The market crash Monday, coming hot on the heels of the one last Thursday, made me think of the book of dark short stories pictured below, "Here Comes Another Lesson." A brief excerpt should illustrate.

This excerpt is from a story called The Professor of Atheism: Here Comes Another Lesson, in which a failed academic named Charles finds a pair of angel wings that miraculously attach to his body and allow him to fly:

Lesson 1: Diversification Doesn't Protect Against Market Risk

Diversifying among a basket of different stocks reduces stock-specific risk, but not market risk. When the market crashes, nearly all stocks get hammered. That’s what happened on Thursday, as 497 of the stocks in the S&P 500 were down on the day. And that's what happened Monday, when all 500 stocks in the S&P 500 were down on the day.

Lesson 2: Hedging Can Limit Market Risk

The screen shot below shows the performance of the SPDR S&P 500 Trust ETF (SPY), the SPDR Dow Jones Industrial Average ETF (DIA), and a few put options on them that I referred to in my last Slope post. More on the DIA puts below.

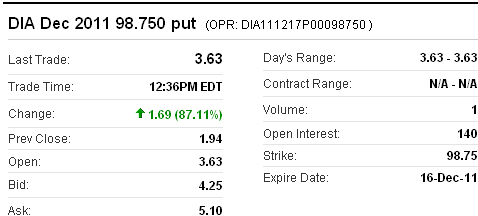

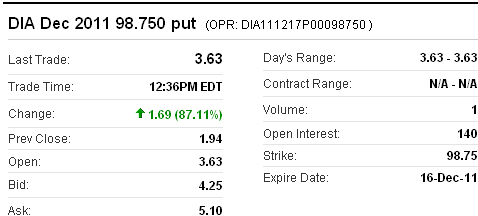

Up 87.11% Monday

This is the $98.75 strike put option on DIA expiring in December, 2011. In recent posts, I've mentioned in the disclosures that I am long puts on DIA as a hedge. Those are the specific DIA puts I own. In late June, I used Portfolio Armor to find the optimal put options to hedge against a greater-than-20% drop in DIA, and those were the ones Portfolio Armor presented. I bought them at $1.28. The screen shot below shows the quote for them as of Thursday, but first a quick reminder about optimal puts.

About Optimal Puts

Optimal puts are the ones that will give you the level of protection you specify at the lowest possible cost. As University of Maine finance professor Dr. Robert Strong, CFA has noted, picking the most economical puts can be a complicated task. With Portfolio Armor (available on the web and as an Apple iOS app), you just enter the symbol of the stock or ETF you're looking to hedge, the number of shares you own, and the maximum decline you're willing to risk (your threshold). Then the app uses an algorithm developed by a finance PhD to sort through and analyze all of the available puts for your position, scanning for the optimal ones.

Lesson 3: Higher Volatility Means Higher Hedging Costs

A point I've made in previous posts (e.g., this one) is that investors ought to consider hedging when volatility is low, and hedging costs are relatively low as well. Below are a few snap shots of hedging costs at different volatility levels that show how quickly volatility can spike and hedging costs can rise. Hedging costs as of May 9, with the VIX at 17.16

The hedging costs in this table were first posted in this article on May 10.

Hedging costs as of August 5, with the VIX at 32

Hedging costs as of August 8, with the VIX at 48

*Based on optimal puts expiring in December 2011.

**Based on optimal puts expiring in March 2012.

This excerpt is from a story called The Professor of Atheism: Here Comes Another Lesson, in which a failed academic named Charles finds a pair of angel wings that miraculously attach to his body and allow him to fly:

“Hey, Professor!” Charles turns around to see a very short, very wide man stamping and scraping his feet on the cinders. His blunt, wide head is lowered between his mountainous shoulders, and a massive nose ring loops between his snorting nostrils. “Who are you?” asks Charles. “I’m a real angel,” says the main. “Then where are your wings?” “Don’t be stupid! That’s just a cliché.” Even before these words are out of his mouth, the man has begun running toward Charles, ramming his blunt forehead into Charles’s solar plexus and knocking him onto his bewinged back. It is a moment before Charles can catch his breath. He sits up and asks, “What did you do that for?.” “To teach you a lesson.” “What kind of lesson is that?” What other kind of lesson is there?” It is a long time before Charles can think of a response to this one. Finally he asks, “Who sent you?” Who do you think?” “God?” The man laughs. “Satan?” the man laughs even harder. “You know,” he says, “your so pathetic I almost hate to do this.” The man slaps his hands together and begins stamping and shuffling again. “Okay,” he says, “here comes another lesson!”Three lessons from the market meltdowns

Lesson 1: Diversification Doesn't Protect Against Market Risk

Diversifying among a basket of different stocks reduces stock-specific risk, but not market risk. When the market crashes, nearly all stocks get hammered. That’s what happened on Thursday, as 497 of the stocks in the S&P 500 were down on the day. And that's what happened Monday, when all 500 stocks in the S&P 500 were down on the day.

Lesson 2: Hedging Can Limit Market Risk

The screen shot below shows the performance of the SPDR S&P 500 Trust ETF (SPY), the SPDR Dow Jones Industrial Average ETF (DIA), and a few put options on them that I referred to in my last Slope post. More on the DIA puts below.

Up 87.11% Monday

This is the $98.75 strike put option on DIA expiring in December, 2011. In recent posts, I've mentioned in the disclosures that I am long puts on DIA as a hedge. Those are the specific DIA puts I own. In late June, I used Portfolio Armor to find the optimal put options to hedge against a greater-than-20% drop in DIA, and those were the ones Portfolio Armor presented. I bought them at $1.28. The screen shot below shows the quote for them as of Thursday, but first a quick reminder about optimal puts.

About Optimal Puts

Optimal puts are the ones that will give you the level of protection you specify at the lowest possible cost. As University of Maine finance professor Dr. Robert Strong, CFA has noted, picking the most economical puts can be a complicated task. With Portfolio Armor (available on the web and as an Apple iOS app), you just enter the symbol of the stock or ETF you're looking to hedge, the number of shares you own, and the maximum decline you're willing to risk (your threshold). Then the app uses an algorithm developed by a finance PhD to sort through and analyze all of the available puts for your position, scanning for the optimal ones.

Lesson 3: Higher Volatility Means Higher Hedging Costs

A point I've made in previous posts (e.g., this one) is that investors ought to consider hedging when volatility is low, and hedging costs are relatively low as well. Below are a few snap shots of hedging costs at different volatility levels that show how quickly volatility can spike and hedging costs can rise. Hedging costs as of May 9, with the VIX at 17.16

The hedging costs in this table were first posted in this article on May 10.

| Symbol | Name | Cost of Protection (as % of position value) |

| SPY | SPDR S&P 500 | 1.77%* |

| DIA | SPDR Dow Jones Industrial Avg | 1.49%* |

| QQQ | PowerShares QQQ Trust | 2.11%* |

| Symbol | Name | Cost of Protection (as % of position value) |

| SPY | SPDR S&P 500 | 3.56%** |

| DIA | SPDR Dow Jones Industrial Avg | 3.06%** |

| QQQ | PowerShares QQQ Trust | 3.30%** |

Hedging costs as of August 8, with the VIX at 48

| Symbol | Name | Cost of Protection (as % of position value) |

| SPY | SPDR S&P 500 | 5.38%** |

| DIA | SPDR Dow Jones Industrial Avg | 5.23%** |

| QQQ | PowerShares QQQ Trust | 5.83%* |

*Based on optimal puts expiring in December 2011.

**Based on optimal puts expiring in March 2012.