An analysis of Reinet Investments SCA's dividend history, yield, growth rate, and sustainability

Reinet Investments SCA (REVNF, Financial) recently announced a dividend of $0.3 per share, payable on 2023-09-20, with the ex-dividend date set for 2023-09-13. As investors eagerly anticipate this upcoming payment, it's an opportune time to examine the company's dividend history, yield, and growth rates. Using data from GuruFocus, let's delve into Reinet Investments SCA's dividend performance and assess its sustainability.

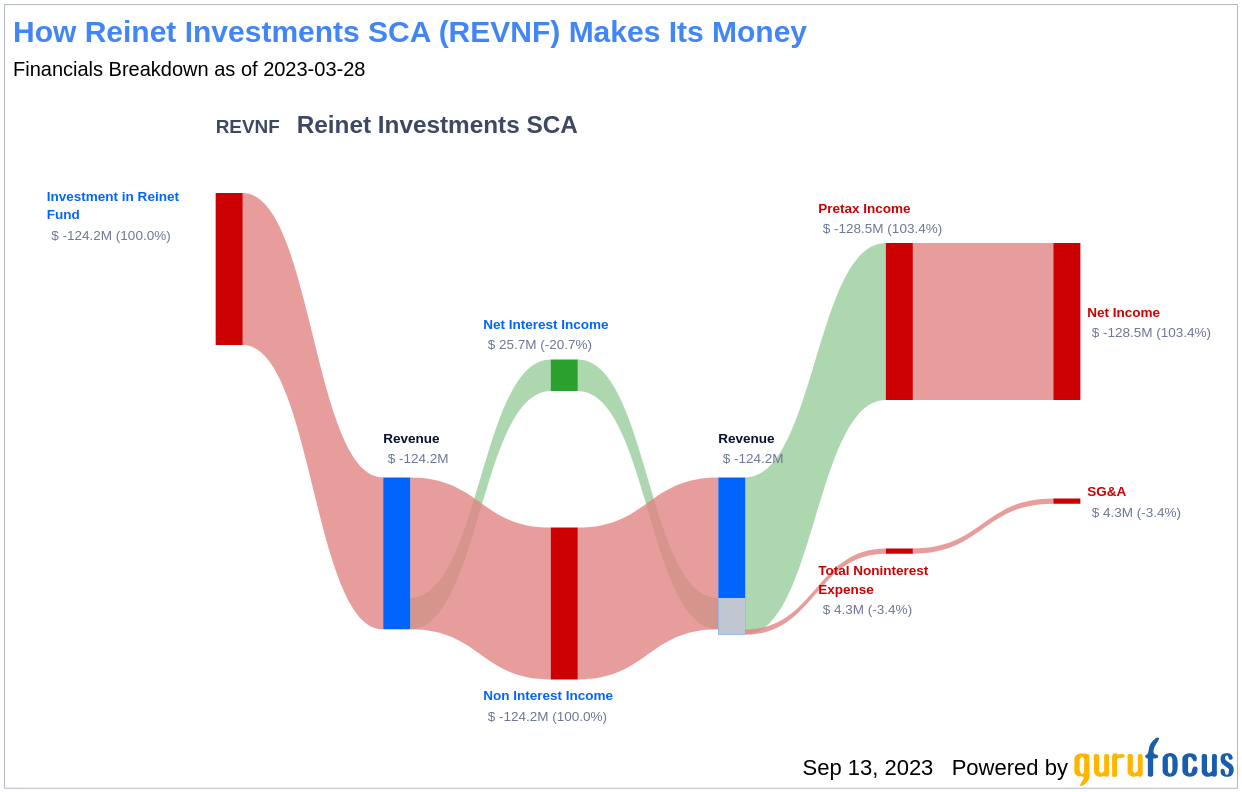

What Does Reinet Investments SCA Do?

Reinet Investments SCA is a Luxembourg-based closed-end, specialized investment fund (SIF) aiming to achieve long-term capital growth. The company invests in a wide range of asset classes, including listed and unlisted equities, bonds, real estate, and derivative instruments. It collaborates with experienced partners to invest in unique opportunities, focusing on value creation for investors. The company's principal source of earnings is the returns in the form of income and capital gains from the investments made through Reinet Fund and its subsidiaries.

A Glimpse at Reinet Investments SCA's Dividend History

Reinet Investments SCA has maintained a consistent dividend payment record since 2018, with dividends currently being distributed on an annual basis. The chart below shows annual Dividends Per Share for tracking historical trends.

Breaking Down Reinet Investments SCA's Dividend Yield and Growth

As of today, Reinet Investments SCA currently has a 12-month trailing dividend yield of 1.43% and a 12-month forward dividend yield of 1.66%. This suggests an expectation of increased dividend payments over the next 12 months.

Over the past three years, Reinet Investments SCA's annual dividend growth rate was 13.80%. Extended to a five-year horizon, this rate decreased to 10.90% per year. Based on Reinet Investments SCA's dividend yield and five-year growth rate, the 5-year yield on cost of Reinet Investments SCA stock as of today is approximately 2.40%.

The Sustainability Question: Payout Ratio and Profitability

To assess the sustainability of the dividend, one needs to evaluate the company's payout ratio. The dividend payout ratio provides insights into the portion of earnings the company distributes as dividends. A lower ratio suggests that the company retains a significant part of its earnings, thereby ensuring the availability of funds for future growth and unexpected downturns. As of 2023-03-31, Reinet Investments SCA's dividend payout ratio is 0.00.

Reinet Investments SCA's profitability rank is 2 out of 10 as of 2023-03-31, suggesting the dividend may not be sustainable. The company has reported net profit in 6 out of the past 10 years.

Growth Metrics: The Future Outlook

Reinet Investments SCA's growth rank of 2 out of 10 suggests that the company has poor growth prospects. Hence, the dividend may not be sustainable. However, Reinet Investments SCA's revenue has increased by approximately 29.10% per year on average, outperforming approximately 78.77% of global competitors. The company's 3-year EPS growth rate showcases its capability to grow its earnings, a critical component for sustaining dividends in the long run. During the past three years, Reinet Investments SCA's earnings increased by approximately 28.30% per year on average, outperforming approximately 72.67% of global competitors.

Conclusion

Given Reinet Investments SCA's consistent dividend payments, growth rate, and payout ratio, the company appears to have a robust dividend strategy. However, its profitability rank and growth rank suggest that the sustainability of its dividends may be questionable. Investors should weigh these factors carefully while making investment decisions. GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.