When screening the market for value opportunities, investors may want to consider stocks that represent companies with high profitability and robust financial conditions. These qualities are represented by GuruFocus profitability and financial strength ratings of at least 6 out of 10.

The companies below meet the above criteria. Furthermore, sell-side analysts on Wall Street have recommended positive ratings for them.

Entegris

The first stock that makes the cut is Entegris (ENTG, Financial). Based in Billerica, Massachusetts, the company is a manufacturer and supplier of semiconductor equipment and materials. Its customers are located across North America, Europe, Asia and Southeast Asia, including Taiwan.

GuruFocus rated its financial strength 6 out of 10, driven by an Altman Z-Score of 10.59, which indicates the company is not in danger of bankruptcy.

GuruFocus rated its profitability 8 out of 10, driven by a three-year earnings per share without non-recurring items growth rate versus of 54.1% versus the industry median of 10.6%.

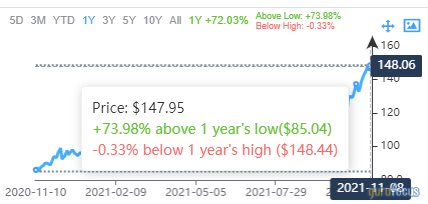

The share price ($147.95 as of Nov. 8) has risen by 72% over the past year for a market capitalization of $20.05 billion, a price-earnings ratio of 53.61 and a price-book ratio of 12.45.

The price-sales ratio is 9.26 and the 52-week range is $84.73 to $149.47.

On Wall Street, the stock has a median recommendation rating of overweight with an average target price of $145.91 per share.

Wheaton Precious Metals Corp

The second stock that qualifies is Wheaton Precious Metals Corp (WPM, Financial), a Canadian gold and silver streaming company.

GuruFocus rated its financial strength 9 out of 10, driven by a Piotroski F-Score of 9 out of 9 and an Altman Z-Score of 259.52, which indicates that the company has a fortress-like balance sheet.

GuruFocus rated its profitability 7 out of 10, driven by a three-year earnings per share without non-recurring items growth rate of 105.7% versus the industry median of 16.1%.

The share price ($41.33 as of Nov. 8) has fallen by 6.4% over the past year for a market capitalization of $18.60 billion, a price-earnings ratio of 28.76 and a price-book ratio of 3.04.

The price-sales ratio is 15.27 and the 52-week range is $34.85 to $49.10.

On Wall Street, the stock has a median recommendation rating of buy and an average target price of approximately $55.97 per share.

HEICO Corporation

The third stock that qualifies is HEICO Corporation (HEI, Financial), a Hollywood, Florida-based manufacturer of aerospace, defense and electronic products.

GuruFocus rated its financial strength 7 out of 10, driven by an Altman Z-Score of 11.04, which suggests that the company is in safe zones and is not at risk of bankruptcy.

The company's profitability rating scored 8 out of 10, driven by a return on capital ratio of 58.27% versus the industry median of 8.43%.

The share price ($147.37 as of Nov. 8) has risen by 13.56% over the past year for a market capitalization of $18.93 billion, a price-earnings ratio of 66.41 and a price-book ratio of 8.35.

The price-sales ratio is 10.42 and the 52-week range is $115.57 to $148.95.

On Wall Street the stock has a median recommendation rating of hold and an average target price of $143.58 per share.