Real estate investment trusts (REITs) can be an excellent source of income for those looking for yield in this ultra low-rate environment. REITs can make great income investments as they are required to pay out the vast majority of net earnings in the form of dividends.

In this article, we will examine two REITs that currently offer at least three times the average yield of 1.3% for the S&P 500 Index.

Medical Properties

Medical Properties Trust (MPW, Financial) is the only pure-play hospital REIT in the market today. Medical Properties has a market capitalization of just over $13 billion and generated revenue of $1.25 billion in 2020.

Medical Properties has a very diversified portfolio, which provides for some protection in case of difficulty in a certain area. The portfolio includes more than 400 properties leased to more than 30 operators. The trust benefits from geographical diversification as well, with operations in 29 U.S. states. Outside of its U.S. holdings, Medical Properties has facilities in several European countries, such as Germany, Italy and the U.K., in addition to Australia.

Funds from operation have a compound annual growth rate (CAGR) of more than 9% over the last decade even as the share count has increased more than five times from 2011 levels.

With a current annualized dividend of $1.12, Medical Properties has a yield of just over 5%. The dividend was raised 3.7% for the April 8, 2021 payment date, which is nearly in-line with the 10-year CAGR of 3.8%. The trust has raised its dividend for nine consecutive years.

Wall Street analysts expect that Medical Properties will generate $1.75 of funds from operation for the year, implying a projected payout ratio of just 64%. This is below the 10-year average payout ratio of 79%.

With the stock trading at $22.27, the trust is trading at a forward price-to-funds-from-operation ratio of 12.7. This isn’t too far off the 10-year average price-to-funds-from-operation ratio of 12.2.

Shares look fairly valued according to GuruFocus Value chart.

With a GF Value of $22.62, Medical Properties has a price-to-GF-Value ratio of 0.98. Shares could gain 1.6% if they were to trade with the GF Value. Combined with the dividend, total returns could be in the mid-single-digit range.

National Retail

National Retail Properties, Inc. (NNN, Financial) focuses on owning and leasing single-tenant properties in the U.S. The trust is valued at $8 billion and had revenue of $661 million last year.

National Retail owns nearly 3,000 properties that it leases to retail clients. The trust’s tenants operate in a wide variety of industries, including convenience stores, restaurants, automotive services and entertainment venues.

These industries were some of the most impacted during the beginning of the Covid-19 pandemic, but National Retail’s revenue barely fell, with the worst year-over-year performance being a less than 6% decline in the third quarter of 2020. The trust’s occupancy rate stood at 98.6% last quarter, showing just how in demand National Retail’s properties are. The trust has seen funds from operation compound at a rate of almost 6% over the last decade even as the share count expanded by nearly 66% since 2011.

National Retail has an annualized dividend of $2.12. Using the current price, the stock offers a yield of yield of 4.6%, which is below the 10-year average yield of 5.2% but in-line with the five-year average yield. The trust raised its dividend 1.9% for the Aug. 16 payment, which compares favorably with the 10-year CAGR of 3.4%. National Retail has increased its dividend for 21 consecutive years.

The trust is expected to bring in funds from operation of $2.79 in 2021, placing the payout ratio at 76%. This is just below the long-term average payout ratio of 80%.

National Retail is trading at $45.75, giving shares a forward price-to-funds-from-operation ratio of 16.4. This compares somewhat unfavorably to the 10-year average price-to-funds-from-operation ratio of 15.6.

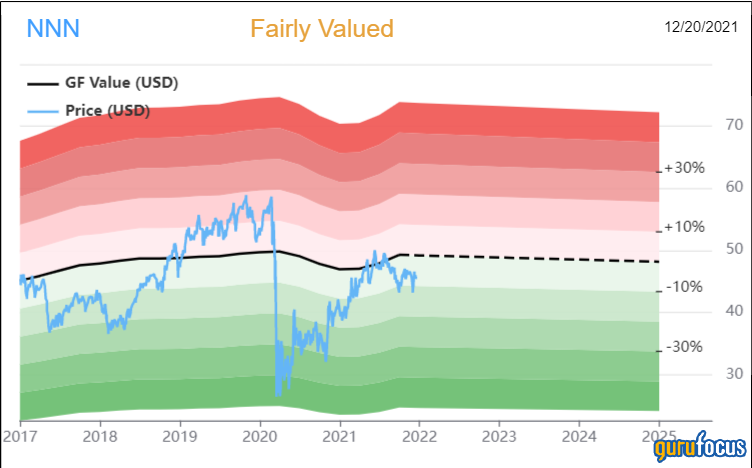

Shares of National Retail look to have potential upside when considering the GuruFocus Value chart.

With a GF Value of $49.19, National Retail has a price-to-GF-Value ratio of 0.93. Reaching the GF Value would mean a 7.5% improvement in the share price. Add in the dividend yield and total returns could reach into the low double-digit range.

Final thoughts

Medical Properties and National Retail are two high-yielding stocks providing significantly more income than the S&P 500 Index. Both trusts also have solid dividend growth streaks going and projected payout ratios lower than usual.

The two trusts receive a rating of fairly valued from GuruFocus, but both trade with at least some discount to their intrinsic value, though National Retail looks to offer a better total return potential at this point.

Solid business models, dividend growth history, current yield and reasonable valuations suggest that Medical Properties and National Retail could both be an option for those looking for safe and reliable income, in my view.