Exploring the Sustainability and Growth of Rockwell Automation Inc's Dividends

Introduction to Rockwell Automation Inc's Upcoming Dividend

Rockwell Automation Inc (ROK, Financial) recently announced a dividend of $1.25 per share, payable on 2024-06-10, with the ex-dividend date set for 2024-05-10. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Rockwell Automation Inc's dividend performance and assess its sustainability.

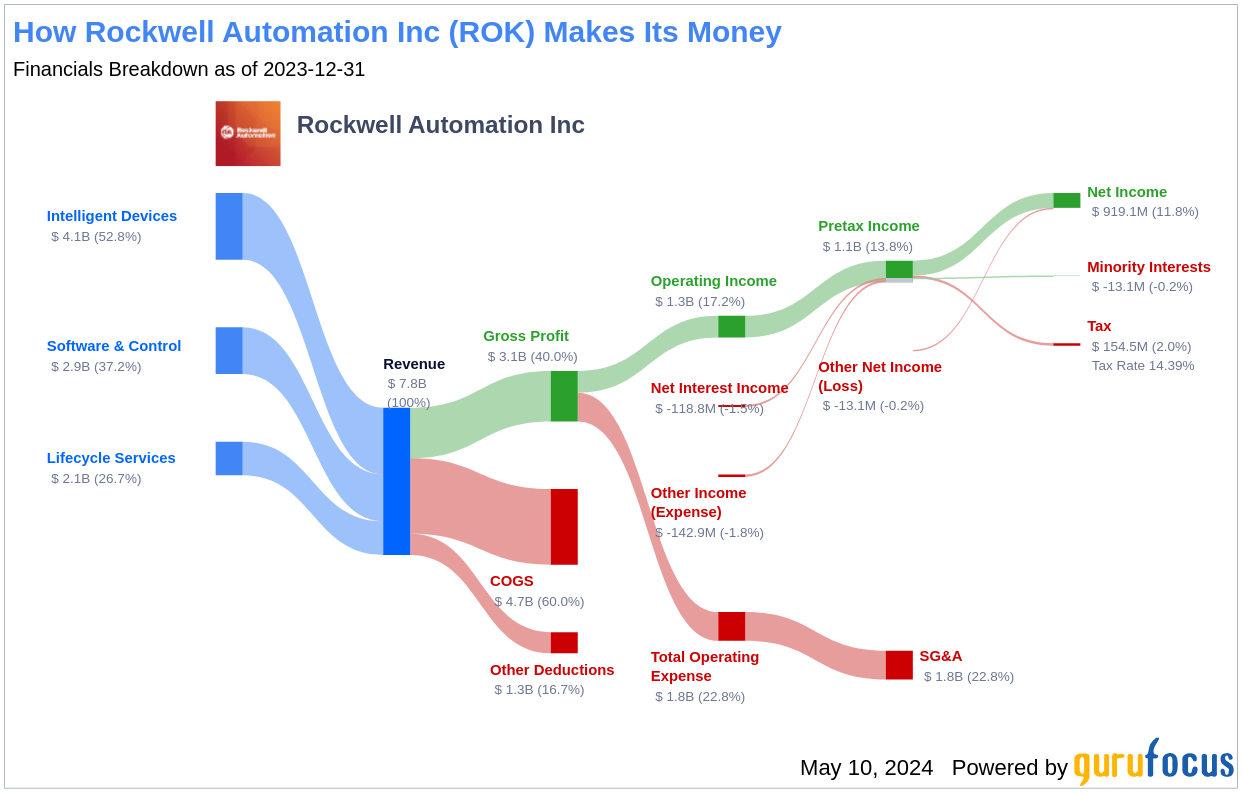

What Does Rockwell Automation Inc Do?

Rockwell Automation is a pure-play automation competitor that emerged from Rockwell International after spinning off its former Rockwell Collins avionics segment in 2001. Operating through three segments—intelligent devices, software and control, and lifecycle services—Rockwell Automation offers a comprehensive range of automation solutions. These include drives, sensors, industrial components, as well as information and network security software, complemented by consulting and maintenance services through its Sensia JV with SLB.

