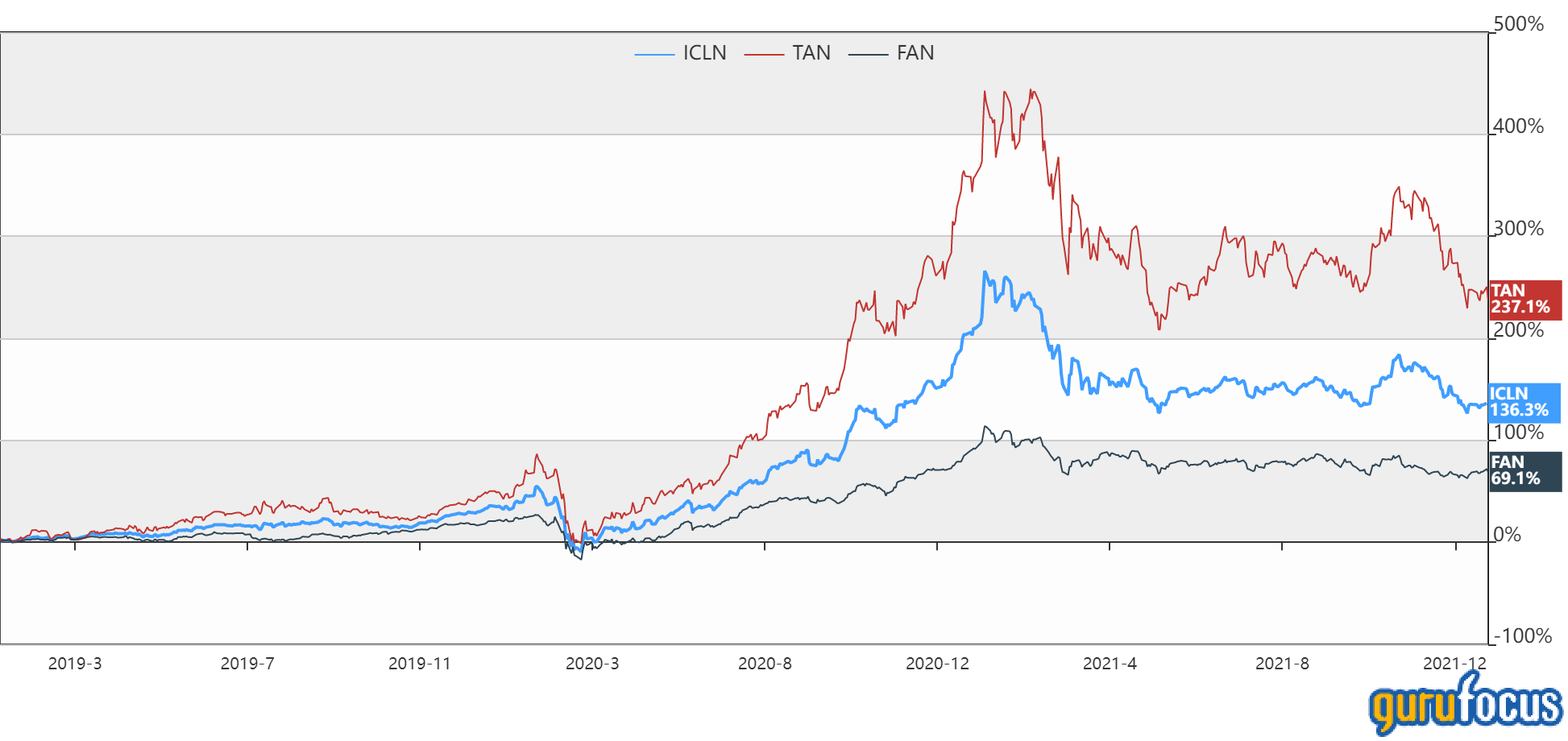

Last year was a tough one for clean energy stocks as supply chain issues mixed with overvaluation concerns and policy uncertainty caused broad selloffs. The iShares S&P Global Clean Energy Index Fund (ICLN, Financial) ETF lost 25% in 2021, while the Invesco Solar ETF (TAN, Financial) was down 26% and the First Trust Global Wind Energy ETF (FAN, Financial) booked a 13% decline.

However, before 2021, clean energy stocks had been booking strong gains, especially in 2020, when a brief drop in March was followed by skyrocketing valuations as investors began to take note of the inevitability of fossil fuels someday running out and needing to be replaced with clean energy sources.

With the correction in clean energy stocks seeming to have levelled out to more reasonable valuations, could further gains be ahead for the sector as governments around the world increase their investments in clean energy? Let’s take a look.

Clean energy tailwinds

As a whole, global demand for energy is expected to increase by 4% in 2022, according to the International Energy Agency. However, over the same timeframe, the amount of energy produced from renewable energy sources is only projected to grow by about 6%. Considering that renewables account for 30% of the total energy market share as of 2021, this means clean energy output is currently not increasing fast enough to meet the world’s growing energy demand.

This shortfall of clean energy growth means that without further investments in building out clean energy infrastructure, the world will keep increasing its consumption of fossil fuels, accelerating the inevitable time when we will eventually run out of these fuel sources.

