Should investors holding shares of Vertex Pharmaceuticals Incorporated (VRTX, Financial) follow the axiom, “Good things come to those who wait?”

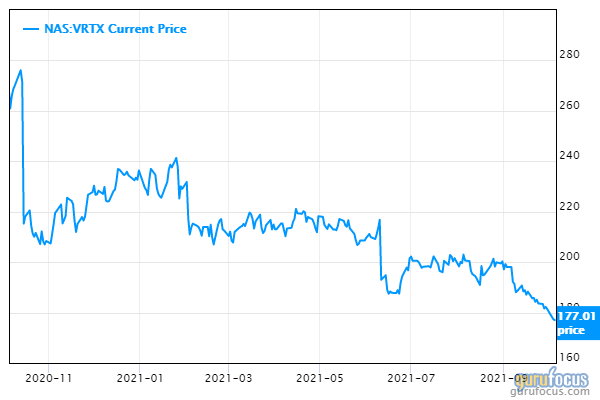

Management at the Boston-based biotech thinks they should, urging stock owners to have patience. But that may be asking a lot considering the company has seen its shares plummet about 36% in the past year to near $178 and faces formidable challenges as it seeks to become a full-fledged pharmaceutical company.

You can count Brian Abrahams of RBC Capital Markets among those analysts questioning whether Vertex will ever achieve its goal, according to BioPharma Dive. He thinks that if the company can’t stem the bleeding, it should consider a sale or split in two.

"They haven't had success of late to help shift the narrative," Abrahams said in an interview, adding that recent setbacks may be focusing attention away from the company's strong cystic fibrosis drug business.

Caption: Vertex shares have suffered a steep decline in the past year.

Vertex has a lot of company when it comes to being unable to form “multiple, company-sustaining drug franchises.” Among those biotechs who failed at this task were Alexion and Celgene, both of which were acquired after investors grew tired of waiting for them to make the jump to Big Pharma status.

"They're a victim of their own success," said Paul Matteis, a biotech analyst at Stifel said of Vertex. He pointed out that a lot of big companies in biotech get to a point where they build an incredible company on one drug and the investment question becomes, can you do it again?"

Vertex suffered a setback about three months ago when a drug it was developing for a rare genetic disease worked but fell short of the bar the company had set for it, the same thing that happened to an earlier medication aimed at the same condition. The company says not to fret; it will make a treatment that meets its standards, imploring investors and analysts to stay the course.

"This is the time to double down, not walk away," CEO Reshma Kewalramani said in an interview with BioPharma Dive. "This is when it counts the most."

Today, Vertex is a powerhouse in cystic fibrosis drugs, but some followers think that business is already fairly valued and wonder what comes next. Moreover, the company’s franchise in the field might come under pressure from AbbVie Inc.(ABBV, Financial), which has a cystic fibrosis drug in testing with a data readout scheduled for next year.

SVB Leerink's Geoffrey Porges isn’t enthusiastic about the company’s plans. He thinks not much is going to change unless Vertex makes a major deal or drops down to a price where it becomes a buyout candidate.

Investors who believe the company’s strategy will work may want to hold onto their shares in the hope Vertex can return to its glory days. If it doesn’t, maybe the company will get taken out at a premium that enables shareholders to recover at least some of their original investment.