Measuring a company's return on equity (ROE) is a useful way to determine whether management is justified in retaining earnings for further investment, particularly for a company with low debt levels. For example, if ROE is above 15%, in most cases the company should attempt to re-invest its profits in order to grow; if ROE is consistently under 10%, management should pay out earnings so that capital can be allocated to more profitable ventures. Sometimes, however, the ROE numbers don't tell the whole story.

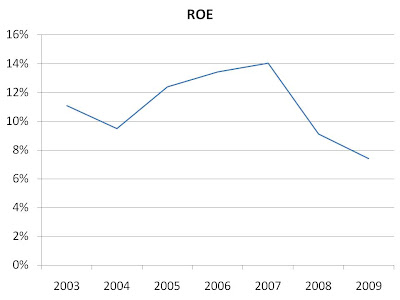

Consider ROE numbers for DRYCLEAN USA, Inc. (DCU, Financial),which will soon be known as EnviroStar (EVI), a distributor of laundry equipment, over the last several years:

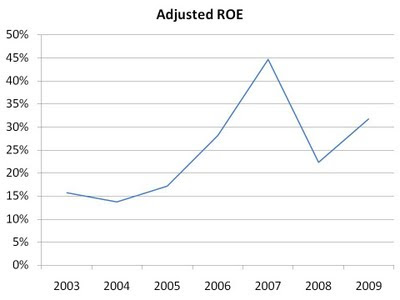

Note that the company has had no debt over this period. Returns look decent, and then turn downward as the recession hit. However, the company generated mounds of cash over this period that it has not distributed. As such, ROE numbers are held down because of the large cash balance - but unlike in other cases we have seen, this cash balance is not required to run the business. Subtracting the cash balance from equity in the ROE equation yields the following adjusted ROE:

Clearly, even through this recession, the company has earned excellent returns on its invested capital, suggesting the company's prospects going forward are positive.

Of course, the cash balance is stuck in the business and therefore from the point of view of the shareholder, actual returns are of the order of those seen in the first chart above. However, the business is clearly a profitable one, as it can generate strong returns even with most of its capital sitting idle in the form of cash. Furthermore, if/when that cash is either put to work in earning returns or returned to shareholders, the business' owners will benefit. This is a company we have previously discussed as a potential value investment.

When considering ROE numbers, adjustments may be required depending on exactly what the investor is attempting to determine.

Disclosure: Author has a long position in shares of DCU

Saj Karsan

http://www.barelkarsan.com/

Consider ROE numbers for DRYCLEAN USA, Inc. (DCU, Financial),which will soon be known as EnviroStar (EVI), a distributor of laundry equipment, over the last several years:

Note that the company has had no debt over this period. Returns look decent, and then turn downward as the recession hit. However, the company generated mounds of cash over this period that it has not distributed. As such, ROE numbers are held down because of the large cash balance - but unlike in other cases we have seen, this cash balance is not required to run the business. Subtracting the cash balance from equity in the ROE equation yields the following adjusted ROE:

Clearly, even through this recession, the company has earned excellent returns on its invested capital, suggesting the company's prospects going forward are positive.

Of course, the cash balance is stuck in the business and therefore from the point of view of the shareholder, actual returns are of the order of those seen in the first chart above. However, the business is clearly a profitable one, as it can generate strong returns even with most of its capital sitting idle in the form of cash. Furthermore, if/when that cash is either put to work in earning returns or returned to shareholders, the business' owners will benefit. This is a company we have previously discussed as a potential value investment.

When considering ROE numbers, adjustments may be required depending on exactly what the investor is attempting to determine.

Disclosure: Author has a long position in shares of DCU

Saj Karsan

http://www.barelkarsan.com/