Apple (AAPL) is the cheapest big-name tech stock on the market. It's cheaper than Microsoft (MSFT), Google (GOOG), Cisco (CSCO), Oracle (ORCL) or Qualcomm (QCOM). The price should be $500 at the bare minimum, if not $600. If that sounds like a bold claim to you then I hope to change your mind by the end of this article. You are probably already wondering how the market could be this wrong if Apple really is this cheap.

Ben Graham said that, "In the short run, the market is a voting machine, but in the long run it is a weighing machine." Meaning that a stock's price in the short term is a "product partly of reason and partly of emotion." I'm going to argue that the current price is being driven more by emotion and less by reason and then proceed straight to valuation. I will not talk about Apple's products or prospects here, because they're all well publicized and don't need repeating.

An Unstable Reaction

As children, most of us first learned about unstable chemical reactions by mixing vinegar and baking soda, possibly to create a model volcano. Well, the unstable reaction that was so fun to watch as a child isn't nearly as fun to witness as an investor. Professor Aswath Damodaran of NYU has written on multiple occasions that when a stock (Apple) gets mixed with value, growth, dividend and momentum investors, there can be a powerful reaction, much like mixing vinegar and baking soda.

It should not be difficult for anyone watching Apple to imagine a scenario where growth is either too slow or too uncertain to please growth investors, the company's product — technology — is too unpredictable for traditional values investors, the dividend isn't large enough or isn't growing fast enough to please dividend investors, and that the conflict among these groups ceases all price momentum to the dismay of momentum and institutional investors. That's exactly what is happening now. The result is that no one is happy, and that's being reflected in the current price. The fact that investors keep a daily laser-like focus on this stock certainly adds to the cauldron of emotional tension, which only pushes level-headed reasoning that much further into the background. There has to be a catalyst to shake investors and unlock Apple's value.

Damodaran Versus Einhorn

As most of you probably already know, Professor Damodaran and hedge fund manager David Einhorn have gotten entangled in a public argument over Apple's value and its cash hoard. Damodaran said that Einhorn's plan to issue iPrefs would, "not add value to the company, not one cent." Einhorn, on the other hand, feels that Apple's true value is being buried alive by its cash hoard, so distributing that cash would "create" value. Einhorn is essentially saying that investors cannot see the company's value for all the green, if you will. I believe that both of them are correct and will explain.

Damodaran is correct that returning cash to shareholders does not increase the intrinsic value of a business. Dividends are simply a transfer of value, like withdrawing cash from an ATM. The second you take your cash from the machine you still own the same amount of money. Some of it just happens to be going into your pocket now. Or in the professor's own words:

Apple's Intrinsic Value

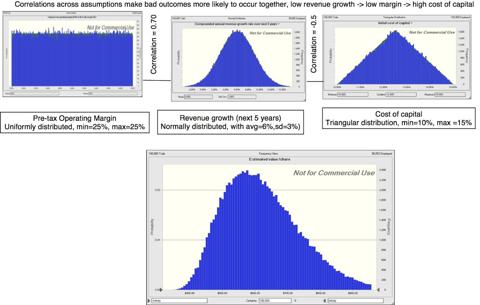

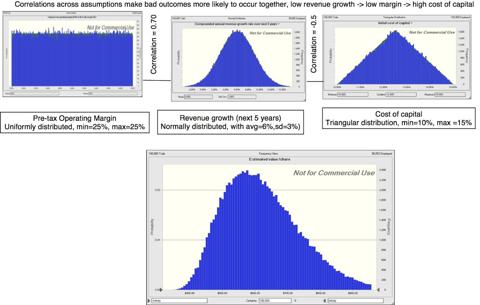

Whether you value Apple on an intrinsic or a relative basis, it is cheap. In February, Professor Damodaran wrote that, by his calculation, the probability of Apple being undervalued at $440 per share was 90%. He used a Monte Carlo simulation to arrive at this probability. The simulation valued Apple's shares by adjusting key variables across 100,000 possible scenarios. The results are shown below.

(click to enlarge)

He pegged Apple's intrinsic value at $608 and concluded this analysis by stating, "For Apple to be worth only $440 (or less), you would need negative or close to zero revenue growth, pre-tax operating margins of 25% (current margin is closer to 35%, down from 40% plus a year ago) and the cost of capital would have to be at 15% (the 97th percentile of U.S. stocks)."

With the current price around $390, you can imagine what the professor's estimated probability of undervaluation would be now. I recommend that all of you examine his writing and valuation yourself. You will find his thinking and math to be sound, reasonable and of the utmost quality.

