We typically post investment ideas that we like enough to add to our portfolio. However, we have not been able to find a lot of bargains out there lately, so we’ll start posting ideas that are close to meeting our requirements.

A Valuehuntr near miss is Church & Dwight Co. Inc. (CHD, Financial). CHD is one of those boring companies we would love to own. It also happens to be the largest producer of sodium bicarbonate (baking soda) in the world, and likely one of the best run companies in America. The company was founded in 1846, and (as Coca Cola) it still uses the original company formula today.

The company develops, manufactures, and markets a range of household, personal care, and specialty products under various brand names in the United States and internationally. Its top brands include ARM & HAMMER, TROJAN, and OXICLEAN. The company meets a lot of the characteristics we look for when searching for good businesses, such as wide barriers to entry and great management, but the stock seems overvalued, which is the reason why it has not been added to the Valuehuntr Portfolio. Although CHD is not being added to our portfolio, we will like to highlight the company anyway.

THE BUSINESS

The company operates in three segments: Consumer Domestic, Consumer International, and Specialty Products.

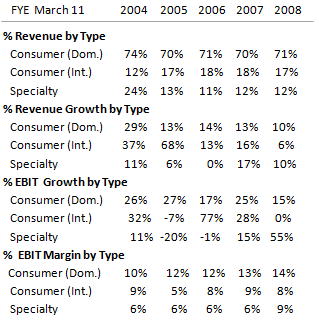

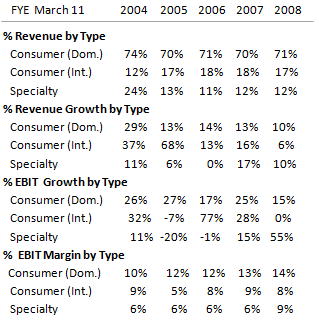

The Consumer Domestic segment offers household products for deodorizing, such as ARM & HAMMER baking soda, cat litter products, laundry/cleaning products, and consumer care products such as TROJAN condoms and ARM & HAMMER deodorants and toothpaste. The Consumer International segment sells the personal care products highlighted above in international markets, including France, the United Kingdom, Canada, Mexico, Australia, Brazil, and China. Finally, the Specialty Products segment produces sodium bicarbonate, which it sells together with other specialty inorganic chemicals for a range of industrial, institutional, medical, and food applications. This segment also sells a range of animal nutrition and specialty cleaning products. Operating data for FY 2004-2008 is shown below.

THE PRODUCT

The core product of the company has historically been baking soda, which is used in products within every business segment. The main advantage of baking soda is in its versatility of use. For instance, it is estimated that 95% of US households have a product containing baking soda at their home. Baking soda is not only used for cooking, but it is also an active ingredient in tooth paste, laundry detergents, pool cleaners, fire extinguishers, chemotherapy machines, deodorants, among many others.

(For more information about the versatility of baking soda, we recommend reading: “75 Extraordinary uses of Baking Soda”)

RECENT HIGHLIGHTS

We could use DCF to come up with company value estimates for the next few years to perpetuity. Instead, we’ll make our lives simpler by assuming the company will be able to generate earnings equal to at least its 3-year average EPS. The two quick calculations we show are the value of CHD with no growth, and its value with growth assuming terminal growth roughly equal to historical U.S. GDP.

PV = (Avg. 3-Yr EPS)/WACC = $35/share

EPV= (Avg. 3-Yr EPS)(1+G)/(WACC-G) = $63/share

(Assuming WACC~7%, G=3%)

Currently trading at $61/share, these quick calculations show the company may be currently trading at the top of its valuation range. Additionally, the stock price implies a 5.3% earnings yield, which is only slightly higher than the 4.6% 30-Year T-bill. Based on this price, there are likely other opportunities where investors could get a better return for their money. This is mainly the reason why CHD has not been added to our portfolio.

INVESTMENT RISKS

In our view, there are two things every potential investor should take a closer look at before investing in CHD.

1) Cost of Raw Materials: the cost of soda ash, surfactants, diesel fuel, corrugated paper, liner board and oil-based raw and packaging materials used in the household and specialty products businesses are not hedged (only diesel fuel costs for transportation are).

2) Off-Balance Sheet Liabilities: Pension Plan was underfunded by USD -14mm in 2008 based on a discount rate of 6.58%. Company’s Post Retirement Benefits Plan was also underfunded by USD -22mm (We were not able to find 2009 numbers).

MANAGEMENT & EXECUTIVE COMPENSATION

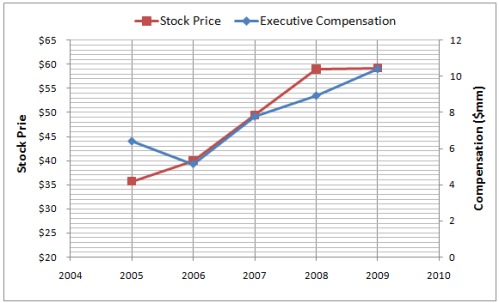

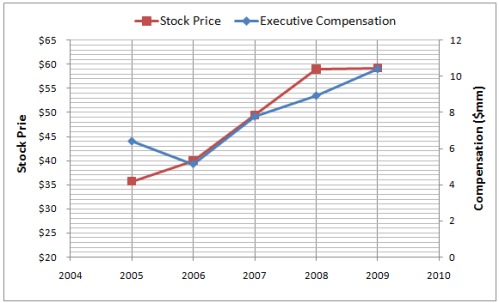

CHD has one of the best independent boards in America. This is evident in the governance policies the company has developed over the years for executive compensation. Over the years, the rewards given to company executives have been highly correlated with the stock price, as shown below.