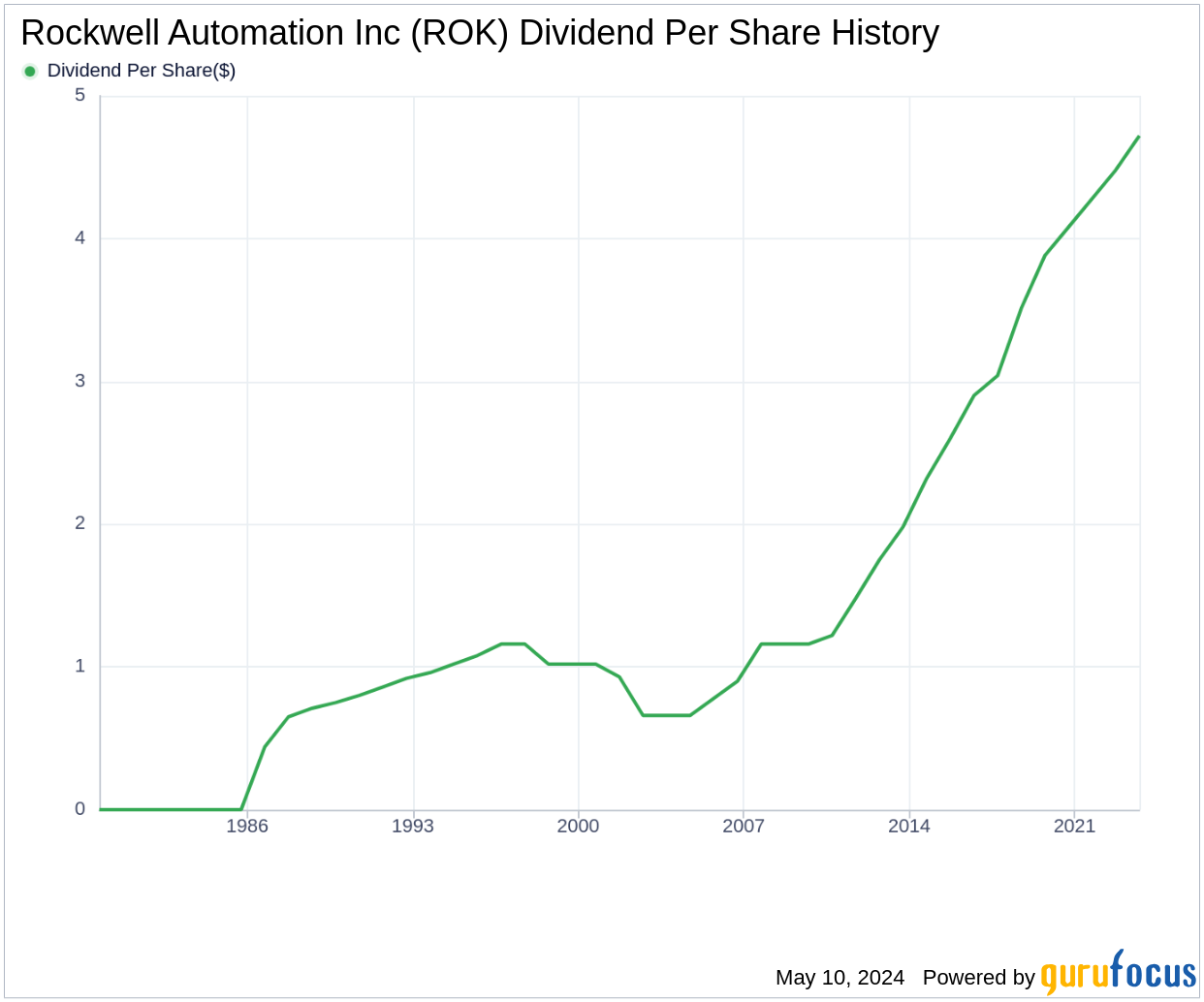

A Glimpse at Rockwell Automation Inc's Dividend History

Rockwell Automation Inc has consistently paid dividends since 1986 and has increased its dividend annually since 2002, earning it the status of a dividend achiever. This accolade is reserved for companies that have consistently raised their dividends for at least 22 consecutive years. Dividends are distributed quarterly.

Breaking Down Rockwell Automation Inc's Dividend Yield and Growth

Currently, Rockwell Automation Inc boasts a trailing dividend yield of 1.80% and a forward dividend yield of 1.85%, indicating anticipated increases in dividend payments over the next year. Over the last three years, the annual dividend growth rate was 5.00%, which extended to 5.80% over five years, and an impressive 8.90% over the past decade. As of today, the 5-year yield on cost for Rockwell Automation Inc stock is approximately 2.39%.

The Sustainability Question: Payout Ratio and Profitability

The dividend payout ratio, which stands at 0.43 as of 2024-03-31, offers insights into the portion of earnings Rockwell Automation Inc distributes as dividends. A lower ratio implies substantial retention of earnings, which supports future growth and stability. The company's profitability rank is 9 out of 10, indicating robust earnings potential. Consistent positive net income over the past decade further underscores its financial health.

Growth Metrics: The Future Outlook

Rockwell Automation Inc's impressive growth rank of 9 out of 10 highlights its strong competitive position. With a 3-year revenue growth rate of approximately 13.00% annually—outperforming about 66.38% of global competitors—and a 3-year EPS growth rate of 15.50% annually—outperforming about 54.67% of global competitors—Rockwell Automation Inc demonstrates a solid growth trajectory. Additionally, its 5-year EBITDA growth rate of 7.20% surpasses about 48.02% of global peers.

Conclusion: Assessing Dividend Stability and Growth

Considering Rockwell Automation Inc's consistent dividend increases, healthy payout ratio, robust profitability, and strong growth metrics, the company appears well-positioned to sustain and potentially increase its dividends in the future. For investors seeking dividend growth stocks, Rockwell Automation Inc represents a compelling option. For further exploration of high-dividend yield stocks, GuruFocus Premium users can utilize the High Dividend Yield Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.