Tweedy Browne (Trades, Portfolio) CO LLC sold shares of the following stocks during the first quarter of 2021, which ended on March 31.

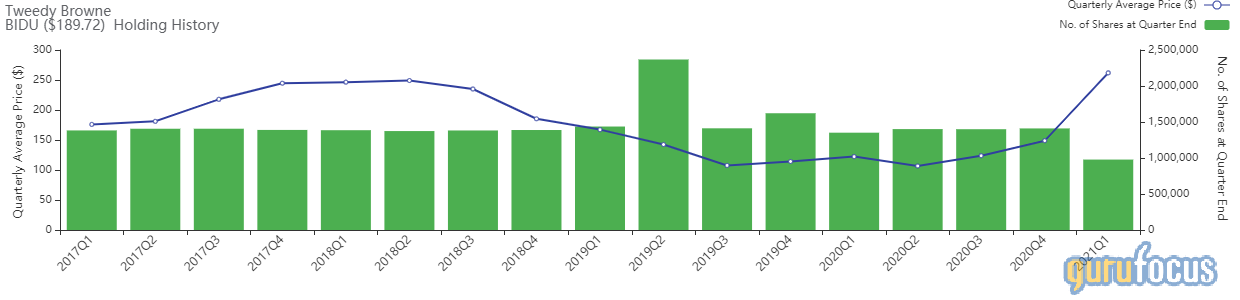

Baidu

The guru's Baidu Inc. (BIDU) position was reduced by 30.66%, impacting the portfolio by -2.91%.

The Chinese Internet search engine has a market cap of $65.93 billion and an enterprise value of $54.68 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 13.39% and return on assets of 7.34% are outperforming 68% of companies in the interactive media industry. Its financial strength is rated 6 out of 10 with a cash-debt ratio of 1.96.

The largest guru shareholder of the company is PRIMECAP Management (Trades, Portfolio) with 2.79% of outstanding shares, followed by Jim Simons (Trades, Portfolio)' Renaissance Technologies with 2.52%, Baillie Gifford (Trades, Portfolio) with 1.12% and Dodge & Cox with 1.10%.

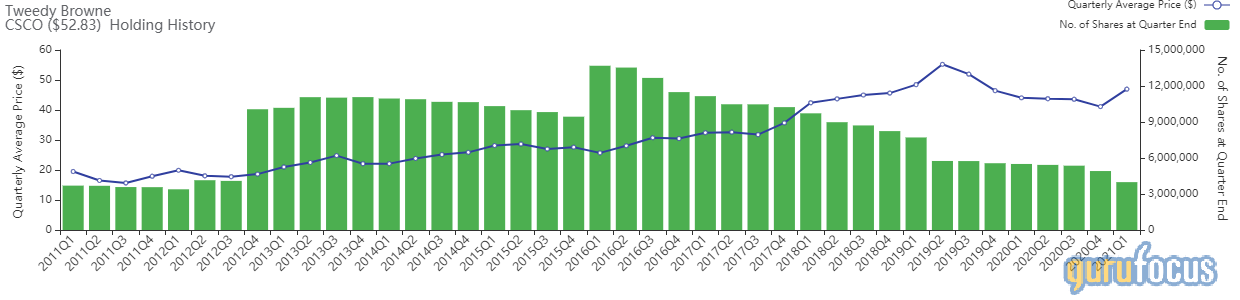

Cisco Systems

The guru curbed the position in Cisco Systems Inc. (CSCO) by 18.82%, impacting the portfolio by -1.29%.

The hardware and software supplier has a market cap of $223.04 billion and an enterprise value of $207 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 27.16% and return on assets of 10.84% are outperforming 92% of companies in the hardware industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 2.1 is above the industry median of 1.41.

The largest guru shareholders of the company include Dodge & Cox with 0.91% of outstanding shares, Al Gore (Trades, Portfolio) with 0.55% and Ken Fisher (Trades, Portfolio) with 0.51%.

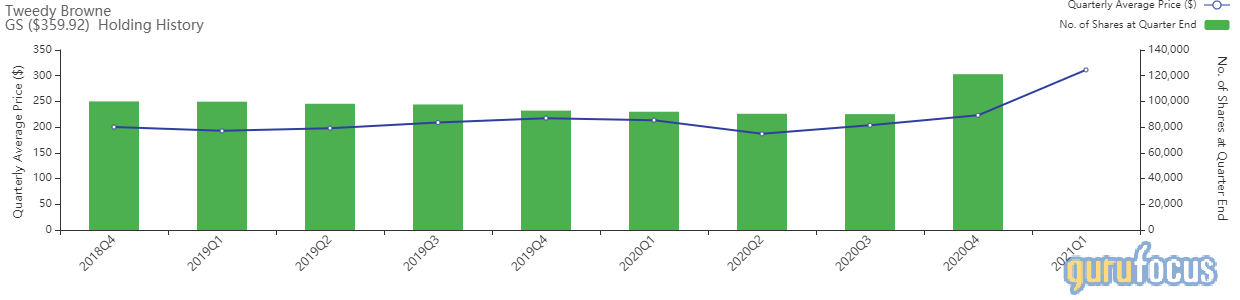

Goldman Sachs

The firm closed its position in Goldman Sachs Group Inc. (GS). The trade had an impact of -0.99% on the portfolio.

The investment banking firm has a market cap of $122.29 billion and an enterprise value of $247.83 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of 15.47% is outperforming 76% of companies in the capital markets industry. Its financial strength is rated 3 out of 10 with a cash-debt ratio of 0.62.

The largest guru shareholder of the company is Dodge & Cox with 2.60% of outstanding shares, followed by Fisher with 0.76% and HOTCHKIS & WILEY with 0.75%.

