As the Tokyo Olympics draw to a close and children begin returning to school following the summer season, four stocks with high profitability and could benefit from back-to-school shopping trends include Walmart Inc. (WMT, Financial), Target Corp. (TGT, Financial), Big Lots Inc. (BIG, Financial) and Newell Brands Inc. (NWL, Financial) according to the All-in-One Screener, a Premium feature of GuruFocus.

Coronavirus trends worsen as students start shopping for the return to school

According to CNBC, major U.K.-based consulting company Deloitte has estimated that back-to-school spending for students in grades K-12 this year would increase by approximately 16% from last year and approximately 17% from 2019. Despite the strong shopping trends, new surges in coronavirus cases and other related shipping and industry constraints may slow momentum in back-to-school spending.

On Sunday, the U.S. reported a seven-day average of 108,600 new Covid-19 cases, up 36% from a week prior according to Johns Hopkins University statistics.

Despite the concerns regarding the possible slowdown in back-to-school spending, investors can still find opportunities in companies specializing in back-to-school retail products. GuruFocus’ All-in-One Screener listed four such stocks with a profitability rank of at least 7.

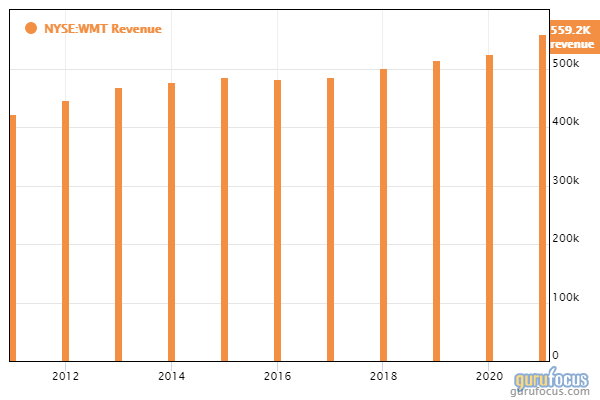

Walmart

Walmart (WMT, Financial) sells a wide range of general merchandise, grocery and clothing items. GuruFocus ranks the Bentonville, Arkansas-based company’s profitability 7 out of 10 on the back of profit margins and returns outperforming more than 68% of global competitors.

Gurus with large holdings in Walmart include Ken Fisher (Trades, Portfolio)’s Fisher Investments, Bill Gates (Trades, Portfolio)’ foundation trust and Ray Dalio (Trades, Portfolio)’s Bridgewater Associates.

