Loren M Starr - Net Worth and Insider Trading

Loren M Starr Net Worth

The estimated net worth of Loren M Starr is at least $9 Million dollars as of 2024-07-27. Loren M Starr is the SMD & CFO of Invesco Ltd and owns about 338,841 shares of Invesco Ltd (IVZ) stock worth over $6 Million. Loren M Starr is also the SVP, CFO of Janus Capital Group Inc and owns about 212,552 shares of Janus Capital Group Inc (JNS) stock worth over $3 Million. Details can be seen in Loren M Starr's Latest Holdings Summary section.

Disclaimer: The insider information is derived from SEC filings. The estimated net worth is based on the assumption that Loren M Starr has not made any transactions after 2013-02-04 and currently still holds the listed stock(s).

Transaction Summary of Loren M Starr

Loren M Starr Insider Ownership Reports

Based on ownership reports from SEC filings, as the reporting owner, Loren M Starr owns 20 companies in total, including Invesco Ltd (IVZ) , Invesco Mortgage Capital Inc (IVR) , and Invesco Bond Fund (VBF) among others .

Click here to see the complete history of Loren M Starr’s form 4 insider trades.

Insider Ownership Summary of Loren M Starr

| Ticker | Comapny | Transaction Date | Type of Owner |

|---|---|---|---|

| IVZ | Invesco Ltd | 2013-02-04 | Senior Managing Director & CFO |

| IVR | Invesco Mortgage Capital Inc | 2019-08-01 | director |

| VBF | Invesco Bond Fund | 2020-05-15 | director |

| 2020-05-15 | director | ||

| 2020-05-15 | director | ||

| 2020-05-15 | director | ||

| 2020-05-15 | director | ||

| 2020-05-15 | director | ||

| 2020-05-15 | director | ||

| 2020-05-15 | director | ||

| 2020-05-15 | director | ||

| 2020-05-15 | director | ||

| 2020-05-15 | director | ||

| 2020-05-15 | director | ||

| 2020-05-15 | director | ||

| 2020-05-15 | director | ||

| 2020-05-15 | director | ||

| 2020-05-15 | director | ||

| 2005-03-31 | SVP & Chief Financial Officer | ||

| 2023-09-25 | director |

Loren M Starr Latest Holdings Summary

Loren M Starr currently owns a total of 2 stocks. Among these stocks, Loren M Starr owns 338,841 shares of Invesco Ltd (IVZ) as of February 4, 2013, with a value of $6 Million and a weighting of 66.21%. Loren M Starr also owns 212,552 shares of Janus Capital Group Inc (JNS) as of March 31, 2005, with a value of $3 Million and a weighting of 33.79%.

Latest Holdings of Loren M Starr

| Ticker | Comapny | Latest Transaction Date | Shares Owned | Current Price ($) | Current Value ($) |

|---|---|---|---|---|---|

| IVZ | Invesco Ltd | 2013-02-04 | 338,841 | 17.42 | 5,902,610 |

| JNS | Janus Capital Group Inc | 2005-03-31 | 212,552 | 14.17 | 3,011,862 |

Holding Weightings of Loren M Starr

Loren M Starr Form 4 Trading Tracker

According to the SEC Form 4 filings, Loren M Starr has made a total of 0 transactions in Invesco Ltd (IVZ) over the past 5 years. The most-recent trade in Invesco Ltd is the sale of 126,000 shares on February 4, 2013, which brought Loren M Starr around $3 Million.

According to the SEC Form 4 filings, Loren M Starr has made a total of 0 transactions in Janus Capital Group Inc (JNS) over the past 5 years. The most-recent trade in Janus Capital Group Inc is the sale of 3,154 shares on March 31, 2005, which brought Loren M Starr around $43,967.

Insider Trading History of Loren M Starr

- 1

Loren M Starr Trading Performance

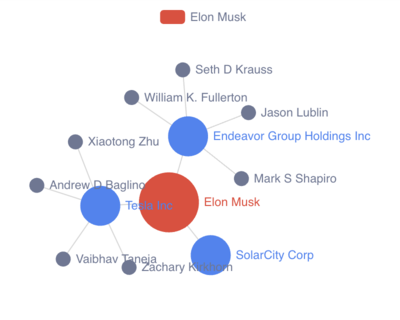

Loren M Starr Ownership Network

Loren M Starr Owned Company Details

What does Invesco Ltd do?

Who are the key executives at Invesco Ltd?

Loren M Starr is the Senior Managing Director & CFO of Invesco Ltd. Other key executives at Invesco Ltd include director & President & CEO Martin L Flanagan , Senior Managing Director Tony Wong , and Senior Managing Director Stephanie Butcher .

Invesco Ltd (IVZ) Insider Trades Summary

Over the past 18 months, Loren M Starr made no insider transaction in Invesco Ltd (IVZ). Other recent insider transactions involving Invesco Ltd (IVZ) include a net sale of 3,153,855 shares made by Trian Fund Management, L.p. , and a net sale of 232,413 shares made by Martin L Flanagan .

In summary, during the past 3 months, insiders sold 0 shares of Invesco Ltd (IVZ) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 3,386,268 shares of Invesco Ltd (IVZ) were sold and 0 shares were bought by its insiders, resulting in a net sale of 3,386,268 shares.

Invesco Ltd (IVZ)'s detailed insider trading history can be found in Insider Trading Tracker table.

Invesco Ltd Insider Transactions

Loren M Starr Mailing Address

Above is the net worth, insider trading, and ownership report for Loren M Starr. Currently GuruFocus does not have mailing address information for Loren M Starr.