Relative Value

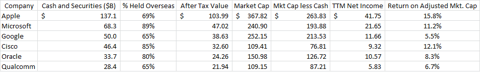

Einhorn, as stated earlier, believes that Apple's cash hoard is hiding the company's real value and that distributing the cash will make that value obvious. Let's do that here. Let's strip out the cash and compare Apple to other big tech names with large cash hoards. All of these names are undoubtedly familiar to you, and Apple is far cheaper than each of them following this approach.

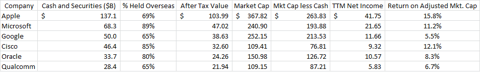

You will see in the chart below that I laid out each company's current cash and equivalents and marketable securities below alongside the percentage of those holdings overseas. I taxed the percentage held overseas by 35% for repatriation, added that amount back to the domestic cash holdings, and subtracted that full amount from each company's respective market capitalization. I used the most recent data I could find, and the market caps are as of the market close on April 18, 2013.

(click to enlarge)

The return on adjusted market capitalization is nothing more than an adjusted earnings yield. I realize that the return on cash can impact earnings, but I don't consider the impact to be meaningful enough to drastically alter the data.

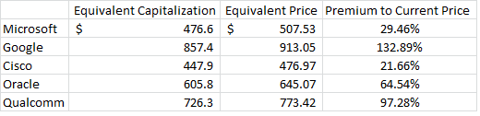

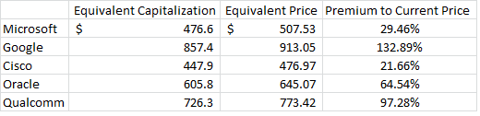

Next, I valued Apple by determining the equivalent market capitalization for a given level of return on the adjusted market cap. For example, the chart below shows that Apple's current market cap before adjusting for cash, or its equivalent capitalization, would have to rise to $476.6 billion to return 11.2% on a cash adjusted basis, as shown for Microsoft in the previous chart. This means that Apple's share price should be $507.53, which is a 29.46% premium to its current price of $392.05, if it were priced on an equivalent basis with Microsoft. The other companies follow.

(click to enlarge)

Conclusion

It would appear that Einhorn is correct that Apple is being under-appreciated on a cash-adjusted basis. Think what you will about relative valuation, the data here is hard to ignore. The company's adjusted earnings yield dwarfs that of Google, Oracle and Qualcomm and is significantly higher than Cisco and Micosoft's.

It leaves one left asking, are the other companies' prospects that much better or Apple's that much worse that there should be such a large return differential? If I had $400 billion to spend on an acquisition would I rather own Microsoft and earn a lower return than I would owning Apple?

If you feel that Samsung's presence makes owning Apple far riskier than these other companies then you might still argue for its low valuation. However, we would have to agree to disagree, because Professor Damodaran's work clearly shows that Apple is intrinsically undervalued even after accounting for competitive pressure. Therefore, I must conclude by saying that it is clear, to me, that no matter how you prefer to value its shares Apple is cheap.

James DeMasi is founder and CIO of Seraphin Group, a registered investment advisory company. Learn how Seraphin Group can help you with your investments by visiting SeraphinGroup.com.

Ben Graham said that, "In the short run, the market is a voting machine, but in the long run it is a weighing machine." Meaning that a stock's price in the short term is a "product partly of reason and partly of emotion." I'm going to argue that the current price is being driven more by emotion and less by reason and then proceed straight to valuation. I will not talk about Apple's products or prospects here, because they're all well publicized and don't need repeating.

An Unstable Reaction

As children, most of us first learned about unstable chemical reactions by mixing vinegar and baking soda, possibly to create a model volcano. Well, the unstable reaction that was so fun to watch as a child isn't nearly as fun to witness as an investor. Professor Aswath Damodaran of NYU has written on multiple occasions that when a stock (Apple) gets mixed with value, growth, dividend and momentum investors, there can be a powerful reaction, much like mixing vinegar and baking soda.

It should not be difficult for anyone watching Apple to imagine a scenario where growth is either too slow or too uncertain to please growth investors, the company's product — technology — is too unpredictable for traditional values investors, the dividend isn't large enough or isn't growing fast enough to please dividend investors, and that the conflict among these groups ceases all price momentum to the dismay of momentum and institutional investors. That's exactly what is happening now. The result is that no one is happy, and that's being reflected in the current price. The fact that investors keep a daily laser-like focus on this stock certainly adds to the cauldron of emotional tension, which only pushes level-headed reasoning that much further into the background. There has to be a catalyst to shake investors and unlock Apple's value.

