In addition to the headwinds caused by the ongoing Covid-19 pandemic, the U.K. is being faced with an onslaught of other economic problems that have formed in the aftermath of Brexit, including labor shortages, skyrocketing natural gas prices and global supply chain constraints.

While concerns regarding availability of goods and increasing prices persist heading into winter, investors may still find value opportunities among British consumer defensive companies with 10-year revenue per share growth rates of at least 6% and that are undervalued or fairly valued according to the GF Value Line, which is based off historical ratios, past performance and future earnings projections.

The All-in-One Screener, a Premium GuruFocus feature, found companies that met these criteria as of Oct. 19 included Ocado Group PLC (LSE:OCDO, Financial), Bunzl PLC (LSE:BNZL, Financial), Cranswick PLC (LSE:CWK, Financial), Hilton Food Group PLC (LSE:HFG, Financial) and MP Evans Group PLC (LSE:MPE, Financial).

Ocado Group

A provider of online grocery shopping services and logistics solutions, Ocado Group (LSE:OCDO, Financial) has a market cap of 13.49 billion pounds ($18.61 billion); its shares closed at 17.96 pounds on Monday with a price-book ratio of 7.9 and a price-sales ratio of 5.16.

Based on a GF Value of 17.93 pounds and a price-to-GF Value ratio of 1, the stock appears to be fairly valued currently.

GuruFocus rated Ocado’s financial strength 5 out of 10. As a result of issuing approximately 910.5 million pounds in new long-term debt over the past three years, the company has weak interest coverage. The robust Altman Z-Score of 5, however, indicates it is in good standing even though assets are building up at a faster rate than revenue is growing.

The company’s profitability scored a 4 out of 10 rating on the back of negative margins and returns on equity, assets and capital that underperform a majority of competitors. Ocado also has a moderate Piotroski F-Score of 5 out of 9, indicating conditions are stable for a typical company, as well as a predictability rank of 2.5 out of five stars. According to GuruFocus, companies with this rank return an average of 7.3% annually over a 10-year period.

The iShares MSCI ACWI ex U.S. ETF (Trades, Portfolio) hold 0.01% of the company’s outstanding shares.

Bunzl

London-based Bunzl (LSE:BNZL, Financial), which is a multinational distribution and outsourcing company, has a market cap of 8.56 billion pounds; its shares closed at 25.38 pounds on Monday with a price-earnings ratio of 18.81, a price-book ratio of 4.48 and a price-sales ratio of 0.84.

According to a GF Value of 24.31 pounds and a price-to-GF Value ratio of 1.04, the stock is fairly valued currently.

Bunzl’s financial strength was rated 5 out of 10 by GuruFocus. Although the company has issued new long-term debt over the past several years, it is at a manageable level due to adequate interest coverage. The Altman Z-Score of 3.38 indicates the company is in good standing even though assets are building up at a faster rate than revenue is growing. The return on invested capital also overshadows the weighted average cost of capital, meaning value is being created as the company grows.

The company’s profitability fared even better, scoring an 8 out of 10 rating on the back of operating margin expansion, strong returns that top a majority of industry peers and a high Piotroski F-Score of 7, suggesting business conditions are healthy. Due to consistent earnings and revenue growth, Bunzl also has a four-star predictability rank. GuruFocus says companies with this rank return, on average, 9.8% annually.

Of the gurus invested in Bunzl, David Herro (Trades, Portfolio) has the largest stake with 0.95% of its outstanding shares. Bernard Horn (Trades, Portfolio) and the iShares MSCI ACWI ex. U.S. ETF also have positions in the stock.

Cranswick

Consumer packaged goods company Cranswick (LSE:CWK, Financial), which supplies fresh pork, sausages, cooked meats, pastry and sandwich products, has a market cap of 1.88 billion pounds; its shares closed at 35.46 pounds on Monday with a price-earnings ratio of 20.2, a price-book ratio of 2.73 and a price-sales ratio of 0.98.

