Orla Mining Ltd. (TSX:OLA, Financial) (ORLA, Financial) announced recently that the company has poured the first gold from its Camino Rojo Oxide open pit mine project located in Zacatecas State, Mexico. The first pour occurred on Dec. 13, 2021. Three bars were poured with a total weight of 1,278 ounces containing approximately 770 ounces of gold and 510 ounces of silver.

Commissioning and operational ramp-up will continue during the first quarter of 2022. The company said that mining and processing tonnes and grades have been meeting expectations thus far and commercial production is targeted for the end of the first quarter of 2022.

During the month of November, the company mined a total of 466,215 ore tonnes at an average grade of 0.65 grams of gold per tonne and crushed and stacked a total of 374,976 tonnes on the heap leach pad. Year to date as of Nov. 30, 2021, the company mined a total of 1,589,994 tonnes of ore at an average grade of 0.72 grams of gold per tonne and crushed and stacked a total of 750,564 tonnes.

Orla has two projects :

- The Camino Rojo Oxide Project in Mexico, which is now entering production. The estimated after-tax Net Present Value (“NPV”) (using a 5% discount rate) of the Camino Rojo Project is $452 million, with an after-tax Internal Rate of Return (“IRR”) of 62% at a gold price of $1,600 per ounce.

- The Cerro Quema Project Development in Panama, which is undergoing feasibility studies. The estimated after-tax Net Present Value (“NPV”) (with a 5% discount rate) of the Cerro Quema Project is $176 million, with an after-tax Internal Rate of Return (“IRR”) of 38% at a gold price of $1,600 per ounce.

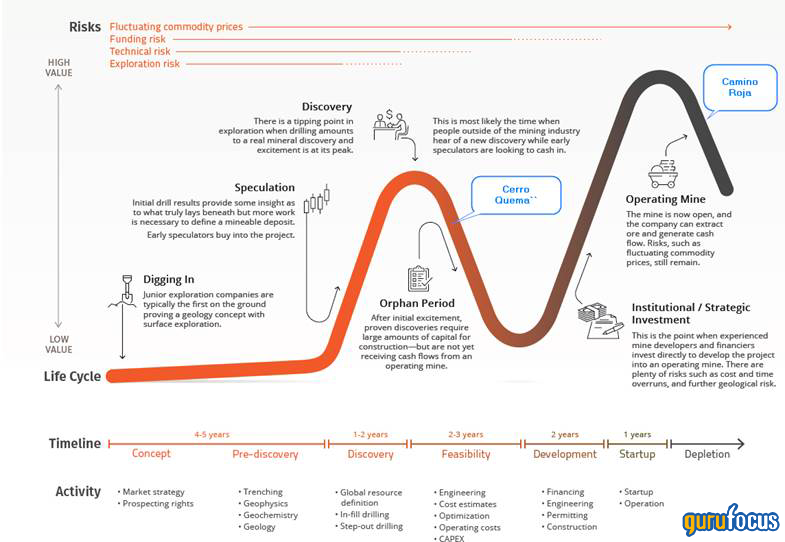

The following graphic shows the positioning of the two projects on the Lassonde curve. Pierre Lassonde was one of the founders of Franco-Nevada, the first gold royalty company. Thirty years ago he created his curve, that has now become a foundation in the junior mining business. The Lassonde Curve outlines the company's life stages, beginning at exploration and ending at production. It shows the perceived value (i.e. stock value) that investors may assign at each life stage.

Source: Company presentation materials.

The company's share structure as of Sept. 30, 2021 is as follows:

- Issued and Outstanding shares - 247,479,954

- Stock Options - 9,920,874

- Warrants 40,292,500

- Bonus Shares 500,000

- Fully Diluted 299,608,196

*Includes 0.7 million RSUs and 0.7 million of DSUs

Top shareholders include Newmont (NEM, Financial) with 41.1 million shares, or 16.6% of shares outstanding; Pierre Lassonde with 30.4 million, or 12.3%; Agnico Eagle (AEM, Financial) with 23.6 million, or 9.6%; Fidelity Management and Research with 12.6 million, or 5.1%; the company's own management and directors with 9.2 million, or 3.7%; and First Eagle Investment (Trades, Portfolio) with 5.8 million, or 2.3%.

The following chart is a snapshot of Orla's current balance sheet. The balance sheet is straightforward with equity and liability nicely balanced:

The development period seems to finally be coming to an end for Orla, which is a positive sign for investors in the stock. Orla's Comino Rojo mine is on the cusp of producing gold. Camino Rojo's oxide economics alone justify the current $960 million enterprise value, in my opinion. The sulphide resources at the Comino Rojo mine as well as Cerro Quema provide a margin of safety, though the former would be owned 70% by Newmont, if developed.

The presence of tier-one gold investors in the shareholder list of the company is an attraction. They would not be here unless this was a good opportunity, based on their successful gold investing track records.

One unknown factor is the price of gold. Currently gold is about $1,800 per ounce (oz), much higher than the $1,600 per oz cost the economics of the Camino Rojo oxide is based on. Orla expects to be able to produce gold at an AISC (all in sustaining cost) of below $550 per oz. I expect the price of gold to rise in the coming year, and producing gold miners such as Orla could become quite attractive becuase of inflation.

Another wild card is cryptocurrencies. A lot of speculative dollars which would normally go into gold are currently going into crypto. If this trend were to reverse, gold should benefit.

Also, Orla has quite a bit of exploration potential in and around its two existing properties. There is a very good chance that additional ore bodies are discovered in the vicinity which may be exploited with existing infrastructure.

Overall, to me this appears to be a good value opportunity. I think there is a decent chance that Orla could become a multi-bagger. Key to investing in gold miners is to get in and out at the right time, as these stocks can be quite volatile. It's a good idea to keep a watch on the key shareholders and their buying and selling behaviour to see which way they are leaning. They have access to information as well as experience which an ordinary retail investor does not have. Junior gold miners like Orla are very volatile.

Another risk to keep in mind is the law and order situation in Mexico. The Frenillo area where Camino Rojo is located is known for narcotic cartel activity. There is potential that the low level war between organized crime and the government forces could start to affect Orla's mining operations. This is a high-risk, high-reward situation that might not be for everyone.