The Invesco European Growth Fund (Trades, Portfolio) recently disclosed the portfolio updates for its fourth quarter of fiscal 2021, which ended on Oct. 31.

Invesco is a global financial services company with headquarters in Atlant and offices in 25 countries around the world. The Invesco European Growth Fund (Trades, Portfolio) seeks long-term exposure to high-quality growth opportunities in both developed and emerging European markets.

Based on its investing criteria, the Invesco European Growth Fund (Trades, Portfolio)’s top buys for the quarter were Flatex AG (XTER:FTK, Financial) and Arkema SA (XPAR:AKE, Financial), while its biggest sells were Gamesys Group PLC (LSE:GYS, Financial) and Ultra Electronics Holdings PLC (LSE:ULE, Financial).

Flatex

The fund established a new stake worth 444,027 shares in Flatex (XTER:FTK, Financial), giving the holding a 0.89% weight in the equity portfolio. During the quarter, shares traded for an average price of 20.42 euros ($23.06).

Flatex is an online broker based in Germany. Operating under the Flatex and DEGIRO brands, the company offers a proprietary securities trading platform and related services for retail customers in 18 European countries.

On Jan. 1, shares of Flatex traded around 21.76 euros for a market cap of 976.67 million euros. According to the GF Value Line, the stock is significantly overvalued.

The company has a financial strength rating of 6 out of 10 on the back of a cash-debt ratio of 52.18 and a healthy Piotroski F-Score of 7 out of 9. Its profitability is rated of 6 out of 10 with a three-year revenue per share growth rate of 22.2% and a three-year Ebitda per share growth rate of 30.4%.

Arkema

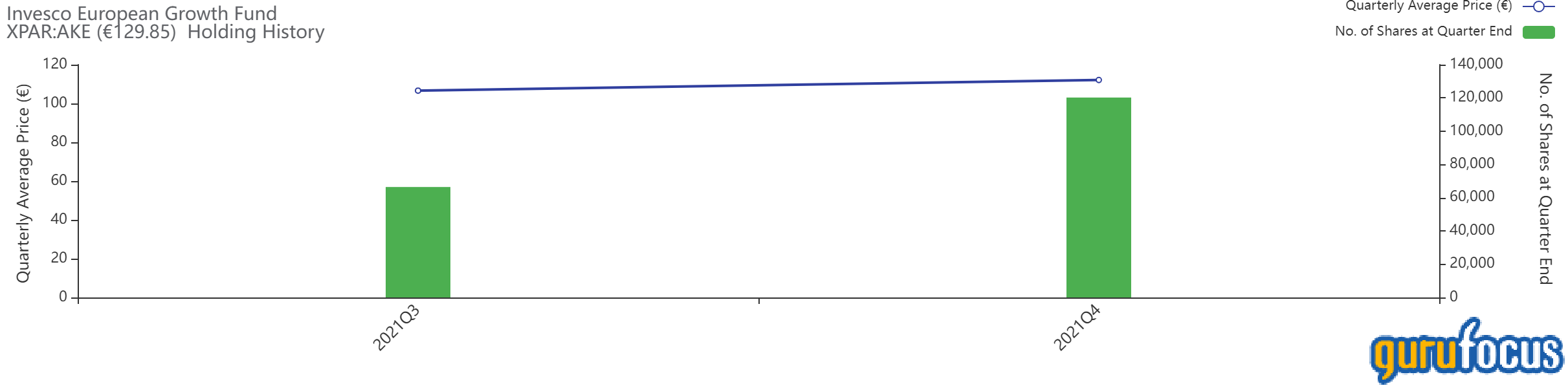

The fund increased its Arkema (XPAR:AKE, Financial) position by 81% for a total holding of 120,233 shares. The trade had a 0.65% impact on the equity portfolio. The stock traded for an average price of 112.11 euros per share during the three months to the end of October.

Arkema is a French specialty materials and chemicals company that aims to offer sustainable and innovative materials solutions. Its products include packaging, adhesives, refrigerants, renewable energy storage, construction materials and paints.

On Jan. 1, shares of Arkema traded around 129.85 euros for a market cap of 9.60 billion euros. The GF Value Line rates the stock as significantly overvalued.

The company has a financial strength rating of 5 out of 10. The Altman Z-Score of 2.47 and Piotroski F-Score of 6 out of 9 show a stable financial situation. The company’s profitability is rated of 6 out of 10, with the return on invested capital surpassing the weighted average cost of capital most of the time.

Gamesys Group

The fund sold out of its 873,733-share holding in Gamesys Group (LSE:GYS, Financial), which previously took up 1.95% of the equity portfolio. During the quarter, shares changed hands for an average of 18.43 British pounds ($24.93) apiece.

Gamesys is a developer of online software and gaming. The U.K.-based company, which specializes in online and app-based gambling services, was acquired by Bally’s Corp., a private company, in October of 2021, meaning that Invesco’s position in the stock was likely bought as part of the deal.

Bally’s acquisition of Gamesys was completed on Oct. 4 for a price of 2 billion pounds. The acquisition price represented a 40% premium to what the stock was trading at when the companies announced the deal last March, causing the stock price to rise accordingly and granting investors a nice profit.

Ultra Electronics Holdings

The firm reduced its Ultra Electronics Holdings PLC (LSE:ULE, Financial) holding by 29.16%, leaving a remaining investment of 828,063 shares and trimming 1.31% of the equity portfolio. Shares traded for an average price of 32.11 pounds during the quarter.

Ultra Electronics is a British security company that designs, manufactures and supports electronic and electromechanical systems, subsystems and so on for the defense, security, critical detection and control markets.

On Jan. 1, shares of Ultra Electronics traded around 31.38 pounds for a market cap of 2.24 billion pounds. According to the GF Value Line, the stock is significantly overvalued.

The company has a financial strength rating of 6 out of 10, driven by an Altman Z-Score of 4.28 and an interest coverage ratio of 10.74. Its profitability is rated of 7 out of 10, with operating and net margins outperforming more than 75% of industry peers.

Portfolio overview

As of the quarter’s end, the equity portfolio consisted of positions in 60 stocks valued at $1.13 billion. The turnover for the period was 4%.

The fund’s top equity positions on the filing date were Sberbank of Russia PJSC (MIC:SBERP, Financial) with 5.76% of the equity portfolio, DCC PLC (LSE:DCC, Financial) with 4.78% and Savills PLC (LSE:SVS, Financial) with 3.54%.

In terms of sector weighting, the fund was most heavily invested in industrials and financial services, followed distantly by communication services and consumer defensive.