It is good idea to review what insiders are buying on a regular basis as it is a solid source for investment ideas. It can be argued that someone putting their money at risk is a lot better than opinions by talking heads on CNBC and the like.

Nejat Seyhun, a professor and researcher in the field of insider trading at the University of Michigan and author of "Investment Intelligence from Insider Trading," found that when executives bought shares in their own companies, the stock tended to outperform the total market by 8.9% over the following 12 months. Additionally, legendary investor Peter Lynch once observed that, "Insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise."

Insiders are prevented from buying and selling their company stock within a six-month period, so they buy stock when they feel the company will perform well over at least the medium term (one to three years).

In particular, key people that should be closely watched are the CEO and chief financial officer. Typically, they are the most informed of all insiders. A search of the GuruFocus database for recent significant insider buying by both CEOs and CFOs yielded the following stocks:

| Ticker | Company | CurrentPrice | CEO ValueBuying | CFO ValueBuying | Date | Insider ClusterBuying | Insider ValueBuying |

| RIVN | Rivian Automotive Inc. | $94.84 | 9,997,650 | 191,100 | 2021-11-15 | 10 | 18,403,008 |

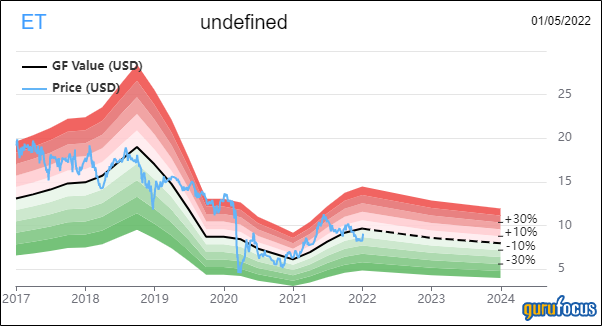

| ET | Energy Transfer LP | $9.02 | 600,067.69 | 500,051.44 | 2021-12-10 | 5 | 122,363,339.45 |

| CLF | Cleveland-Cliffs Inc. | $24.27 | 988,500 | 206,550 | 2021-12-13 | 6 | 1,714,050 |

| RNR | RenaissanceRe Holdings Ltd. | $164.06 | 2,162,100 | 490,076 | 2021-11-05 | 5 | 4,359,631.19 |

| KD | Kyndryl Holdings Inc. | $18.03 | 996,930 | 248,440.50 | 2021-11-29 | 3 | 1,745,876 |

| ETWO | E2open Parent Holdings Inc. | $10.75 | 1,146,400 | 114,540 | 2021-10-21 | 9 | 1,411,180.10 |

| VCTR | Victory Capital Holdings Inc. | $36.27 | 1,017,828 | 259,650 | 2021-11-29 | 4 | 2,254,528.91 |

| PRM | Perimeter Solutions SA | $14.41 | 2,229,570 | 1,964,160 | 2021-11-09 | 9 | 13,468,970 |

| CMTG | Claros Mortgage Trust Inc. | $16.85 | 6,905,117.38 | 373,000 | 2021-12-17 | 8 | 8,024,997.38 |

There are some interesting ideas on this list that are worth highlighting.

Rivian Automotive Inc. (RIVN, Financial) is a recently public, high-profile electric vehicle manufacturer. Most of the insider buying is likely connected to the initial public offering, when insider shares are converted to public ones. As a result, I would not pursuse Rivian currently as it looks very overvalued.

Energy Transfer (ET, Financial) looks interesting as the stock is bouncing off 52-week lows. The company recently lost a court case, resulting in negative publicity. The fact insiders are being optimistic about its prospects is good sign. While the stock has value potential, it looks high risk due to its debt level. The company pays a good dividend of 6.74%.

Cleveland-Cliffs (CLF, Financial) is also an interesting stock that has been doing very well. Steel demand is up due to infrastructure buildout and tariffs on imported steel is increasing the price. As a result, the stock has good investment potential.

RenaissanceRe Holdings (RNR, Financial) looks undervalued. As I discussed previously, It's a high-quality company that has value potential.

Victory Capital Holdings (VCTR, Financial) is an asset management company. The GF Value Line is indicative of some overvaluation, but given insider buying this can be explored further.

Kyndryl Holdings (KD, Financial) was spun off of IBM (IBM, Financial) recently. It operates data centers for other companies. While business is declining as more and more companies move to the cloud, the stock looks cheap and is down substantially. As such, the neglected, contrarian pick could be worth a look.

E2open Parent Holdings (ETWO, Financial) is an end-to-end and cloud-based supply chain management and software-as-a-service platform. It was bought to the market via a special purpose acquisition company, which has rolled up some supply chain management software company. It's too early to tell if it will succeed. Currently it's burning cash and is not my cup of tea.

Perimeter Solutions (PRM, Financial) is a chemical manufacturer for firefighting products and lubricant additives.

The Fire Safety business includes formulation and manufacturing of fire management products along with services and pre-treatment solutions for managing wildland, military, industrial and municipal fires. Given all the wildfires happening recently, this looks like a growth business.

The Oil Additives business produces high-quality phosphorous pentasulfide utilized in the preparation of zinc dialkyldithiophosphate-based lubricant additives, providing critical anti-wear solutions for end customers.

Perimeter recently went public. It's a roll-up put together by private equity.

Guru Chase Coleman (Trades, Portfolio) has a big position in the company. Perimeter looks interesting and should be explored further since it is profitable and cash flow positive.

Claros Mortgage Trust (CMTG) is a recently formed mortgage real estate investment trust focused primarily on originating senior and subordinate loans on transitional commercial real estate assets located in major markets across the U.S. It is trading slightly below tangible book value. It pays an 8% dividend, so the company is a candidate for an income stock, but mREITs are risky. As a result, the stock could be a candidate for a small position in a well-diversified portfolio.