Pro Development Holdings Corp. - Net Worth and Insider Trading

Pro Development Holdings Corp. Net Worth

The estimated net worth of Pro Development Holdings Corp. is at least $936 Million dollars as of 2025-07-19. Pro Development Holdings Corp. is the 2101 Beneficial owner of Anton Oilfield Services Group and owns about 664,140,740 shares of Anton Oilfield Services Group (HKSE:03337) stock worth over $936 Million. Details can be seen in Pro Development Holdings Corp.'s Latest Holdings Summary section.

Disclaimer: The insider information is derived from SEC filings. The estimated net worth is based on the final shares held after open market or private purchases and sales of common stock with a transaction code of "P" or "S" on Form 4, assuming that Pro Development Holdings Corp. has not made any transactions after 2018-09-10 and currently still holds the listed stock(s). Please note that this estimate may not reflect the actual net worth.

Transaction Summary of Pro Development Holdings Corp.

Pro Development Holdings Corp. Insider Ownership Reports

Based on ownership reports from SEC filings, as the reporting owner, Pro Development Holdings Corp. owns 1 companies in total, including Anton Oilfield Services Group (HKSE:03337) .

Click here to see the complete history of Pro Development Holdings Corp.’s form 4 insider trades.

Insider Ownership Summary of Pro Development Holdings Corp.

| Ticker | Company | Transaction Date | Type of Owner |

|---|---|---|---|

| HKSE:03337 | Anton Oilfield Services Group | 2018-09-10 | 2101 Beneficial owner |

Pro Development Holdings Corp. Latest Holdings Summary

Pro Development Holdings Corp. currently owns a total of 1 stock. Pro Development Holdings Corp. owns 664,140,740 shares of Anton Oilfield Services Group (HKSE:03337) as of September 10, 2018, with a value of $936 Million.

Latest Holdings of Pro Development Holdings Corp.

| Ticker | Company | Latest Transaction Date | Shares Owned | Current Price ($) | Current Value ($) |

|---|---|---|---|---|---|

| HKSE:03337 | Anton Oilfield Services Group | 2018-09-10 | 664,140,740 | 1.41 | 936,438,443 |

Holding Weightings of Pro Development Holdings Corp.

Pro Development Holdings Corp. Form 4 Trading Tracker

According to the SEC Form 4 filings, Pro Development Holdings Corp. has made a total of 0 transactions in Anton Oilfield Services Group (HKSE:03337) over the past 5 years. The most-recent trade in Anton Oilfield Services Group is the acquisition of 5,000,000 shares on September 10, 2018, which cost Pro Development Holdings Corp. around $5 Million.

Insider Trading History of Pro Development Holdings Corp.

- 1

Pro Development Holdings Corp. Trading Performance

GuruFocus tracks the stock performance after each of Pro Development Holdings Corp.'s buying transactions within different timeframes. To be detailed, the average return of stocks after 3 months bought by Pro Development Holdings Corp. is -6.73%. GuruFocus also compares Pro Development Holdings Corp.'s trading performance to market benchmark return within the same time period. The performance of stocks bought by Pro Development Holdings Corp. within 3 months outperforms 1 times out of 1 transactions in total compared to the return of S&P 500 within the same period.

You can select different timeframes to see how Pro Development Holdings Corp.'s insider trading performs compared to the benchmark.

Performance of Pro Development Holdings Corp.

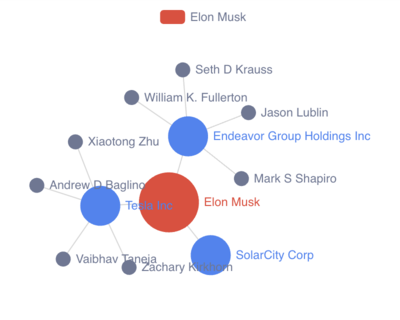

Pro Development Holdings Corp. Ownership Network

Ownership Network List of Pro Development Holdings Corp.

Ownership Network Relation of Pro Development Holdings Corp.

Pro Development Holdings Corp. Owned Company Details

What does Anton Oilfield Services Group do?

Who are the key executives at Anton Oilfield Services Group?

Pro Development Holdings Corp. is the 2101 Beneficial owner of Anton Oilfield Services Group. Other key executives at Anton Oilfield Services Group include 2101 Beneficial owner Luo Lin , 2301 Trustee BOCI Trustee (Hong Kong) Limited , and 2101 Beneficial owner Avalon Assets Limited .

Anton Oilfield Services Group (HKSE:03337) Insider Trades Summary

Over the past 18 months, Pro Development Holdings Corp. made no insider transaction in Anton Oilfield Services Group (HKSE:03337). Other recent insider transactions involving Anton Oilfield Services Group (HKSE:03337) include a net sale of 0 shares made by Luo Lin , and a net purchase of 33,300,000 shares made by BOCI Trustee (Hong Kong) Limited .

In summary, during the past 3 months, insiders sold 0 shares of Anton Oilfield Services Group (HKSE:03337) in total and bought 0 shares, with a net sale of 0 shares. During the past 18 months, 0 shares of Anton Oilfield Services Group (HKSE:03337) were sold and 33,300,000 shares were bought by its insiders, resulting in a net purchase of 33,300,000 shares.

Anton Oilfield Services Group (HKSE:03337)'s detailed insider trading history can be found in Insider Trading Tracker table.

Anton Oilfield Services Group Insider Transactions

Pro Development Holdings Corp. Mailing Address

Above is the net worth, insider trading, and ownership report for Pro Development Holdings Corp.. Currently GuruFocus does not have mailing address information for Pro Development Holdings Corp..