We are pleased to announce that we started tracking Azvalor Internacional FI’s portfolio on GuruFocus. The fund’s top six trades during the first quarter included new positions in Arch Resources Inc. (ARCH, Financial), Whitehaven Coal Ltd. (ASX:WHC, Financial) and Endeavour Mining Corp. (TSX:EDV, Financial), and reductions to its holdings in Teck Resources Ltd. (TECK, Financial), Cameco Corp. (CCJ, Financial) and OCI NV (XAMS:OCI, Financial).

According to the firm’s website, the Internacional FI fund seeks long-term capital appreciation through a value-oriented investing approach. Managed by Alvaro Guzman de Lazaro and Fernando Bernad, the fund invests in the common stock of companies that are trading below intrinsic value. While the fund primarily invests in European securities, the Internacional FI fund may have over 35% of its total assets invested in global, emerging markets.

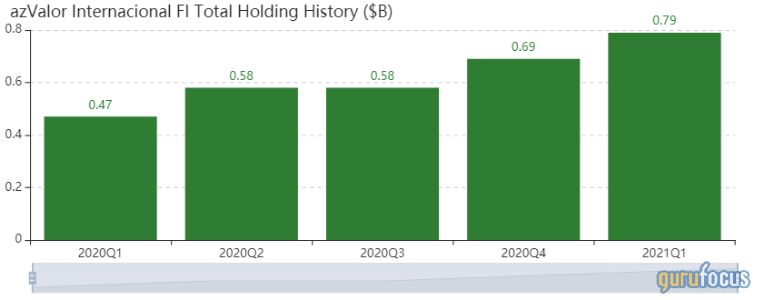

As of March 31, the fund’s $793 million equity portfolio contains 72 stocks, with 11 new positions and a turnover ratio of 23%. The top four sectors in terms of weight are energy, basic materials, industrials and consumer defensive, representing 53.98%, 33.45%, 6.80% and 3.35% of the equity portfolio.

Arch Resources

The fund purchased 599,294 shares of Arch Resources (ARCH, Financial), giving the position 2.68% weight in the equity portfolio. Shares averaged $48.16 during the first quarter; the stock is fairly valued based on Friday’s price-to-GF Value ratio of 1.07.

GuruFocus ranks the St. Louis-based coal producer’s financial strength 3 out of 10 on several warning signs, which include a low Piotroski F-score of 2, a weak Altman Z-score of 1.07 and debt ratios that underperform more than 90% of global competitors.

Other gurus with holdings in Arch Resources include Steven Cohen (Trades, Portfolio)’s Point72 Asset Management and Paul Tudor Jones (Trades, Portfolio)’ Tudor Investment.

Whitehaven Coal

The fund purchased 18,013,840 shares of Whitehaven Coal (ASX:WHC, Financial), giving the position 2.55% weight in the equity portfolio. Shares averaged 1.63 Australian dollars ($1.25) during the first quarter; the stock is a possible value trap based on Friday’s price-to-GF Value ratio of 0.69 and a low financial strength rank of 4.

According to GuruFocus, the Australian coal miner’s warning signs of low financial strength include a low Altman Z-score of 1.02 and an interest coverage ratio that is less than Benjamin Graham’s safe threshold of five and underperforms more than 86% of global competitors.

Endeavour Mining

The fund purchased 907,754 shares of Endeavour Mining (TSX:EDV, Financial), giving the position 1.97% weight in the equity portfolio. Shares averaged 26.57 Canadian dollars ($21.85) during the first quarter; the stock is modestly undervalued based on Friday’s price-to-GF Value ratio of 0.79.

GuruFocus ranks the Canadian gold miner’s financial strength 5 out of 10: The company has a high Piotroski F-score of 8 despite a low Altman Z-score of 1.75 and interest coverage and debt ratios underperforming more than 65% of global competitors.

Teck Resources

The fund sold 1,210,678 shares of Teck Resources (TECK, Financial), slashing 58.19% of the position and 2.62% of the equity portfolio. Shares averaged $20.25 during the first quarter; the stock is modestly overvalued based on Friday’s price-to-GF Value ratio of 1.23.

GuruFocus ranks the Vancouver-based coal miner’s financial strength 4 out of 10 on several warning signs, which include a weak Altman Z-score of 0.66 and interest coverage and debt ratios underperforming more than 70% of global competitors.

Cameco

The fund sold 1,606,779 shares of Cameco (CCJ, Financial), chopping approximately half of the stake and 2.57% of the equity portfolio. Shares averaged $15.37 during the first quarter; the stock is significantly overvalued based on Friday’s price-to-GF Value ratio of 2.24.

GuruFocus ranks the Canada-based uranium producer’s financial strength 5 out of 10: Although the company has a strong Altman Z-score of 3.59, Cameco has a low Piotroski F-score of 1 and a debt-to-Ebitda ratio that underperforms more than 65% of global competitors.

OCI NV

The fund sold 1,005,564 shares of OCI (XAMS:OCI, Financial), axing 90.91% of the position and 2.29% of the equity portfolio. Shares averaged 18 euros ($21.78) during the first quarter; the stock is fairly valued based on Friday’s price-to-GF Value ratio of 0.97.

GuruFocus ranks the Dutch chemical company’s financial strength 3 out of 10 on several warning signs, which include a weak Altman Z-score of 0.43 and interest coverage and debt ratios underperforming more than 90% of global competitors.