According to the Insider Cluster Buys screen, a Premium feature of GuruFocus, five stocks with high insider buys during October include Life Time Group Holdings Inc. (LTH, Financial), Clearwater Analytics Holdings Inc. (CWAN, Financial), Catalyst Bancorp Inc. (CLST, Financial), Simon Property Group Inc. (SPG, Financial) and Malvern Bancorp Inc. (MLVF, Financial).

Legendary investor Peter Lynch said that while company directors may sell shares for several reasons, they buy shares only when they believe the stock is set to appreciate. GuruFocus’ research further adds that stocks with multiple buys over the past few months signal potential gains are ahead.

As such, investors can find opportunities in stocks that had multiple directors and chief officers purchasing shares over the past month. GuruFocus’ Insider Cluster Buys tracks both the number of insider buys and the number of unique insider buys. While the former tracks the total number of buy transactions over the past month, the latter counts each insider as one regardless of the number of transactions.

Life Time Group Holdings

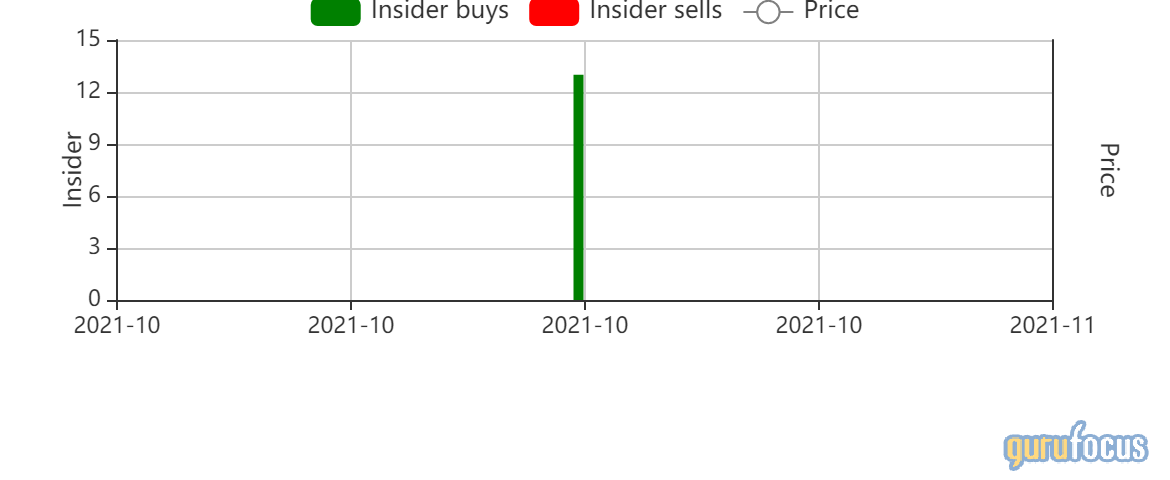

Twelve insiders purchased shares of Life Time Group Holdings (LTH, Financial) during the past month. The total number of shares purchased was 21,687,815.

The Chanhassen, Minnesota-based gym resort company staged on Oct. 12 its initial public holding at $18 per share. According to GuruFocus, the company’s cash-to-debt ratio of 0.03 underperforms more than 90% of global competitors, suggesting low financial strength.

Clearwater Analytics

Ten insiders purchased shares of Clearwater Analytics (CWAN, Financial) during the past month. The total number of shares purchased was 16,907.

The Boise, Idaho-based software-as-a-service company provides investment accounting, performance measurement and risk analysis solutions. The company priced its initial public offering on Sept. 23 at $18 per share.

According to GuruFocus, Clearwater’s cash-to-debt ratio of 0.1 underperforms 94% of global competitors.

Catalyst Bancorp

Ten insiders purchased shares of Catalyst Bancorp (CLST, Financial) during the past month. The total number of shares purchased was 189,000.

The Opelousas, Louisiana-based bank priced its initial public offering on Oct. 13 at $10 per share. According to GuruFocus, the company has no long-term debt and an equity-to-asset ratio that outperforms more than 95% of global competitors.

Simon Property Group

Eight insiders purchased shares of Simon Property Group (SPG, Financial) during the past month. The total number of shares purchased was 2,105.

GuruFocus ranks the Indianapolis-based real estate investment trust’s financial strength 3 out of 10 on several warning signs, which include a weak Altman Z-score of 1.03 and an interest coverage ratio that underperforms more than 62% of global competitors.

Gurus with holdings in Simon Property Group include the Parnassus Endeavor Fund (Trades, Portfolio), the Smead Value Fund (Trades, Portfolio) and Pioneer Investments.

Malvern Bancorp

Seven insiders purchased shares of Malvern Bancorp (MLVF, Financial) during the past month. The total number of shares purchased was 1,553.

GuruFocus ranks the Paoli, Pennsylvania-based bank’s financial strength 3 out of 10 on the back of cash-to-debt and debt-to-equity ratios underperforming more than 70% of global competitors despite the company’s equity-to-asset ratio outperforming more than 81% of global banks.