Even putting aside the damages that fossil fuels are causing the environment, if we keep burning fossil fuels at the current rate (with no further increases in daily fossil fuel consumption), then the world will run out of fossil fuels entirely by around 2060, according to a combination of estimates compiled by Octopus Energy. That’s barring any new reserves that might be found, but it also excludes growth in fossil fuel demand.

Regardless, we should run out of fossil fuels by the end of the century at the latest, and about 50% of current known reserves are unburnable if we want to keep global warming to a “relatively safe” level of 2 degrees Celsius by 2050.

All of this means that governments and companies alike need to step up their investments in clean energy infrastructure if we want to still have things like electricity and cars in 50 years. Clean energy pledges are becoming common among companies, with many claiming that they have plans to reach net zero by 2050. The U.S. government, for its part, aims to reach net zero emissions in its operations by 2050 (excluding military).

With industry growth expected and necessary for many decades to come, investors may find it worth their time to look at the names in this sector in depth (or invest in exchange-traded funds for easy portfolio diversification), as the 2021 pullback in clean energy stock prices appears to have mostly stabilized.

One tool that investors can use to find potential opportunities in this space is the GuruFocus All-in-One Screener. Below are some of the stocks I found using different criteria on the screener, which fall broadly into two different categories: value and growth.

Value stocks to watch

When it comes to value, the pickings are slim among clean energy stocks. With high-growth industries, investors are willing to assign sky-high valuations to stocks that they are enthusiastic about. One need look no farther than Tesla Inc. (TSLA, Financial) for an example of this; the pioneer in electric vehicles accounts for more than half of the total market cap of the entire U.S. automobile industry, despite delivering nowhere near as many vehicles as the likes of General Motors (GM, Financial) or Ford Motor Co (F, Financial).

Screening for stocks that trade at a discount to their GF Value does throw up a couple of notable names, such as Canadian Solar Inc. (CSIQ, Financial), a Canadian solar module producer and solar product developer. This company is growing its earnings per share at 12% per year, which isn’t too shabby, although its three-year revenue per share growth rate is only 0.4%. Spanish renewable energy utility operator Solaria Energia y Medio Ambiente SA (XMAD:SLR, Financial) is trading below its GF Value, is profitable and has top and bottom line growth rates of more than 12%.

Most undervalued clean energy opportunities appear to be outside the U.S., in countries that have invested more in renewable energy production, but some value opportunities might still be found here. For example, U.S.-based solar energy company First Solar Inc. (FSLR, Financial) has a price-earnings ratio of just over 20 now that its earnings have grown to be more in line with its stock price.

Wind farm equipment maker TPI Composites Inc. (TPIC, Financial) is often overlooked because it an industrial products company, and while its weak financials are a big risk (the Altman Z-Score of 1.88 shows bankruptcy potential), the stock is trading below its GF value. If this company can resolve its supply chain issues, it may be able to pull itself out of hot water, but this one will probably fall under the “too risky” category for most people. I’m putting it on my watchlist to monitor any new developments.

Growth stocks to watch

Expanding the search beyond value, there are other clean energy names to consider that could be worth their higher valuations due to outperforming on the growth front. The list of clean energy companies that have grown both their top and bottom lines at double-digit rates in recent years is a short one, though, even shorter than the value list.

SolarEdge Technologies Inc. (SEDG, Financial), an Israeli manufacturer of power optimizers, monitoring systems and other products for solar panel arrays, is one of the few that makes the list. This company’s rare combination of fast growth and a solid financial situation has granted it a price-earnings ratio upwards of 100.

New Zealand’s largest power producer, Meridian Energy Ltd. (NZSE:MEL, Financial), has been producing double-digit growth as well, and it is even undervalued based on the GF Value Line. The state-owned hydro-electric power generator may not have much room for multiple expansion given its status as a state-owned utility, but it does pay a 3%-plus dividend and is unlikely to run out of funding given its political importance.

In the Asia region, fast-growing renewable energy names include Shanghai Nenghui Technology Co. Ltd. (SZSE:301046, Financial), a China-based “new energy” power generator and engineering services provider that is growing fast thanks to substantial government investment.

Japan’s RENOVA Inc. (TSE:9519, Financial) has seen its stock undergo a spectacular rise and fall, but with the top line growing at more than 30% per year and the bottom line doubling that, the formation and popping of this bubble shouldn’t affect the company’s long-term potential. The price rose to unsustainable levels on investor optimism and plummeted back to a more reasonable level when the company announced that it would comply with the G20’s Task Force on Climate-related Financial Disclosure on Dec. 21, 2021.

Conclusion

Above is only a surface-level look at some of the companies in the renewable energy sector that look attractive based on certain value or growth metrics. Investors who are interested in these companies will want to conduct their own in-depth research on profitability, growth potential and financial risks, among other factors.

The outlook for the sector as a whole is attractive, and there are also many more companies out their that might fit your own investment criteria. For investors that are bullish on the sector but do not want the risk of picking individual names, clean energy ETFs can provide some portfolio diversification as well.