Trading with a GF Value of 40.79 pounds and a price-to-GF Value ratio of 0.87, the stock appears to be modestly undervalued currently.

Cranswick’s financial strength and profitability were both rated 7 out of 10 by GuruFocus. Despite issuing new long-term debt over the past several years, it is at a manageable level due to a comfortable level of interest coverage. The Altman Z-Score of 6.23 indicates the company is in good standing even though assets are building up at a faster rate than revenue is growing. The ROIC also eclipses the WACC, suggesting good value creation is occurring.

The company also has strong margins and returns that outperform a majority of competitors as well as a moderate Piotroski F-Score of 4. As a result of steady earnings and revenue growth, Cranswick also has a 3.5-star predictability rank. GuruFocus data shows companies with this rank return an average of 9.3% annually.

No gurus are currently invested in the stock.

Hilton Food Group

Hilton Food Group (LSE:HFG, Financial), a food packaging business, has a market cap of 963.21 million pounds; its shares closed at 11.70 pounds on Monday with a price-earnings ratio of 25.94, a price-book ratio of 4.54 and a price-sales ratio of 0.3.

Supported by a GF Value of 19.65 pounds and a price-to-GF Value ratio of 0.60, the stock is significantly undervalued.

GuruFocus rated Hilton Food’s financial strength 5 out of 10. Despite the company issuing new long-term debt over the past several years, it is at a manageable level due to sufficient interest coverage. The Altman Z-Score of 3.81 also indicates it is in good standing even though assets are building up at a faster rate than revenue is growing.

The company’s profitability scored a 7 out of 10 rating. Although the operating margin has declined, Hilton Food is supported by strong returns that outperform a majority of industry peers as well as a moderate Piotroski F-Score of 4. Consistent earnings and revenue growth also contributed to a 1.5-star predictability rank. According to GuruFocus, companies with this rank return an average of less than 6% per year.

No gurus currently have positions in the stock.

MP Evans Group

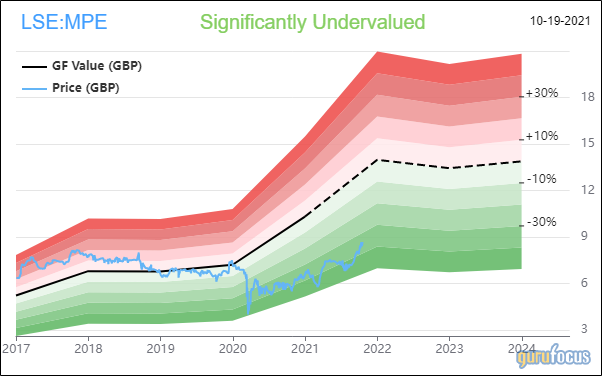

A producer of Indonesian crude palm oil, MP Evans Group (LSE:MPE, Financial) has a market cap of 474.76 million pounds; its shares closed at 8.68 pounds on Monday with a price-earnings ratio of 14.44, a price-book ratio of 1.74 and a price-sales ratio of 3.55.

With a GF Value of 13.25 pounds and a price-to-GF Value ratio of 0.66, the stock is significantly undervalued currently.

MP Evans’ financial strength was rated 6 out of 10 by GuruFocus. Although the company has issued new long-term debt over the past several years, it is at a manageable level as a result of adequate interest coverage. The Altman Z-Score of 3.64 indicates the company is in good standing. The WACC, however, surpasses the ROIC, indicating it struggles to create value.

The company’s profitability scored a 7 out of 10 rating. Although the operating margin is in decline, it is outperforming versus competitors. MP Evans’ returns, however, are underperforming. It also has a high Piotroski F-Score of 8, but the one-star predictability rank is on watch as a result of recording a decline in revenue per share over the past 12 months. GuruFocus data shows companies with this rank return an average of 1.1% annually.

There are currently no gurus invested in the stock.