Lone Pine Capital, the hedge fund founded by Steve Mandel (Trades, Portfolio) in 1997, revealed a stake in Marqeta Inc. (MQ, Financial) earlier this week.

The Greenwich, Connecticut-based firm picks stocks using a long-short strategy that focuses on bottom-up, fundamental analysis. Combining growth and value strategies, the firm, whose founder was a former “tiger cub” of Julian Robertson (Trades, Portfolio), is known to not hold positions for very long.

According to GuruFocus Real-Time Picks, a Premium feature, Mandel’s firm invested in 19.17 million shares of the newly public Oakland, California-based fintech company on June 11, allocating 2.15% of the equity portfolio to the stake. The stock traded for an average price of $31.50 per share on the day of the transaction.

Founded in 2009, Marqeta, which calls itself a “modern card issuing platform,” sells payment technology that is designed to detect potential fraud and ensure that money is properly routed. It operates an API platform that enables companies to create and issue physical and virtual debit, credit and prepaid cards to their staff to make point-of-sale purchases. It also offers a feature called “Just-in-Time Funding” that eliminates the need to maintain sufficient balances for each cardholder transaction as funds are automatically transferred into the account at the time of the payment.

To make money, the company takes a percentage cut of every transaction from customers as well as charges software fees. With operations in 35 countries, Marqeta’s notable customers include companies like Uber Technologies Inc. (UBER, Financial), Square Inc. (SQ, Financial), Instacart, Brex and DoorDash Inc. (DASH, Financial). It has issued more than 270 million cards through its platform over the past 10 years.

On June 8, the company announced the pricing of its initial public offering of 45.4 million shares of its Class A common stock for $27 per share, valuing it at around $15 billion. Underwriters were also granted the 30-day option of purchasing up to an additional 6.8 million shares at the same price. The offering closed on June 11, raising $1.23 billion.

Marqeta has a $16.59 billion market cap; its shares were trading around $31.58 on Wednesday with a price-sales ratio of 96.85. Since its IPO on June 9, the stock has risen 2.16%.

As more and more consumers shopped online and ordered food delivery as a result of the Covid-19 pandemic, the company disclosed in May that its annual revenue more than doubled in 2020 to $290.3 million.

With a 3.62% stake, Mandel’s firm is currently the only guru invested in Marqeta.

Portfolio composition and other tech investments

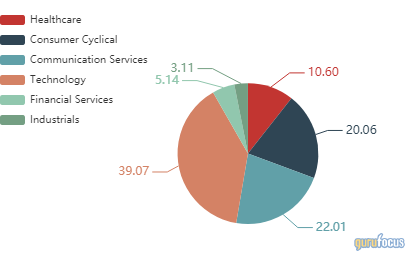

Nearly 40% of Lone Pine’s $27.53 billion equity portfolio, which was composed of 38 stocks as of March 31, was invested in the technology sector, followed by smaller holdings in the communication services, consumer cyclial and health care spaces.

Other tech stocks the firm had positions in as of the end of the first quarter included Shopify Inc. (SHOP, Financial), Microsoft Corp. (MSFT, Financial), Adobe Inc. (ADBE, Financial), Coupa Software Inc. (COUP, Financial) and ServiceNow Inc. (NOW, Financial).