Coatue Management recently disclosed its 13F portfolio updates for the second quarter of 2021, which ended on June 30.

Founded in 1999 and headquartered in New York, Coatue Management is an employee-owned private hedge fund sponsor. It launches and manages various hedge funds for clients and is perhaps best known for its tech-focused hedge fund. The firm mainly invests in U.S. and non-U.S. publicly traded equity securities, but it also has short positions and investments in private equity and hedging markets. Chief Investment Officer Philippe Laffont (Trades, Portfolio), who founded the firm after leaving Tiger Management, takes a top-down approach to stock picking and focuses on the information technology sector.

Based on its investing criteria, the firm’s top buys for the quarter (according to its latest 13F filing) were Moderna Inc. (MRNA, Financial), UiPath Inc. (PATH, Financial), Endeavor Group Holdings Inc. (EDR, Financial) and Amazon.com Inc. (AMZN, Financial).

Moderna

The firm upped its stake in Moderna Inc. (MRNA, Financial) by 4,883,219 shares, or 388.27%, for a total holding of 6,140,904 shares. The trade had a 4.49% impact on the equity portfolio. During the quarter, shares traded for an average price of $177.38.

Moderna is a biotechnology and pharmaceutical company based in Cambridge, Massachusetts. Its research focus is developing vaccines based on messenger RNA. Moderna's vaccine platform inserts synthetic nucleoside-modified messenger RNA into human cells using a coating of lipid nanoparticles.

On Aug. 23, shares of Moderna traded around $409.20 for a market cap of $165.19 billion. According to the Peter Lynch chart, the stock is trading above the value of its earnings but below its median historical valuation.

The company has a financial strength rating of 7 out of 10 and a profitability rating of 1 out of 10. The interest coverage ratio of 266.2 and Altman Z-Score of 11.34 show a fortress-like balance sheet. In the pre-revenue stage, the company’s margins were deep in negative territory, but recent quarters have seen the operating margin rise to 70.33% and the net margin rise to 63.85%.

UiPath

The firm reported a stake worth 11,332,361 shares in UiPath (PATH, Financial), giving the position a 3.02% weight in the equity portfolio. Shares traded for an average price of $73.46 during the quarter.

UiPath is a New York-based software company that provides a leading robotic process automation platform. Its offerings aim to streamline processes, uncover efficiencies, provide insights and make the path to digital transformation fast and cost-effective.

On Aug. 23, shares of UiPath traded around $60.37 for a market cap of $30.66 billion. Since going public at the end of April, the stock is down 12%.

The company has a financial strength rating of 6 out of 10. After a successful public offering, the cash-debt ratio is healthy at 97.77. The company does not yet have enough reported data to calculate its profitability rating, but the operating margin of -126.73% and net margin of -128.7% indicate the company is not yet profitable.

Endeavor Group Holdings

The firm reported a holding of 24,999,999 shares in Endeavor Group Holdings (EDR, Financial), giving the position a 2.71% portfolio weight. During the quarter, shares traded for an average price of $28.83.

Formerly known as William Morris Endeavor Entertainment, Endeavor is an American holding company for talent and media agencies. It represents artists in movies, television, music, theater, digital media and publishing. It also owns the Ultimate Fighting Championship and Miss Universe.

On Aug. 23, shares of Endeavor traded around $24.18 for a market cap of $6.36 billion. Since making its public debut at the end of April, the stock is down 4%.

The company has a financial strength rating of 3 out of 10 and a profitability rating of 1 out of 10. The cash-debt ratio of 0.15 and Altman Z-Score of 0.52 indicate the company may face a risk of bankruptcy in the next couple of years. The three-year revenue per share growth rate is 4.8%, while the three-year Ebitda per share growth rate is -6.4%.

Amazon.com

The firm added 168,944 shares, or 63.64%, to its investment in Amazon.com (AMZN, Financial) for a total holding of 434,399 shares. The trade had a 2.28% impact on the equity portfolio. Shares traded for an average price of $3,316.50 during the quarter.

Amazon is a multinational e-commerce giant based in Seattle. Its vast network allows it to deliver many products to customers within one or two days, giving it tremendous pricing power. The company also has cloud computing, digital streaming, artificial intelligence and other tech operations.

On Aug. 23, shares of Amazon traded around $3,265.87 for a market cap of $1.65 trillion. According to the GF Value chart, the stock is fairly valued.

The company has a financial strength rating of 6 out of 10 and a profitability rating of 8 out of 10. The Piotroski F-Score of 8 out of 9 and Altman Z-Score of 5.86 show a very healthy financial situation. The company has a three-year revenue per share growth rate of 28% and a three-year Ebitda per share growth rate of 45.2%.

Portfolio overview

As of the quarter’s end, the firm held shares of 76 common stocks valued at a total of $25.52 billion. The turnover for the period was 29%.

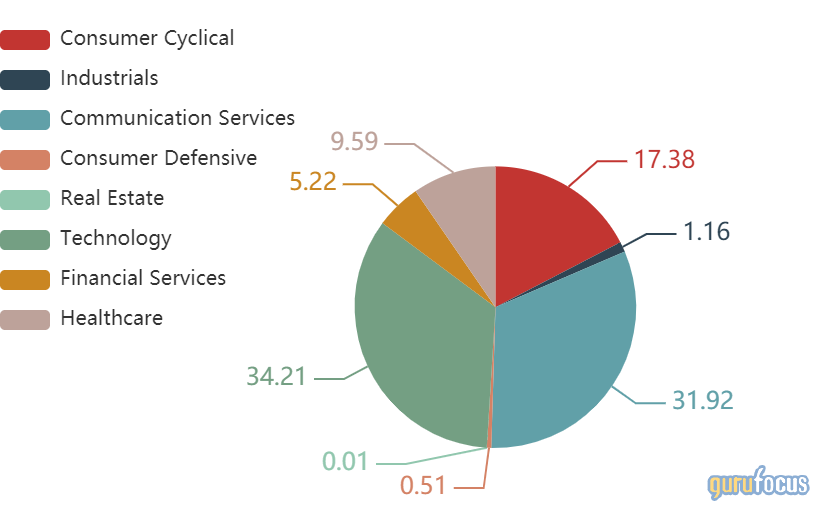

The top holdings were DoorDash Inc. (DASH, Financial) with 6.75% of the equity portfolio, Amazon with 5.86% and Moderna with 5.65%. In terms of sector weighting, the firm was most invested in technology, communication services and consumer cyclical.