Warren Buffett (Trades, Portfolio)’s multibillion-dollar conglomerate, Berkshire Hathaway Inc. (BRK.A, Financial)(BRK.B, Financial), disclosed its equity portfolio for the second quarter of 2021 on Monday.

Despite having around $144 billion to spend on stocks, the renowned guru and his two portfolio managers, Ted Weschler and Todd Combs, only revealed one new position, which was Organon & Co. (OGN, Financial). They also added to The Kroger Co. (KR, Financial) holding and made small boosts to both Aon PLC (AON, Financial) and RH (RH, Financial).

In contrast, the value investor was a fairly active seller, paring back eight positions and completely divesting of three stocks. In addition to completely eliminating the stake in Axalta Coating Systems Ltd. (AXTA, Financial), other major cuts Buffett and his team made were in Merck & Co. Inc. (MRK, Financial), slashing it by 48.79%, General Motors Co. (GM, Financial), curbing it by 10.45%, and Bristol-Myers Squibb Co. (BMY, Financial), trimming it by 15.27%.

Berkshire’s five largest holdings, accounting for over half of the equity portfolio, are Apple Inc. (AAPL, Financial), Bank of America Corp. (BAC, Financial), American Express Co. (AXP, Financial), The Coca-Cola Co. (KO, Financial) and Kraft Heinz Co. (KHC, Financial).

The guru’s $270.44 billion equity portfolio consisted of 46 stocks as of June 30. A majority of the portfolio was invested in technology stocks at 43.21%, while the financial services sector has a weight of 31.74% and the consumer defensive space represents 12.75%.

Organon

The guru disclosed a 1.55 million-share investment in Organon (OGN, Financial), dedicating 0.02% of the equity portfolio to the stake. The stock traded for an average price of $33 per share during the quarter.

The New Jersey-based pharmaceutical company, which was spun off of Merck in June, has an $8.7 billion market cap; its shares were trading around $34.33 on Monday with a price-earnings ratio of 21.78, a price-book ratio of 1.81 and a price-sales ratio of 5.77.

While the parent company received a $9 billion distribution in connection with the spinoff, Organon did not issue fractional shares of its common stock. Instead, shareholders of Merck common shares received cash in lieu of any fractional shares of Organon common stock that they would have otherwise been entitled to.

Additionally, the parent company declared a special dividend distribution of one-tenth of a share of Organon common stock for every Merck common share outstanding as of the close of business on May 17. As such, for every 10 shares of Merck held by an investor, they received one share of Organon.

Since being spun off, the stock has fallen around 2.6%.

Kroger

Increasing the stake by 21.01%, the value investor picked up 10.7 million shares of Kroger (KR, Financial). The trade had an impact of 0.14% on the equity portfolio. Shares traded for an average price of $37.58 each during the quarter.

Buffett now holds 61.8 million shares total, representing 0.81% of the equity portfolio. According to GuruFocus, he has gained an estimated 35.3% on the investment so far.

The grocery store chain, which is headquartered in Cincinnati, has a market cap of $32.47 billion; its shares were trading around $43.45 on Monday with a price-earnings ratio of 22.75, a price-book ratio of 3.55 and a price-sales ratio of 0.25.

According to the GF Value Line, the stock is modestly overvalued currently.

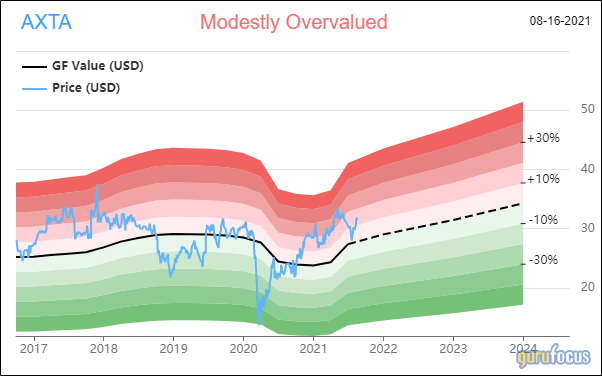

Axalta Coating Systems

With an impact of -0.15% on the equity portfolio, Buffett sold his 13.8 million remaining shares of Axalta (AXTA, Financial). The stock traded for an average per-share price of $31.61 during the quarter.

GuruFocus estimates the guru lost 6.96% on the investment, which was established in the second quarter of 2015.

The Philadelphia-based manufacturer of paint and coatings for industrial applications has a $7.23 billion market cap; its shares were trading around $31.42 on Monday with a price-earnings ratio of 25.13, a price-book ratio of 4.87and a price-sales ratio of 1.74.

Based on the GF Value Line, the stock appears to be modestly overvalued.

Merck

In his largest transaction of the quarter with an impact of -0.25% on the equity portfolio, the Berkshire leader sold 8.7 million shares of Merck (MRK, Financial). During the quarter, the stock traded for an average price of $74.29 per share.

Buffett now holds 9.15 million shares, accounting for 0.24% of the equity portfolio. According to GuruFocus, he has lost an estimated 6.21% on the investment so far.

The pharmaceutical company, which is headquartered in Kenilworth, New Jersey, has a market cap of $197.27 billion; its shares were trading around $77.93 on Monday with a price-earnings ratio of 35.59, a price-book ratio of 5.93 and a price-sales ratio of 4.07.

The GF Value Line suggests the stock is currently fairly valued.

General Motors

The Oracle of Omaha sold 7 million shares of General Motors (GM, Financial), impacting the equity portfolio by -0.15%. Shares traded for an average price of $58.75 each during the quarter.

Buffett now holds 60 million shares total, which make up 1.21% of the equity portfolio. GuruFocus estimates he has gained 61.28% on the investment over its lifetime.

The Detroit-based automaker has a $76.87 billion market cap; its shares were trading around $52.95 on Monday with a price-earnings ratio of 6.13, a price-book ratio of 1.55 and a price-sales ratio of 0.56.

According to the GF Value Line, the stock is significantly overvalued currently.

Bristol-Myers Squibb

Impacting the equity portfolio by -0.11%, Buffett sold 4.7 million shares of Bristol-Myers Squibb (BMY, Financial). During the quarter, the stock traded for an average per-share price of $65.15.

The investor now holds 26.3 million shares total, which represent 0.6% of the equity portfolio. GuruFocus data shows he has gained around 12.31% on the investment, which was established in the third quarter of 2020.

The pharmaceutical company headquartered in New York has a market cap of $152.61 billion; its shares were trading around $68.68 on Monday with a price-book ratio of 4.14 and a price-sales ratio of 3.5.

Based on the GF Value Line, the stock appears to be fairly valued currently.

View all of Buffett’s trades here.