When it comes to retailers, Wall Street has an obsession with same-store sales comparisons. Stocks will rise and fall by significant margins based on the monthly or quarterly changes in sales that a company reports. But the usefulness of such data varies by industry and by retailer. Same-store sales can indeed be a useful indicator of the health of a retail enterprise. Unfortunately, however, Wall Street appears to have exaggerated the importance of such data to a point where it now blindly appraises all retailers by their same-store sales data no matter what their individual circumstances may be.

For example, just last week GameStop (GME) shares took a one-day haircut of 15% after announcing that same-store sales had fallen 8.6% (year over year) in the all-important December sales period. But same-store sales are a particularly weak indicator of performance for a company like GameStop, a retailer of video game products.

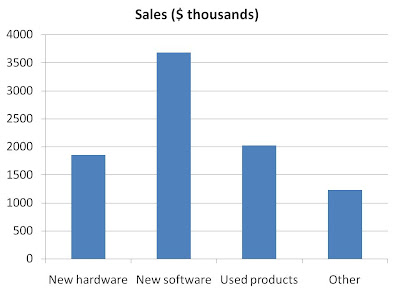

GameStop's revenue segments can be broken down into four components: hardware sales (e.g. Nintendo Wii, PlayStation 3 and Xbox 360 consoles), new software sales (mostly comprised of games for the above consoles), used software sales and other. Here's how the sales break down by type:

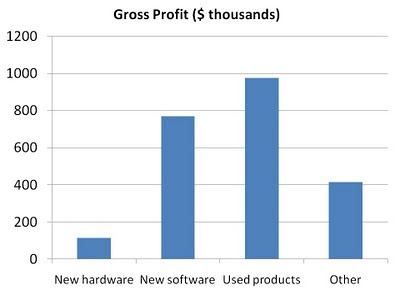

In the press-release detailing December's sales, GameStop reported that overall, hardware sales fell 8% (as there are no new consoles on the market, and the prices of existing consoles have been cut by the manufacturers to spur sales), new software sales rose 4%, and used software sales rose 10%. Why is this important? Consider where the company's profits actually come from:

In the press-release detailing December's sales, GameStop reported that overall, hardware sales fell 8% (as there are no new consoles on the market, and the prices of existing consoles have been cut by the manufacturers to spur sales), new software sales rose 4%, and used software sales rose 10%. Why is this important? Consider where the company's profits actually come from:

Clearly, used game sales is where the company makes its money, even though they represent only a small part of overall sales! Walmart and Best Buy can cut new hardware and software prices to bring in traffic, but they have shown an unwillingness and an inability (respectively) to compete in used products, which is where GameStop has an advantage. Considering only same-store sales for this company overlooks the fact that it is growing where it is profitable, and simply matching prices in other areas in order to be a one-stop shop for the consumer.

Clearly, used game sales is where the company makes its money, even though they represent only a small part of overall sales! Walmart and Best Buy can cut new hardware and software prices to bring in traffic, but they have shown an unwillingness and an inability (respectively) to compete in used products, which is where GameStop has an advantage. Considering only same-store sales for this company overlooks the fact that it is growing where it is profitable, and simply matching prices in other areas in order to be a one-stop shop for the consumer.

While same-store sales changes are an important indicator, they represent only the top-line. When making investment decisions, however, investors should be concerned with the bottom line and the returns on capital.

Disclosure: None

Saj Karsan

http://www.barelkarsan.com

For example, just last week GameStop (GME) shares took a one-day haircut of 15% after announcing that same-store sales had fallen 8.6% (year over year) in the all-important December sales period. But same-store sales are a particularly weak indicator of performance for a company like GameStop, a retailer of video game products.

GameStop's revenue segments can be broken down into four components: hardware sales (e.g. Nintendo Wii, PlayStation 3 and Xbox 360 consoles), new software sales (mostly comprised of games for the above consoles), used software sales and other. Here's how the sales break down by type:

While same-store sales changes are an important indicator, they represent only the top-line. When making investment decisions, however, investors should be concerned with the bottom line and the returns on capital.

Disclosure: None

Saj Karsan

http://www.barelkarsan.com