Introduction

Since my last discussion on GrafTech International Ltd. (EAF, Financial), a few (but meaningful) developments lead me to realize that, two years after I first wrote my investment thesis, this can be the time when all the pieces of the puzzle come together in the real world.

While the long-term agreements currently in place with its customers have not yet been renewed, the market is about to provide GrafTech with a unique opportunity.

The increase in “spot” market selling

Thanks to the LTA contracts, GrafTech's spot prices sales volume has often represented a minimal contribution to revenue, both in terms of price (which was significantly lower than LTA ones) and volume (often kept intentionally low in order to preserve margins).

But this year something changed: spot prices are now significantly higher than they were at the beginning of 2021 (in some cases even 50% higher), so the company is more eager to allocate part of its production to spot customers.

Let's compare last quarter sales volumes with the ones from last year. First, total sales volumes related to the third quarter of 2021 were 43,000 metric tonnes, up from 33,000 metric tonnes recorded in the third quarter of last year. That's an increase of around 30%.

More interestingly, the proportion between LTA and non-LTA (spot) volumes has dramatically changed. Indeed, the ratio changed from 82/18 for the third quarter of 2020 to 65/35 for the past quarter. In percentage terms, spot price volumes have practically doubled.

Is the spot price of graphite electrodes really so interesting to justify such a significant shift? Not at first glance, as the average approximate price for the non-LTA volumes was $4,600 per metric tonne in the last quarter compared to $5,700 per tonne last year.

Additionally, we would have expected much higher non-LTA realized prices, as suggested by the most recent transactions in the market. Indeed, non-LTA prices increased only 12% sequentially from the second quarter of 2021. For the final quarter of this year, the company also expects non-LTA prices to only be up 7% to 9% from the third quarter.

Why is GrafTech not fully enjoying the recent rise in market price?

In order to understand it, let's turn to the latest earnings call and specifically to what CEO David Rintoul said when asked exactly the same question:

"What we're trying to stress and provide some additional transparency for everyone, is that, that's why we've been questioned about, why is it your percentage increase in pricing larger than what you're reporting," he sad. "And the rationale and the reason is that three quarters of what we're talking about in the non-LTA space was deals that were negotiated either last year or early this year and both for the third and fourth quarter."

So only 25% of non-LTA sales volumes are truly spot prices that were negotiated during the the most recent quarter. The rest falls somewhere between an LTA and a spot price: deals that have been closed from six to nine months before.

Referring to the contract mix, Rintoul also said, "Our order book for next year has a mixture of some annual deals, some semi-annual deals, some that are based on a quarterly one or two that are based upon a formula."

This means that the bulk of current price increases will be reflected only starting from the first quarter of next year (but in a significant way).

While this can sound like bad news, the fact the company managed to prolong the duration of contracts (outside of the already existing LTA set) and personalize them for each customer's needs, is a clear positive as this provides more revenue visibility and strengthens customer relationships.

Finally, referring to the renewal of the LTA contracts, Rintoul does not expect to have much conversation with existing LTA partners until the third quarter of next year, which is what usually happens with other hedging contracts (e.g. gas, electricity). Arguably, there's a good probability for them to be able to lock in prices even higher than today, also if probably not so high like the ones they realized with the 2017-18 deals.

Needle coke vertical integration

Another significant strength of GrafTech is its vertical market integration in the most important input raw material needed to produce graphite electrodes: needle coke. The company is the only one on the market having a needle coke producing arm (named Seadrift), so it can produce most of its needed input independently.

This has always been an advantage for GrafTech, but it only makes a real difference when needle coke market prices are significantly higher than its production costs. Experts have been speculating in the past that, as needle coke is a critical component for electric vehicle batteries, its price would come under pressure as both industries would have to share the already scarce needle coke production.

This is exactly what is happening right now, and, in Rintoul's opinion, EV needs are ramping up even faster than projected. Needle coke prices are indeed already up from a range of $1,300 to $1,800 per metric tonne to a range of $1,700 to $2,300 and are expected to continue to rise over the coming quarters.