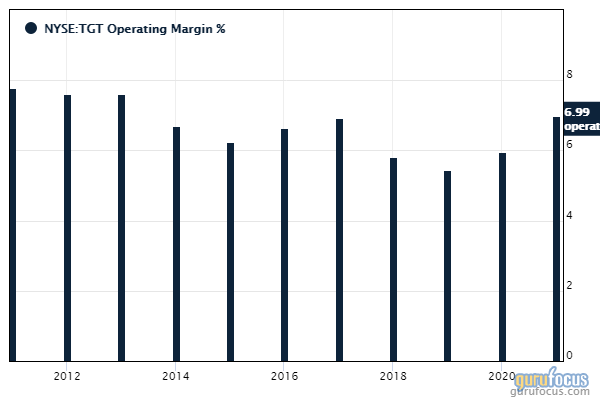

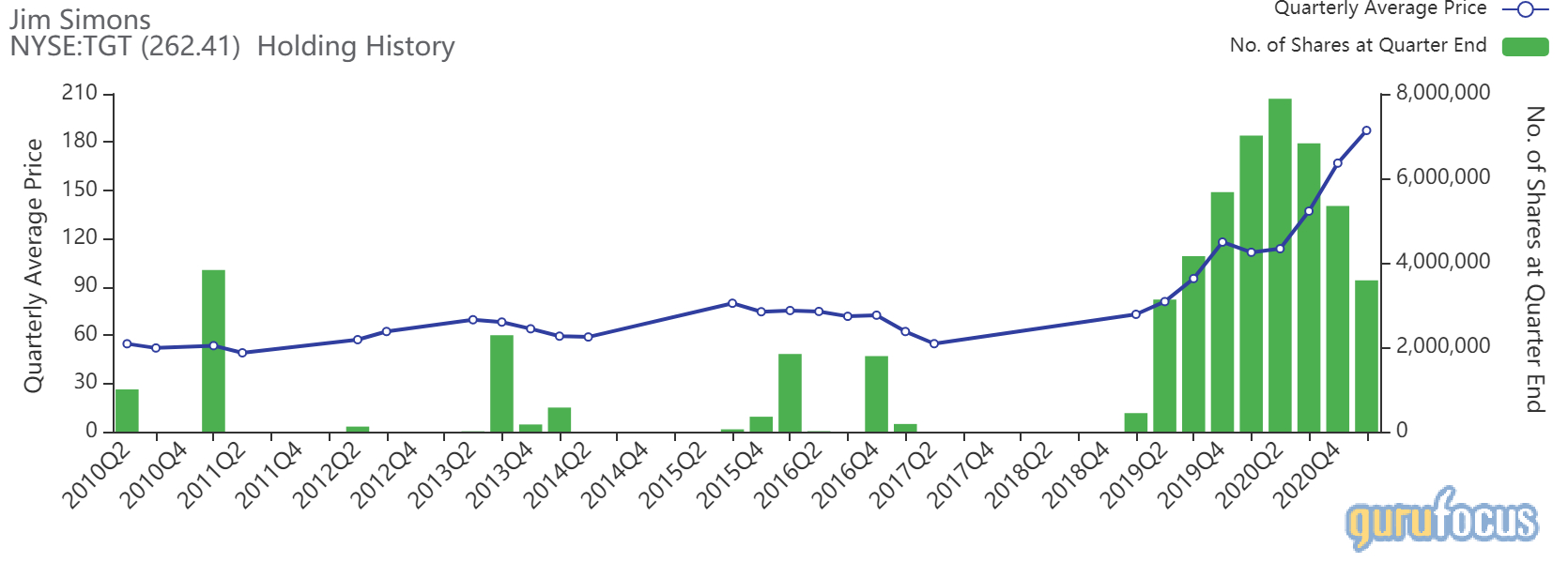

Target

Target (TGT, Financial) operates a network of stores that retail beauty and household products, groceries, clothing and apparel and other essential office products. GuruFocus ranks the Minneapolis-based company’s profitability 8 out of 10 on several positive investing signs, which include a three-star business predictability rank, a high Piotroski F-score of 9 and profit margins and returns that outperform more than 88% of global competitors.

Gurus with large holdings in Target include Jim Simons (Trades, Portfolio)’ Renaissance Technologies, Spiros Segalas (Trades, Portfolio) and Pioneer Investments (Trades, Portfolio).

Big Lots

Big Lots (BIG, Financial) operates a network of discount retail stores that offer grocery, home and office products. GuruFocus ranks the Columbus-based company’s profitability 8 out of 10 on several positive investing signs, which include a high Piotroski F-score of 8 and profit margins and returns that outperform more than 81% of global competitors.

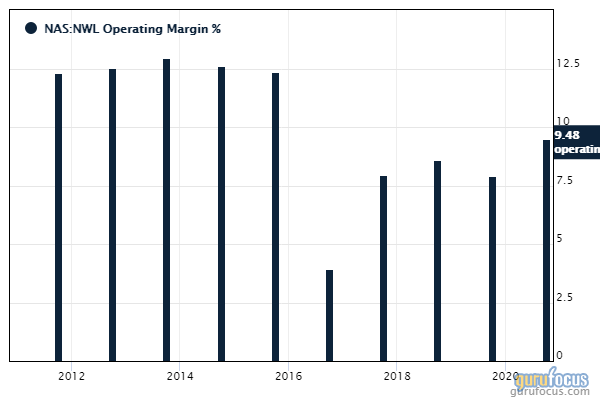

Newell Brands

Newell Brands (NWL, Financial) produces a wide range of school supply products through brands like Paper Mate, Sharpie, EXPO and Rubbermaid. GuruFocus ranks the Atlanta-based company’s profitability 7 out of 10 on several positive investing signs, which include a high Piotroski F-score of 7 and profit margins and returns that outperform more than 70% of global competitors.