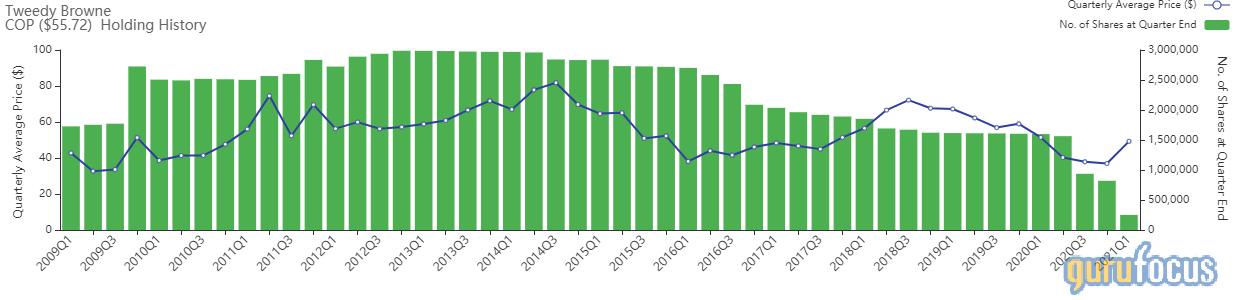

ConocoPhillips

The guru trimmed the position in ConocoPhillips (COP) by 69.31%, impacting the portfolio by -0.71%.

The U.S. independent exploration and production firm has a market cap of $75.19 billion and an enterprise value of $86.72 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of 0.06% and return on assets of 0.03% are outperforming 60% of companies in the oil & gas industry. Its financial strength is rated 5 out of 10 with a cash-debt ratio of 0.42.

The largest guru shareholders of the company include Fisher with 0.39% of outstanding shares, Pioneer Investments (Trades, Portfolio) with 0.34% and Steven Cohen (Trades, Portfolio)'s Point72 Asset Management with 0.12%.

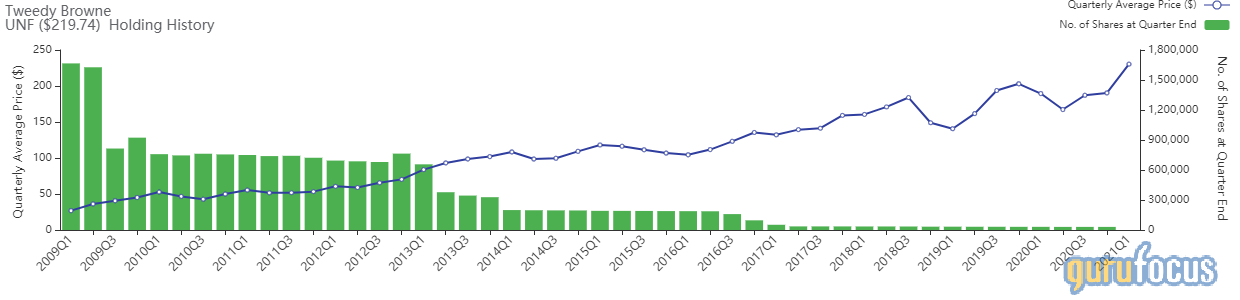

UniFirst

The firm exited its position in UniFirst Corp. (UNF), impacting the portfolio by -0.20%.

The company, which provides workplace products and services, has a market cap of $4.15 billion and an enterprise value of $3.68 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 7.3% and return on assets of 5.78% are outperforming 56% of companies in the business services industry. Its financial strength is rated 7 out of 10 with a cash-debt ratio of 12.38.

The largest guru shareholder of the company is Chuck Royce (Trades, Portfolio) with 0.43% of outstanding shares, followed by Steven Scruggs (Trades, Portfolio) with 0.11% and Third Avenue Management (Trades, Portfolio) with 0.08%.

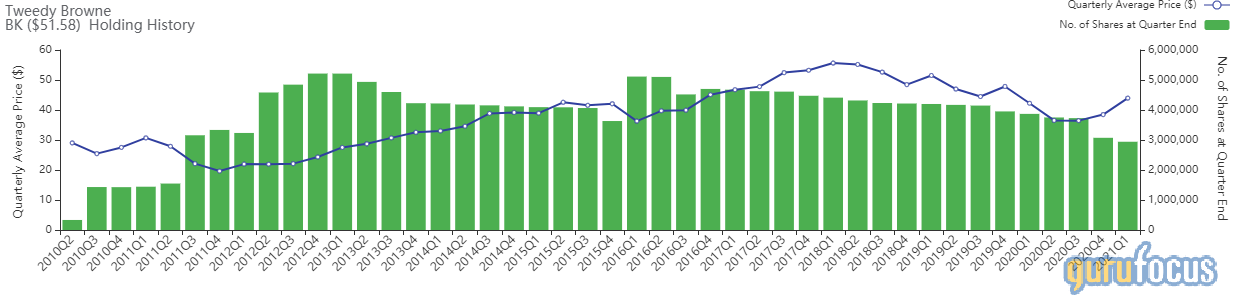

Bank of New York Mellon

The guru trimmed the position in Bank of New York Mellon Corp. (BK) by 4.28%, impacting the portfolio by -0.17%.

The investment company has a market cap of $45.16 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of 7.56% is outperforming 66% of companies in the asset management industry. Its financial strength is rated 3 out of 10 with a cash-debt ratio of 5.6.

The largest guru shareholders of the company include Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway with 8.16% of outstanding shares, Dodge & Cox with 6.92% and First Eagle Investment (Trades, Portfolio) with 2.06%.

Disclosure: I do not own any stocks mentioned.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.