When I was younger, it was my dream to own a casino. Gambling and insurance companies seemed to be the two mathematically sure ways of making money. I’ve since learned that it isn’t quite as simple as that, but with a keen interest in statistics and risk, I feel that these are two sectors are among those that I can fairly well understand.

In 2000, a company called Betfair was founded. It was started by a former JP Morgan (JPM, Financial) trader and a professional gambler. Essentially, it is a betting exchange, so it matches bettors and takes a cut of the winner’s winnings. This seemed like an even more genius business. Humans, or at least a large proportion of them, by nature are gamblers, so setting up a platform to allow people to bet against each other seems like a brilliant idea. Betfair wouldn’t need to rely on the house edge, but rather it just needed to maintain a venue for people to bet and it would take a cut of all the winnings. There would be no fat tails in the distributions of betting probabilities.

Betfair merged with traditional bookmaker Paddy Power in 2016 and was later renamed Flutter Entertainment plc (LSE:FLTR, Financial). Sports fans in Europe are familiar with Paddy Power thanks to its constant stream of marketing stunts and distinctive advertising.

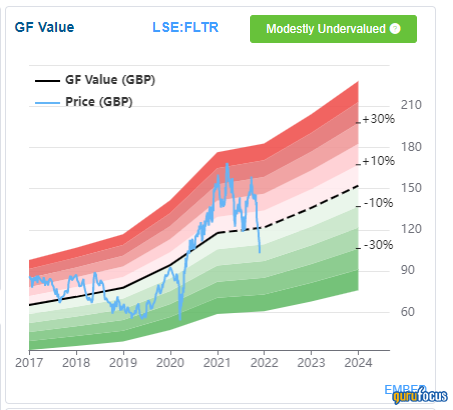

After gaining market dominance in the U.K., the next big market for Flutter is the United States, and the company is making an aggressive attempt to become dominant in this market as well. Despite owning 95% of FanDuel, which is the market leader in the U.S. online sports betting market, Flutter trades at a discount to U.S. gambling giants DraftKings (DKNG, Financial) and Caesars Entertainment (CZR, Financial). That may be because Flutter’s international markets, which are more mature and offer less growth, account for about 40% its value, according to U.K. broker Peel Hunt. Currently, the GuruFocus Value chart rates Flutter's stock as modestly undervalued.

With Flutter’s strong track record in Europe, I expect the group to be successful in the States as well. The 2018 liberalization of the U.S. sports gambling market gives a once-mature industry an opportunity for vast growth. With seven more states allowing sports betting next year, nearly half of all Americans will be living in a state where sports betting is legal by the end of 2022.

This growth is showing at FanDuel. Revenue was up 85% during Q3, accounting for about 20% of Flutter’s total. However, the U.S. betting market land grab does require investment, so marketing and administrative costs required to increase market share means FanDuel is unlikely to be profitable until 2023.

The land grab is competitive, and this is a risk. Flutter’s rivals have also been aggressive in making offers and bonuses to win new customers. However, the growth potential is there. New U.S. average monthly players were up 17% in Q3.

Looking at Q1 and Q2, FanDuel’s customer acquisition cost was $291 per customer. Originally, FanDuel’s payback period on these investments was estimated to be about 12 months, but increased competition in the market means that these customer acquisition costs increased slightly during Q3, and the payback for newer customers is taking longer (betweeen 12 and 18 months).

Flutter is focused on the U.S. currently because European markets are potentially facing more regulation, which means these markets are likely to stay quite steady or even potentially decline a little. For example, in the U.K., a government white paper on gambling safety is likely to hinder growth in the next few years. That may be one of the reasons behind the discount.

But Flutter has suggested it might list part of the business in the U.S., which would likely attract a higher valuation than the U.K. listing. This in turn would likely drag up the London listing’s valuation as the valuation gap gets arbitraged away.

This idea also appeals to my statistical interest, so it’s something I’ll be watching closely, and the stock remains firmly on my watchlist. Investors in DraftKings, Caesars Entertainment and other casinos and gambling stocks may want to put this stock on their watchlists too.