Damodaran Versus Einhorn

As most of you probably already know, Professor Damodaran and hedge fund manager David Einhorn have gotten entangled in a public argument over Apple's value and its cash hoard. Damodaran said that Einhorn's plan to issue iPrefs would, "not add value to the company, not one cent." Einhorn, on the other hand, feels that Apple's true value is being buried alive by its cash hoard, so distributing that cash would "create" value. Einhorn is essentially saying that investors cannot see the company's value for all the green, if you will. I believe that both of them are correct and will explain.

Damodaran is correct that returning cash to shareholders does not increase the intrinsic value of a business. Dividends are simply a transfer of value, like withdrawing cash from an ATM. The second you take your cash from the machine you still own the same amount of money. Some of it just happens to be going into your pocket now. Or in the professor's own words:

If Apple's shares were trading at fair value today (let's say, at $450 per share) and each Apple shareholder were granted a preferred share, with a preferred dividend of 4% and face value of $100, here is what the shareholders will end up holding tomorrow: a common stock with a value of $350 and a preferred share with a value of $100.It appears that this conflict with Einhorn could be a misunderstanding. Damodaran is looking at this from a purely intrinsic standpoint despite the fact that he himself has acknowledged that emotions affect pricing and that he believes Apple is worth much more than its current price. Einhorn may not have literally meant that distributing Apple's cash would create intrinsic value; rather, he likely meant that it would uncover the intrinsic value and align it more closely with the market price. In other words, unloading the cash would make the discrepancy between the stock's price and its value so blatant that even a casual observer would take notice.

Apple's Intrinsic Value

Whether you value Apple on an intrinsic or a relative basis, it is cheap. In February, Professor Damodaran wrote that, by his calculation, the probability of Apple being undervalued at $440 per share was 90%. He used a Monte Carlo simulation to arrive at this probability. The simulation valued Apple's shares by adjusting key variables across 100,000 possible scenarios. The results are shown below.

(click to enlarge)

He pegged Apple's intrinsic value at $608 and concluded this analysis by stating, "For Apple to be worth only $440 (or less), you would need negative or close to zero revenue growth, pre-tax operating margins of 25% (current margin is closer to 35%, down from 40% plus a year ago) and the cost of capital would have to be at 15% (the 97th percentile of U.S. stocks)."

With the current price around $390, you can imagine what the professor's estimated probability of undervaluation would be now. I recommend that all of you examine his writing and valuation yourself. You will find his thinking and math to be sound, reasonable and of the utmost quality.

Relative Value

Einhorn, as stated earlier, believes that Apple's cash hoard is hiding the company's real value and that distributing the cash will make that value obvious. Let's do that here. Let's strip out the cash and compare Apple to other big tech names with large cash hoards. All of these names are undoubtedly familiar to you, and Apple is far cheaper than each of them following this approach.

You will see in the chart below that I laid out each company's current cash and equivalents and marketable securities below alongside the percentage of those holdings overseas. I taxed the percentage held overseas by 35% for repatriation, added that amount back to the domestic cash holdings, and subtracted that full amount from each company's respective market capitalization. I used the most recent data I could find, and the market caps are as of the market close on April 18, 2013.

(click to enlarge)

The return on adjusted market capitalization is nothing more than an adjusted earnings yield. I realize that the return on cash can impact earnings, but I don't consider the impact to be meaningful enough to drastically alter the data.

Next, I valued Apple by determining the equivalent market capitalization for a given level of return on the adjusted market cap. For example, the chart below shows that Apple's current market cap before adjusting for cash, or its equivalent capitalization, would have to rise to $476.6 billion to return 11.2% on a cash adjusted basis, as shown for Microsoft in the previous chart. This means that Apple's share price should be $507.53, which is a 29.46% premium to its current price of $392.05, if it were priced on an equivalent basis with Microsoft. The other companies follow.

(click to enlarge)

Conclusion

It would appear that Einhorn is correct that Apple is being under-appreciated on a cash-adjusted basis. Think what you will about relative valuation, the data here is hard to ignore. The company's adjusted earnings yield dwarfs that of Google, Oracle and Qualcomm and is significantly higher than Cisco and Micosoft's.

It leaves one left asking, are the other companies' prospects that much better or Apple's that much worse that there should be such a large return differential? If I had $400 billion to spend on an acquisition would I rather own Microsoft and earn a lower return than I would owning Apple?

If you feel that Samsung's presence makes owning Apple far riskier than these other companies then you might still argue for its low valuation. However, we would have to agree to disagree, because Professor Damodaran's work clearly shows that Apple is intrinsically undervalued even after accounting for competitive pressure. Therefore, I must conclude by saying that it is clear, to me, that no matter how you prefer to value its shares Apple is cheap.

James DeMasi is founder and CIO of Seraphin Group, a registered investment advisory company. Learn how Seraphin Group can help you with your investments by visiting SeraphinGroup.com.