Ardley Enterprises (ptc) Limited - Net Worth and Insider Trading

Ardley Enterprises (ptc) Limited Net Worth

The estimated net worth of Ardley Enterprises (ptc) Limited is at least $317 Million dollars as of 2024-06-22. Ardley Enterprises (ptc) Limited is the 2301 Trustee of Cafe de Coral Holdings Ltd and owns about 37,983,394 shares of Cafe de Coral Holdings Ltd (HKSE:00341) stock worth over $317 Million. Details can be seen in Ardley Enterprises (ptc) Limited's Latest Holdings Summary section.

Disclaimer: The insider information is derived from SEC filings. The estimated net worth is based on the assumption that Ardley Enterprises (ptc) Limited has not made any transactions after 2018-02-06 and currently still holds the listed stock(s).

Transaction Summary of Ardley Enterprises (ptc) Limited

Ardley Enterprises (ptc) Limited Insider Ownership Reports

Based on ownership reports from SEC filings, as the reporting owner, Ardley Enterprises (ptc) Limited owns 1 companies in total, including Cafe de Coral Holdings Ltd (HKSE:00341) .

Click here to see the complete history of Ardley Enterprises (ptc) Limited’s form 4 insider trades.

Insider Ownership Summary of Ardley Enterprises (ptc) Limited

| Ticker | Comapny | Transaction Date | Type of Owner |

|---|---|---|---|

| HKSE:00341 | Cafe de Coral Holdings Ltd | 2018-02-06 | 2301 Trustee |

Ardley Enterprises (ptc) Limited Latest Holdings Summary

Ardley Enterprises (ptc) Limited currently owns a total of 1 stock. Ardley Enterprises (ptc) Limited owns 37,983,394 shares of Cafe de Coral Holdings Ltd (HKSE:00341) as of February 6, 2018, with a value of $317 Million.

Latest Holdings of Ardley Enterprises (ptc) Limited

| Ticker | Comapny | Latest Transaction Date | Shares Owned | Current Price ($) | Current Value ($) |

|---|---|---|---|---|---|

| HKSE:00341 | Cafe de Coral Holdings Ltd | 2018-02-06 | 37,983,394 | 8.34 | 316,781,506 |

Holding Weightings of Ardley Enterprises (ptc) Limited

Ardley Enterprises (ptc) Limited Form 4 Trading Tracker

According to the SEC Form 4 filings, Ardley Enterprises (ptc) Limited has made a total of 0 transactions in Cafe de Coral Holdings Ltd (HKSE:00341) over the past 5 years. The most-recent trade in Cafe de Coral Holdings Ltd is the acquisition of 400,000 shares on February 6, 2018, which cost Ardley Enterprises (ptc) Limited around $8 Million.

Insider Trading History of Ardley Enterprises (ptc) Limited

- 1

Ardley Enterprises (ptc) Limited Trading Performance

GuruFocus tracks the stock performance after each of Ardley Enterprises (ptc) Limited's buying transactions within different timeframes. To be detailed, the average return of stocks after 3 months bought by Ardley Enterprises (ptc) Limited is -8.03%. GuruFocus also compares Ardley Enterprises (ptc) Limited's trading performance to market benchmark return within the same time period. The performance of stocks bought by Ardley Enterprises (ptc) Limited within 3 months outperforms 0 times out of 1 transactions in total compared to the return of S&P 500 within the same period.

You can select different timeframes to see how Ardley Enterprises (ptc) Limited's insider trading performs compared to the benchmark.

Performance of Ardley Enterprises (ptc) Limited

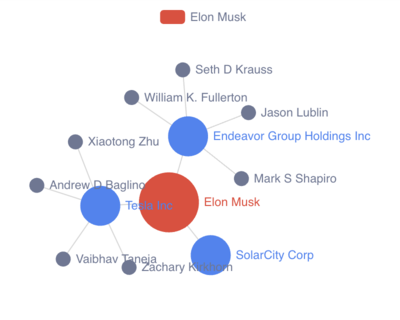

Ardley Enterprises (ptc) Limited Ownership Network

Ardley Enterprises (ptc) Limited Owned Company Details

What does Cafe de Coral Holdings Ltd do?

Who are the key executives at Cafe de Coral Holdings Ltd?

Ardley Enterprises (ptc) Limited is the 2301 Trustee of Cafe de Coral Holdings Ltd. Other key executives at Cafe de Coral Holdings Ltd include 2201 Interest of corporation controlled by you Sky Bright International Limited , 2201 Interest of corporation controlled by you Verdant Success Holdings Limited , and 2101 Beneficial owner Wandels Investment Limited .

Cafe de Coral Holdings Ltd (HKSE:00341) Insider Trades Summary

Over the past 18 months, Ardley Enterprises (ptc) Limited made no insider transaction in Cafe de Coral Holdings Ltd (HKSE:00341). Other recent insider transactions involving Cafe de Coral Holdings Ltd (HKSE:00341) include a net sale of 0 shares made by Lo Tak Shing, Peter , a net sale of 0 shares made by Ng Yuen Han , and a net purchase of 300,000 shares made by Wandels Investment Limited .

In summary, during the past 3 months, insiders sold 0 shares of Cafe de Coral Holdings Ltd (HKSE:00341) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of Cafe de Coral Holdings Ltd (HKSE:00341) were sold and 600,000 shares were bought by its insiders, resulting in a net purchase of 600,000 shares.

Cafe de Coral Holdings Ltd (HKSE:00341)'s detailed insider trading history can be found in Insider Trading Tracker table.

Cafe de Coral Holdings Ltd Insider Transactions

Ardley Enterprises (ptc) Limited Mailing Address

Above is the net worth, insider trading, and ownership report for Ardley Enterprises (ptc) Limited. Currently GuruFocus does not have mailing address information for Ardley Enterprises (ptc) Limited.