SUMMARY

Church & Dwight operates and manages some of the most trusted brands in the world. Although the company is not trading at a bargain price, the earnings generated from its assets are protected by wide competitive advantages expected to continue in the future. The level of usage and versatility that CHD baking soda enjoys is hard to replicate, but because the stock is a bit too pricy we are not adding CHD to our portfolio.

A Valuehuntr near miss is Church & Dwight Co. Inc. (CHD, Financial). CHD is one of those boring companies we would love to own. It also happens to be the largest producer of sodium bicarbonate (baking soda) in the world, and likely one of the best run companies in America. The company was founded in 1846, and (as Coca Cola) it still uses the original company formula today.

The company develops, manufactures, and markets a range of household, personal care, and specialty products under various brand names in the United States and internationally. Its top brands include ARM & HAMMER, TROJAN, and OXICLEAN. The company meets a lot of the characteristics we look for when searching for good businesses, such as wide barriers to entry and great management, but the stock seems overvalued, which is the reason why it has not been added to the Valuehuntr Portfolio. Although CHD is not being added to our portfolio, we will like to highlight the company anyway.

THE BUSINESS

The company operates in three segments: Consumer Domestic, Consumer International, and Specialty Products.

The Consumer Domestic segment offers household products for deodorizing, such as ARM & HAMMER baking soda, cat litter products, laundry/cleaning products, and consumer care products such as TROJAN condoms and ARM & HAMMER deodorants and toothpaste. The Consumer International segment sells the personal care products highlighted above in international markets, including France, the United Kingdom, Canada, Mexico, Australia, Brazil, and China. Finally, the Specialty Products segment produces sodium bicarbonate, which it sells together with other specialty inorganic chemicals for a range of industrial, institutional, medical, and food applications. This segment also sells a range of animal nutrition and specialty cleaning products. Operating data for FY 2004-2008 is shown below.

THE PRODUCT

The core product of the company has historically been baking soda, which is used in products within every business segment. The main advantage of baking soda is in its versatility of use. For instance, it is estimated that 95% of US households have a product containing baking soda at their home. Baking soda is not only used for cooking, but it is also an active ingredient in tooth paste, laundry detergents, pool cleaners, fire extinguishers, chemotherapy machines, deodorants, among many others.

(For more information about the versatility of baking soda, we recommend reading: “75 Extraordinary uses of Baking Soda”)

RECENT HIGHLIGHTS

- Market share gains: Throughout the financial crisis, CHD has been the only company in the home and personal care products sector that has seen its weighted average market share increase, according to ACNielsen.

- Better manufacturing: new $170m plant is slated to open in York, PA, by the start of 2009 Q4, replacing an older factory in Brunswick, NJ. It’s expected to be at least 25% more efficient than the old location.

- Manufacturing Advantage: The baking soda manufactured by CHD is more than 99% pure, which requires proper materials, equipment, and personnel training.

- Government Regulation: baking soda must meet the requirements specified by the FDA as a substance that is Generally Recognized as Safe (GRAS). Distribution of baking soda is prohibited unless the product meets the GRAS specifications.

- Supply Advantage: soda ash deposits at the Green River Basin are large enough to meet the entire world’s needs for baking soda for thousands of years.

- Cost Efficient: mining operation in the Green River is less expensive for production of soda ash than the synthetic soda ash process that predominates in the rest of the world.

We could use DCF to come up with company value estimates for the next few years to perpetuity. Instead, we’ll make our lives simpler by assuming the company will be able to generate earnings equal to at least its 3-year average EPS. The two quick calculations we show are the value of CHD with no growth, and its value with growth assuming terminal growth roughly equal to historical U.S. GDP.

PV = (Avg. 3-Yr EPS)/WACC = $35/share

EPV= (Avg. 3-Yr EPS)(1+G)/(WACC-G) = $63/share

(Assuming WACC~7%, G=3%)

Currently trading at $61/share, these quick calculations show the company may be currently trading at the top of its valuation range. Additionally, the stock price implies a 5.3% earnings yield, which is only slightly higher than the 4.6% 30-Year T-bill. Based on this price, there are likely other opportunities where investors could get a better return for their money. This is mainly the reason why CHD has not been added to our portfolio.

INVESTMENT RISKS

In our view, there are two things every potential investor should take a closer look at before investing in CHD.

1) Cost of Raw Materials: the cost of soda ash, surfactants, diesel fuel, corrugated paper, liner board and oil-based raw and packaging materials used in the household and specialty products businesses are not hedged (only diesel fuel costs for transportation are).

2) Off-Balance Sheet Liabilities: Pension Plan was underfunded by USD -14mm in 2008 based on a discount rate of 6.58%. Company’s Post Retirement Benefits Plan was also underfunded by USD -22mm (We were not able to find 2009 numbers).

MANAGEMENT & EXECUTIVE COMPENSATION

CHD has one of the best independent boards in America. This is evident in the governance policies the company has developed over the years for executive compensation. Over the years, the rewards given to company executives have been highly correlated with the stock price, as shown below.

SUMMARY

Church & Dwight operates and manages some of the most trusted brands in the world. Although the company is not trading at a bargain price, the earnings generated from its assets are protected by wide competitive advantages expected to continue in the future. The level of usage and versatility that CHD baking soda enjoys is hard to replicate, but because the stock is a bit too pricy we are not adding CHD to our portfolio.