Compared to dividends, buybacks provide a more tax efficient method of returning cash to shareholders. But any tax benefits may be more than reversed by the exceedingly poor prices at which corporations buy back their own shares.

Previously, we have seen anecdotal evidence of this, as we examined the recent buyback records of Wal-Mart, The Home Depot, Best Buy, Target and Lowe's. The higher the stock price, the more money these firms would pump into buying back shares, which was the exact opposite of what they should have been doing. For a more recent example, look no further than Netflix (NFLX, Financial), which trades at a P/E of 70 and yet continues to buy back shares.

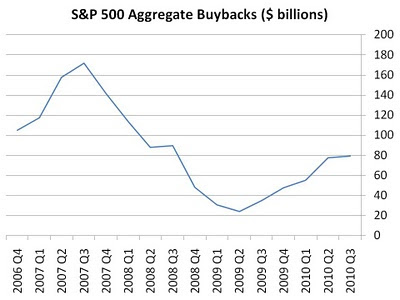

Anecdotal evidence can be misleading, however, and therefore it makes more sense to consider the aggregate market as a whole. The following chart depicts the level of buybacks for the S&P 500 over the last four years:

Note how well this correlates with the overall market. As the market peaked in 2007, firms were furiously buying up shares. As the market fell to its lowest level in March of 2009, companies were too scared to buy back shares. Yet, this is exactly when many companies (those not in debt trouble) should have been active in the market.

Today, companies in the aggregate appear to have regained their appetites for buybacks. But prices have recovered as well, so that even though buyback funds are almost four times higher than they were in the second quarter of 2009, they pack about 40% less punch per dollar. Seeing as how the top tax rate on corporate dividends in the US is 15%, perhaps investors in the aggregate would be better off with dividends over buybacks despite the tax hit.

Saj Karsan

httl://barelkarsan.com

Previously, we have seen anecdotal evidence of this, as we examined the recent buyback records of Wal-Mart, The Home Depot, Best Buy, Target and Lowe's. The higher the stock price, the more money these firms would pump into buying back shares, which was the exact opposite of what they should have been doing. For a more recent example, look no further than Netflix (NFLX, Financial), which trades at a P/E of 70 and yet continues to buy back shares.

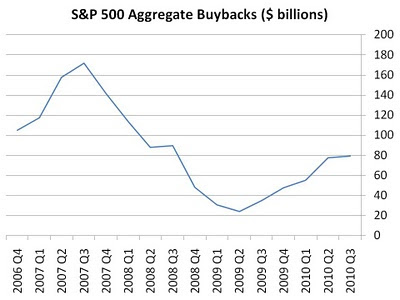

Anecdotal evidence can be misleading, however, and therefore it makes more sense to consider the aggregate market as a whole. The following chart depicts the level of buybacks for the S&P 500 over the last four years:

Note how well this correlates with the overall market. As the market peaked in 2007, firms were furiously buying up shares. As the market fell to its lowest level in March of 2009, companies were too scared to buy back shares. Yet, this is exactly when many companies (those not in debt trouble) should have been active in the market.

Today, companies in the aggregate appear to have regained their appetites for buybacks. But prices have recovered as well, so that even though buyback funds are almost four times higher than they were in the second quarter of 2009, they pack about 40% less punch per dollar. Seeing as how the top tax rate on corporate dividends in the US is 15%, perhaps investors in the aggregate would be better off with dividends over buybacks despite the tax hit.

Saj Karsan

httl://barelkarsan.com