This is, in turn, clearly putting pressure on graphite electrode prices as competitors cannot afford to erode their precious margins (or, even worse, produce at loss) and, as a consequence, GrafTech can easily keep margins intact (or even improve them) while at the same time enjoying graphite price increases. That's when a competitive advantage can really make a difference.

Brookfield, buybacks and debt

Switching to risk management, we can identify three positive aspects:

The reduced ownership of Brookfield, leading to more independent management choices.

The recent reinstatement of stock repurchases.

Easily manageable debt reduction.

Since the first quarter of the year, Brookfield Asset Management (BAM, Financial) has reduced its ownership from 48% to around 24% of the company's outstanding shares.

Even if the company had to pay Brookfield high change in control charges (due to their ownership moving below 30% of total shares outstanding), this is a positive sign as GrafTech's management will have their hands free for the next capital allocation moves.

This is partially already happening: indeed the company reinstated its buyback activities, which had been put on hold. In the third quarter, the company bought back 4.3 million shares and approved a $150 million stock repurchase program.

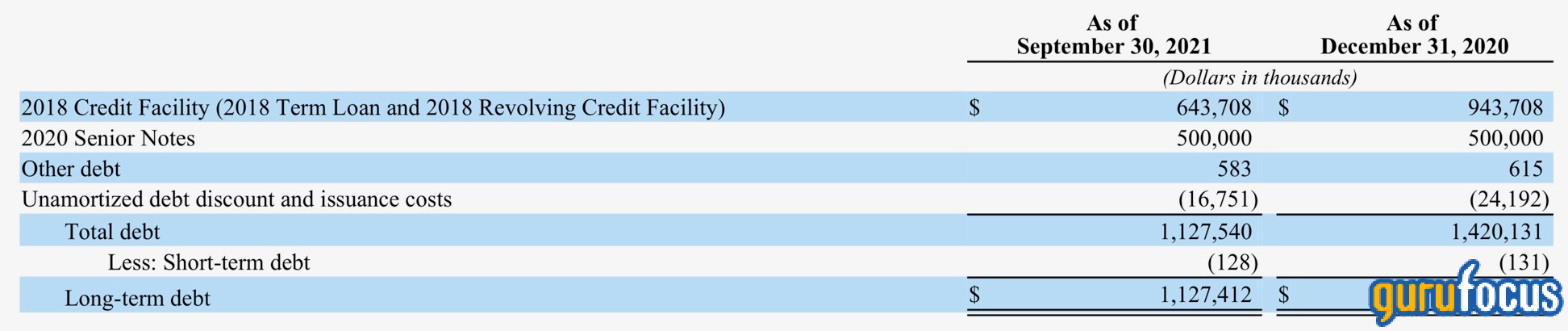

Lastly, debt reduction plans are progressing as expected: the company has reduced long-term debt by $300 million since the beginning of the year, with a $100 million reduction in the third quarter.

Long-term debt is currently set at $1.13 billion and the next principal repayment is not due before February 2023 (this is related to the 2018 revolving credit facility, which is part of the $643 million showed in the first row, while the 2020 senior notes are due in 2028). So if the company keeps paying $100 million per quarter, there will be absolutely no issues paying down the debt.

Conclusion

Due to the market situation and to the uniqueness of GrafTech's capabilities and competitive advantages, what is going to unfold in the next two to three quarters could very well be the perfect storm (in positive terms) for the company.

Both graphite electrodes and needle coke prices are on the rise, resulting in growing revenue and competitors' margins weakening. Customer pricing contracts are much more variable in terms of volume and timing now and the company is locking historically high prices, which will be reflected in the next quarterly results.

Brookfield reducing its ownership is a plus as management will be able to be more independent when allocating capital. Their increased confidence is already reflected in the renewed stock repurchase policies, while debt-related risks appear to be easily manageable.

The patient investor who is willing to wait for the right time will likely be able to harvest the fruits of GrafTech's improved prospects.