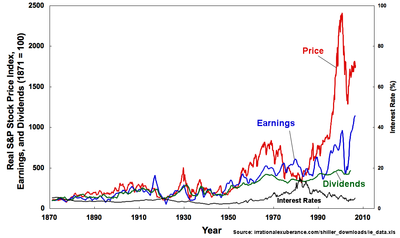

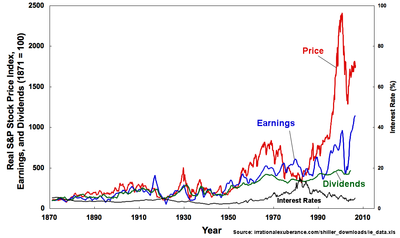

Prof. Robert Shiller is the inventor of Case-Shiller Index, tracking the repeat-sales index using home sales prices data from across the nation. The Index did show a rise of home prices recently.

How more people found themselves underwater while the prices of home go up? Where do we go from here, Professor Shiller explains to the Fox Business Network:

Watch the latest business video atFOXBusiness.com

Click here to watch the video if you do not see the video above.

The proportion of U.S. homeowners who owe more on their mortgages than the properties are worth has swelled to about 23%.Nearly 10.7 million households had negative equity in their homes in the third quarter, according to First American CoreLogic, a real-estate information company based in Santa Ana, Calif.

Home prices have fallen so far that 5.3 million U.S. households are tied to mortgages that are at least 20% higher than their home's value, the First American report said. More than 520,000 of these borrowers have received a notice of default, according to First American.

Most U.S. homeowners still have some equity, and nearly 24 million owner-occupied homes don't have any mortgage, according to the Census Bureau.

Prof. Robert Shiller is the inventor of Case-Shiller Index, tracking the repeat-sales index using home sales prices data from across the nation. The Index did show a rise of home prices recently.

How more people found themselves underwater while the prices of home go up? Where do we go from here, Professor Shiller explains to the Fox Business Network:

Click here to watch the video if you do not see the video above.